CarMax 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

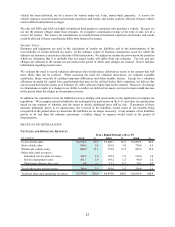

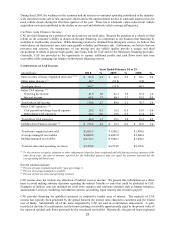

by $0.02 per share, while fiscal 2009 SG&A expenses included various non-recurring items, which in the

aggregate reduced earnings by $0.04 per share. SG&A expenses as a percent of net sales and operating

revenues (the “SG&A ratio”), fell to 11.0% from 12.7% in fiscal 2009 due to both the reduction in SG&A

expenses and the leverage associated with the increases in unit sales and average selling prices.

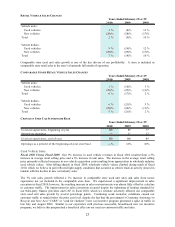

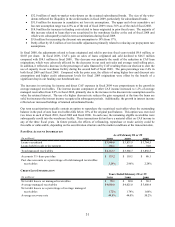

• Net cash provided by operating activities fell to $50.3 million compared with $264.6 million in fiscal 2009.

The reduction occurred despite the significant improvement in net income in fiscal 2010, and it reflected the use

of cash for increases in the retained interest in securitized receivables and inventory in fiscal 2010, and the

generation of cash from a significant reduction in inventory in fiscal 2009. The fiscal 2010 increase in the

retained interest in securitized receivables primarily reflected the effects of retaining subordinated bonds in the

April 2009 term securitization and the $64.0 million of favorable mark-to-market adjustments.

CRITICAL ACCOUNTING POLICIES

Our results of operations and financial condition as reflected in the consolidated financial statements have been

prepared in accordance with U.S. generally accepted accounting principles. Preparation of financial statements

requires management to make estimates and assumptions affecting the reported amounts of assets, liabilities,

revenues, expenses and the disclosures of contingent assets and liabilities. We use our historical experience and

other relevant factors when developing our estimates and assumptions. We continually evaluate these estimates and

assumptions. Note 2 includes a discussion of significant accounting policies. The accounting policies discussed

below are the ones we consider critical to an understanding of our consolidated financial statements because their

application places the most significant demands on our judgment. Our financial results might have been different if

different assumptions had been used or other conditions had prevailed.

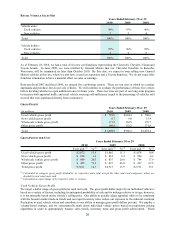

Securitization Transactions

We maintain a revolving securitization program (“warehouse facility”) to fund substantially all of the auto loan

receivables originated by CAF until they can be funded through a term securitization or alternative funding

arrangement. The securitization transactions are accounted for as sales. A gain, recorded at the time of

securitization, results from recording a receivable approximately equal to the present value of the expected residual

cash flows generated by the securitized receivables. We retain an interest in the auto loan receivables that we

securitize. The retained interest includes the present value of the expected residual cash flows generated by the

securitized receivables, various reserve accounts, required excess receivables and retained subordinated bonds.

The present value of the residual cash flows we expect to receive over the life of the securitized receivables is

determined by estimating the future cash flows using our assumptions of key factors, such as finance charge income,

loss rates, prepayment rates, funding costs and discount rates appropriate for the type of asset and risk. These

assumptions are derived from historical experience and projected economic trends. Adjustments to one or more of

these assumptions could have a material impact on the fair value of the retained interest. The fair value of the

retained interest could also be affected by external factors, such as changes in the behavior patterns of customers,

changes in the strength of the economy and developments in the interest rate and credit markets. Note 2(C) includes

a discussion of accounting policies related to securitizations. Note 4 includes a discussion of securitizations and

provides a sensitivity analysis showing the hypothetical effect on the retained interest if there were variations from

the assumptions used. Note 6 includes a discussion on fair value measurements. In addition, see the “CarMax Auto

Finance Income” section of this MD&A for a discussion of the effect of changes in our assumptions.

As discussed in Note 17 and in the “Fiscal 2011 Expectations – CAF Income” section of this MD&A, we will adopt

Accounting Standards Updates (“ASUs”) 2009-16 and 2009-17 (formerly Statement of Financial Accounting

Standards Nos. 166 and 167, respectively) effective March 1, 2010. Pursuant to these pronouncements, we will

recognize existing and future transfers of auto loan receivables into term securitizations as secured borrowings,

which will result in recording the auto loan receivables and the related notes payable to the investors on our

consolidated balance sheets. We will also account for future transfers of receivables into our warehouse facility as

secured borrowings. As of March 1, 2010, we amended our warehouse facility agreement. As a result, the

receivables that were funded in the warehouse facility at that date will be consolidated, along with the related notes

payable, at their fair value. In future periods, CAF income included in the consolidated statements of earnings will

no longer include a gain on the sale of loans originated and sold, but instead will reflect the net interest margin

generated by the auto loan receivables less direct CAF expenses.

Revenue Recognition

We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or

upon delivery to a customer. We recognize used vehicle revenue when a sales contract has been executed and the