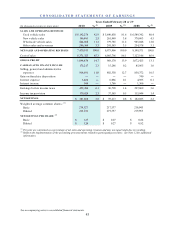

CarMax 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

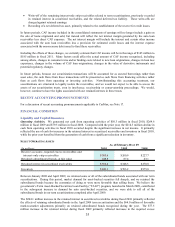

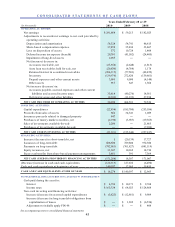

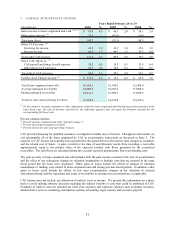

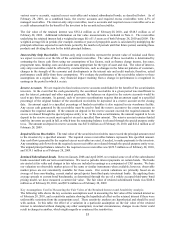

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

O PERATING ACTIVITIES:

Net earnings 281,668$ 59,213$ 182,025$

Adjustments to reconcile net earnings to net cash provided by

operating activities:

Depreciation and amortization 58,328 54,741 46,615

Share-based compensation expense 37,858 35,436 33,467

Loss on disposition of assets 372 10,728 1,404

Deferred income tax expense (benefit) 29,761 (41,502) (24,405)

Impairment of long-lived assets 2,055 ― ―

Net (increase) decrease in:

Accounts receivable, net (23,558) (2,648) (1,815)

Auto loan receivables held for sale, net (20,830) (4,764) 1,178

Retained interest in securitized receivables (204,115) (77,501) (68,459)

Inventory (139,976) 272,620 (139,661)

Prepaid expenses and other current assets 3,095 9,090 (4,148)

Other assets 917 647 1,360

Net increase (decrease) in:

Accounts payable, accrued expenses and other current

liabilities and accru ed inco me taxes 33,818 (40,276) 14,561

Deferred revenue and other liabilities (9,103) (11,193) 37,398

N ET C A S H P R O V ID ED B Y O P ER A TI N G A C TIV ITIES 50,290 264,591 79,520

INVESTING AC TIVITIES:

Capital expenditures (22,434) (185,700) (253,106)

Proceeds from sales of assets 662 34,341 1,089

Insurance proceeds related to damaged property 447 ― ―

Purchases of money market securities, net (2,196) (3,987) (19,565)

Sales of investments available-for-sale 2,200 ― 21,665

Purchases of investments available-for-sale ― ― (7,100)

N ET C A S H U S ED IN IN V ES TIN G A C TIV ITIES (21,321) (155,346) (257,017)

FINANC ING ACTIVITIES:

Increase (decrease) in short-term debt, net 5 (20,139) 17,727

Issuances of long-term debt 606,500 789,800 972,300

Payments on long-term debt (792,981) (761,827) (841,119)

Equity issuances, net 31,307 10,162 14,730

Excess tax benefits from share-based payment arrangements 3,881 391 7,369

NET CASH (USED IN) PRO VIDED BY FINANC ING ACTIVITIES (151,288) 18,387 171,007

(Decrease) increase in cash and cash equivalents (122,319) 127,632 (6,490)

Cash and cash equivalents at beginning of year 140,597 12,965 19,455

CASH AND C ASH EQ UIVALENTS AT END O F YEAR 18,278$ 140,597$ 12,965$

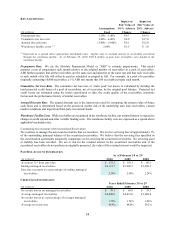

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION

Cash paid during the year for:

Interes t 4,796$ 10,171$ 9,768$

Income taxes 163,324$ 64,023$ 124,868$

Non-cash investing and financing activities:

Increase (decrease) in accrued capital expenditures (5,823)$ (12,861)$ 9,909$

Increase (decrease) in long-term debt obligations from

capitalization of leases ―$ 1,382$ (6,554)$

Adjustment to initially apply FIN 48 ―$ ―$ 408$

Ye ar s Ende d Fe bruar y 2 8 or 2 9

2010 2009 2008

See accompanying notes to consolidated financial statements.