CarMax 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

that time, shares of CarMax, Inc. common stock valued at two times the exercise price. We also have an additional

19,880,000 authorized shares of undesignated preferred stock of which no shares are outstanding.

(B) Stock Incentive Plans

We maintain long-term incentive plans for management, key employees and the nonemployee members of our board

of directors. The plans allow for the grant of equity-based compensation awards, including nonqualified stock

options, incentive stock options, stock appreciation rights, restricted stock awards, stock- and cash-settled restricted

stock units, stock grants or a combination of awards. To date, we have awarded no incentive stock options.

Prior to fiscal 2007, the majority of associates who received share-based compensation awards primarily received

nonqualified stock options. From fiscal 2007 through fiscal 2009, these associates primarily received restricted

stock instead of stock options, and beginning in fiscal 2010, these associates primarily received cash-settled

restricted stock units instead of restricted stock awards. Senior management and other key associates continue to

receive awards of nonqualified stock options and, starting in fiscal 2010, stock-settled restricted stock units.

Nonemployee directors continue to receive awards of nonqualified stock options and stock grants.

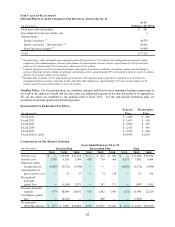

Nonqualified Stock Options. Nonqualified stock options are awards that allow the recipient to purchase shares of

our common stock at a fixed price. Stock options are granted at an exercise price equal to the fair market value of

our common stock on the grant date. Substantially all of the stock options vest annually in equal amounts over

periods of three to four years. These options are subject to forfeiture and expire no later than ten years after the date

of the grant.

Restricted Stock. Restricted stock awards are awards of our common stock that are subject to specified restrictions

and a risk of forfeiture. The restrictions typically lapse three years from the grant date. Participants holding

restricted stock are entitled to vote on matters submitted to holders of our common stock for a vote.

Stock-Settled Restricted Stock Units. Also referred to as market stock units, or MSUs, these are awards to eligible

key associates that are converted into between zero and two shares of common stock for each unit granted at the end

of a three-year vesting period. The conversion ratio is calculated by dividing the average closing price of our stock

during the final forty trading days of the three-year vesting period by our stock price on the grant date, with the

resulting quotient capped at two. This quotient is then multiplied by the number of MSUs granted to yield the

number of shares awarded. MSUs are subject to forfeiture and do not have voting rights.

Cash-Settled Restricted Stock Units. Also referred to as restricted stock units, or RSUs, these are awards that entitle

the holder to a cash payment equal to the fair market value of a share of our common stock for each unit granted at

the end of a three-year vesting period. However, the cash payment per RSU will not be greater than 200% or less

than 75% of the fair market value of a share of our common stock on the grant date. RSUs are liability awards that

are subject to forfeiture and do not have voting rights.

As of February 28, 2010, a total of 39,200,000 shares of our common stock have been authorized to be issued under

the long-term incentive plans. The number of unissued common shares reserved for future grants under the long-

term incentive plans was 7,613,036 as of February 28, 2010.

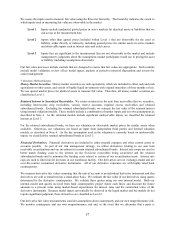

(C) Share-Based Compensation

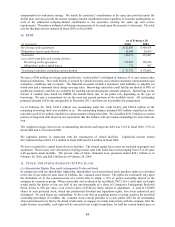

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

(In thousands)

Cost of sales 2,103$ 2,136$ 1,945$

CarMax Auto Finance income 1,334 1,181 1,250

Selling, general and administrative expenses 35,407 33,201 31,487

Share-based compensation expense, before income taxes 38,844$ 36,518$ 34,682$

Ye ar s Ende d Fe bruar y 2 8 or 2 9

2010 2009 2008