CarMax 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

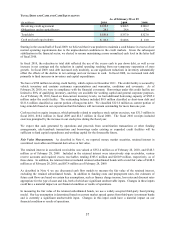

35

• Write-off of the remaining interest-only strip receivables related to term securitizations, previously recorded

in retained interest in securitized receivables, and the related deferred tax liability. These write-offs are

charged against retained earnings.

• Recording of a net deferred tax asset, primarily related to the establishment of the reserve for credit losses.

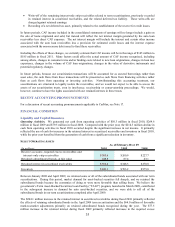

In future periods, CAF income included in the consolidated statements of earnings will no longer include a gain on

the sale of loans originated and sold, but instead will reflect the net interest margin generated by the auto loan

receivables less direct CAF expenses. The net interest margin will include the interest and certain other income

associated with the auto loan receivables less a provision for estimated credit losses and the interest expense

associated with the non-recourse debt issued to fund these receivables.

Including the effects of these changes, we currently estimate that CAF income will be in the range of $145 million to

$185 million in fiscal 2011. Many factors could affect the actual amount of CAF income recognized, including

among others, changes in consumer rates and/or funding costs related to new loan originations, changes in loan loss

experience, changes in the volume of CAF loan originations, changes in the value of derivative instruments and

potential regulatory changes.

In future periods, because our securitization transactions will be accounted for as secured borrowings rather than

asset sales, the cash flows from these transactions will be presented as cash flows from financing activities rather

than as cash flows from operating or investing activities. Notwithstanding this accounting treatment, our

securitizations are structured to legally isolate the receivables, and we would not expect to be able to access the

assets of our securitization trusts, even in insolvency, receivership or conservatorship proceedings. We would,

however, continue to have the rights associated with our retained interests in these trusts.

RECENT ACCOUNTING PRONOUNCEMENTS

For a discussion of recent accounting pronouncements applicable to CarMax, see Note 17.

FINANCIAL CONDITION

Liquidity and Capital Resources

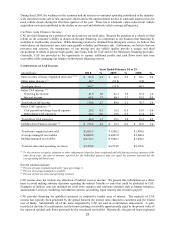

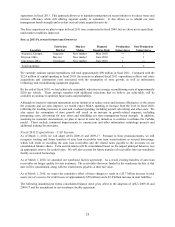

Operating Activities. We generated net cash from operating activities of $50.3 million in fiscal 2010, $264.6

million in fiscal 2009 and $79.5 million in fiscal 2008. Compared with the prior year, the $214.3 million decline in

cash from operating activities in fiscal 2010 occurred despite the significant increase in net income. It primarily

reflected the use of cash for increases in the retained interest in securitized receivables and inventory in fiscal 2010,

while the prior year benefited from the generation of cash from a significant reduction in inventory.

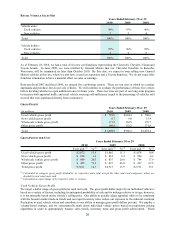

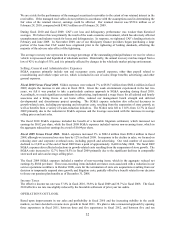

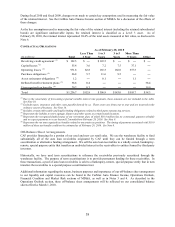

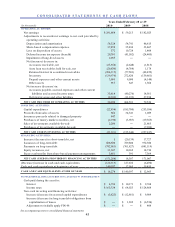

SELECT OPERATING ASSETS

(In millions)

2009 2008

Reserve accounts, required excess receivables and

interest-only s trip receivables 303.6$ 260.9$ 227.7$

Retained s ubordinated bonds , at fair value 248.8 87.4 43.1

Retained interes t in s ecuritized receivables 552.4$ 348.3$ 270.8$

Inventory 843.1$ 703.2$ 975.8$

2010

As of February 28 or 29

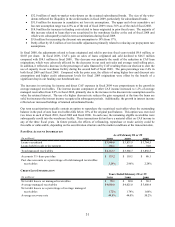

Between January 2008 and April 2009, we retained some or all of the subordinated bonds associated with our term

securitizations. During this period, market demand for asset-backed securities fell sharply, and we retained the

subordinated bonds because the economics of doing so were more favorable than selling them. We believe the

government’s Term Asset-Backed Securities Loan Facility (“TALF”) program, launched in March 2009, contributed

to the subsequent increase in demand for auto asset-backed securities, and we were able to sell all of the

subordinated bonds in our term securitizations completed after April 2009.

The $204.1 million increase in the retained interest in securitized receivables during fiscal 2010 primarily reflected

the effects of retaining subordinated bonds in the April 2009 term securitization and the $64.0 million of favorable

mark-to-market adjustments primarily on retained subordinated bonds recognized during the year. The $77.5

million increase in the retained interest during fiscal 2009 primarily reflected increases in the required excess