CarMax 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 CarMax 2010

Building a Better CarMax –

Discovering Eciencies

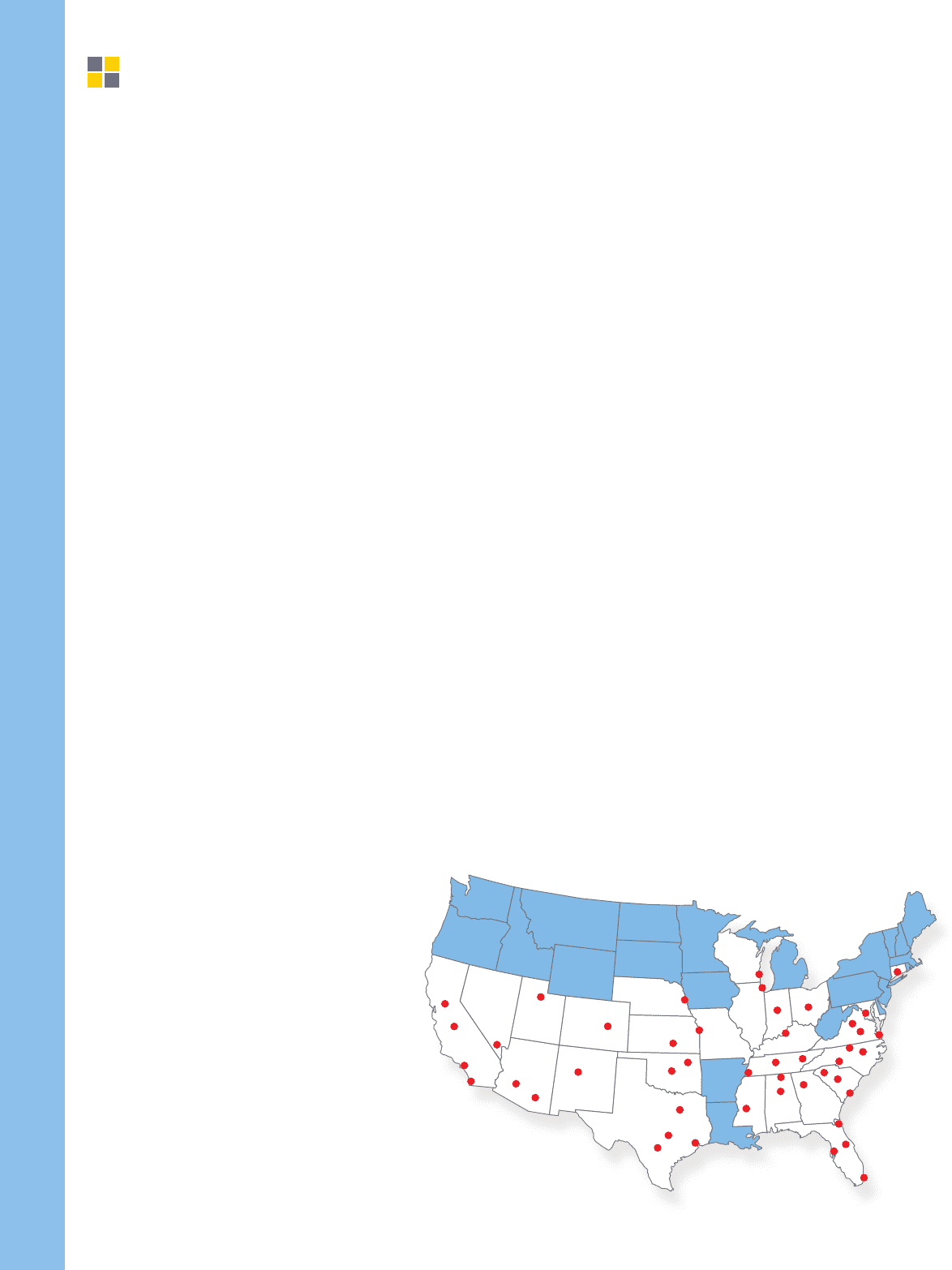

ALABAMA

Birmingham

Huntsville

ARIZONA

Tucson

Phoenix (2)

CALIFORNIA

Fresno

Los Angeles (9)

Sacramento (2)

San Diego

COLORADO

Colorado Springs

CONNECTICUT

Hartford/

New Haven (2)

FLORIDA

Jacksonville

Miami (5)

Orlando (2)

Tampa (2)

GEORGIA

Atlanta (5)

ILLINOIS

Chicago (8)

CarMax Used Car Superstores

(As of February 28, 2010)

INDIANA

Indianapolis

KANSAS

Kansas City (2)

Wichita

KENTUCKY

Louisville

MISSISSIPPI

Jackson

NEBRASKA

Omaha

NEVADA

Las Vegas (2)

NEW MEXICO

Albuquerque

NORTH CAROLINA

Charlotte (4)

Greensboro (2)

Raleigh (2)

OHIO

Columbus (2)

OKLAHOMA

Oklahoma City

Tulsa

SOUTH CAROLINA

Charleston

Columbia

Greenville

TENNESSEE

Knoxville

Memphis

Nashville (2)

TEXAS

Austin (2)

Dallas /

Fort Worth (4)

Houston (4)

San Antonio (2)

UTAH

Salt Lake City

VIRGINIA

Charlottesville

Norfolk/Virginia

Beach (2)

Richmond (2)

WASHINGTON, D.C./

BALTIMORE (7)

WISCONSIN

Milwaukee (2)

CarMax Markets

Finding opportunities to implement organizational change

that improves our processes and systems is key to our goal

of operational excellence. Having temporarily suspended

store growth, during fiscal 2010 we spent more of our time

focusing on Building a Better CarMax: reducing waste

and controlling our costs while offering the same or bet-

ter quality to our customers. “While CarMax has always

been engaged in waste reduction efforts, we have now cre-

ated a common methodology and language that will help

us have the greatest impact companywide,” said Judith

Simon, Director, Operational Excellence. Teams of associ-

ates engaged in waste elimination initiatives are particularly

successful because they are working to improve their own

departments — from the bottom up, instead of working from

the top down. Exciting new successes have been achieved

throughout the company during fiscal 2010.

This year, it was particularly gratifying to realize a signifi-

cant decrease in our vehicle reconditioning costs — and on

a faster pace than we had originally anticipated. On aver-

age, we estimate we achieved a sustainable reduction in

reconditioning costs of approximately $200 per vehicle.

This reduction was primarily accomplished through our

emphasis on the consistent application of our reconditioning

standards across our entire store base. A large portion of the

reduction was achieved through our cosmetic improvement

program, where we are addressing over-processing and waste

in our cosmetic reconditioning techniques. “This initiative

was focused on streamlining our cosmetic reconditioning

standards and ensuring that the same reconditioning stan-

dards are applied to every car in every store,” said Gary

Sheehan, Assistant Vice President, Process Engineering.

Our drive to revolutionize reconditioning will be an ongo-

ing process that we believe can drive additional cost savings,

which will be available to continue to optimize future sales

and profitability.

Successful waste elimination and cost control clearly bene-

fits our selling, general and administrative expenses (SG&A).

Despite the fact that our fiscal 2010 total revenues increased

by 7%, we reduced SG&A by 7%. A large portion of the

decline in our total SG&A expense was due to reductions in

both advertising spending and growth-related costs resulting

from suspending store growth. However, the decline also

reflected our efforts to control overhead costs. Some of these

efforts yielded immediate cost savings. “An example is our

energy cost savings initiative, which has already succeeded

in reducing energy usage in our stores and at our home

office by millions of dollars,” said Joe Maccarone, Project

Manager – Construction, Design and Facilities. Other initia-

tives simply uncover a better way of doing things and will save

costs over time as we continue to grow. Most importantly,

they will most often also improve the experience for one or

more of our customer groups, such as our newly streamlined

system for registering dealers who attend our auctions.

Regardless of the successes we have achieved, we are still at

the beginning of a multi-year process towards becoming a

leaner and more innovative company. In consistently engag-

ing our associates in value-added activities and providing

them with the tools they need to improve efficiency in all

their day-to-day activities, we will continue to enhance our

customers’ experience and shareholder returns.