CarMax 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

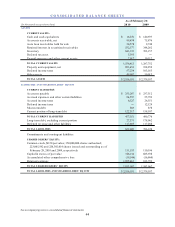

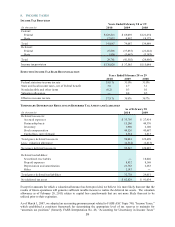

(R) Income Taxes

We file a consolidated federal income tax return for a majority of our subsidiaries. Certain subsidiaries are required

to file separate partnership or corporate federal income tax returns. Deferred income taxes reflect the impact of

temporary differences between the amounts of assets and liabilities recognized for financial reporting purposes and

the amounts recognized for income tax purposes, measured by applying currently enacted tax laws. A deferred tax

asset is recognized if it is more likely than not that a benefit will be realized. Changes in tax laws and tax rates are

reflected in the income tax provision in the period in which the changes are enacted.

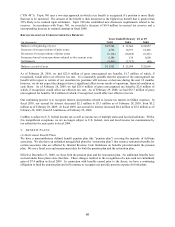

We recognize tax liabilities when, despite our belief that our tax return positions are supportable, we believe that

certain positions may not be fully sustained upon review by tax authorities. Benefits from tax positions are

measured at the highest tax benefit that is greater than 50% likely of being realized upon settlement. The current

portion of tax liabilities is included in accrued income taxes and any noncurrent portion of tax liabilities is included

in deferred revenue and other liabilities. To the extent that the final tax outcome of these matters is different from

the amounts recorded, the differences impact income tax expense in the period in which the determination is made.

Interest and penalties related to income tax matters are included in SG&A expenses.

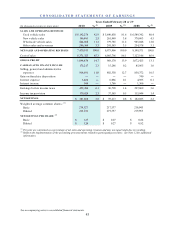

(S) Net Earnings Per Share

Basic net earnings per share is computed by dividing net earnings, less earnings allocated to participating securities,

by the weighted average number of shares of common stock outstanding. Diluted net earnings per share is

computed by dividing net earnings, less earnings allocated to participating securities, by the sum of the weighted

average number of shares of common stock outstanding and dilutive potential common stock. See Note 12 for

additional information.

(T) Risks and Uncertainties

We sell used and new vehicles. The diversity of our customers and suppliers and the highly fragmented nature of

the U.S. automotive retail market reduce the risk that near term changes in our customer base, sources of supply or

competition will have a severe impact on our business. However, unanticipated events could have an adverse effect

on our business, results of operations and financial condition.

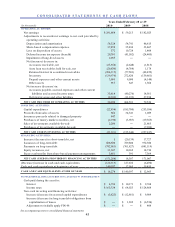

(U) Reclassifications

Certain prior year amounts have been reclassified to conform to the current year’s presentation with no effect on net

earnings.