CarMax 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities.

Our common stock is listed and traded on the New York Stock Exchange under the ticker symbol KMX. We are

authorized to issue up to 350,000,000 shares of common stock and up to 20,000,000 shares of preferred stock. As of

February 28, 2010, there were 223,065,542 shares of CarMax common stock outstanding and there were

approximately 7,500 shareholders of record. As of that date, there were no preferred shares outstanding.

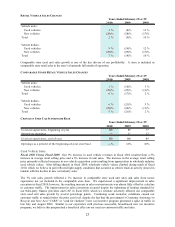

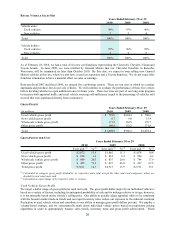

The following table presents the quarterly high and low sales prices per share for our common stock for each quarter

during the last two fiscal years, as reported on the New York Stock Exchange composite tape.

1st 2nd 3rd 4th

Fiscal 2010

High 14.00$ 17.60$ 23.07$ 24.75$

Low 8.40$ 11.31$ 16.64$ 19.60$

Fiscal 2009

High 21.99$ 19.95$ 20.70$ 10.38$

Low 17.30$ 10.53$ 5.76$ 6.59$

Quarter Quarter Quarter Quarter

To date, we have not paid a cash dividend on CarMax common stock. We believe it is prudent to retain our net

earnings for use in operations and for geographic expansion, as well as to maintain maximum financial flexibility

and liquidity for our business. Therefore, we do not anticipate paying any cash dividends in the foreseeable future.

During the fourth quarter of fiscal 2010, we sold no CarMax equity securities that were not registered under the

Securities Act of 1933, as amended. In addition, we did not repurchase any CarMax equity securities during this

period.

Performance Graph

The following graph compares the cumulative total shareholder return (stock price appreciation plus dividends, as

applicable) on our common stock for the last five fiscal years with the cumulative total return of the S&P 500 Index

and the S&P 500 Retailing Index. The graph assumes an original investment of $100 in CarMax common stock and

in each index on February 28, 2005, and the reinvestment of all dividends, as applicable.