CarMax 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

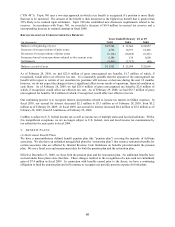

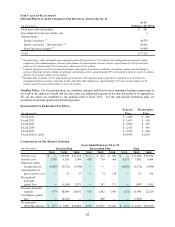

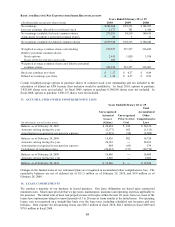

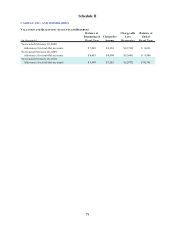

FUTURE MINIMUM LEASE OBLIGATIONS

(In thousands)

Fiscal 2011 3,608$ 82,832$

Fiscal 2012 3,608 82,788

Fiscal 2013 3,608 82,688

Fiscal 2014 3,643 83,026

Fiscal 2015 3,884 83,041

Fiscal 2016 and thereafter 37,056 557,452

Total minimum lease payments 55,407 971,827$

Less amounts representing interest (27,319)

Present value of net minimum capital lease payments 28,088$

As of February 28, 2010

Operating Lease

Commitments (1)

Leas es (1)

Capital

(1) Excludes taxes, insurance and other costs payable directly by us. These costs vary from year to year and are incurred in the

ordinary course of business.

We did not enter into any sale-leaseback transactions in fiscal 2010 or fiscal 2008. We completed sale-leaseback

transactions involving two superstores valued at approximately $31.3 million in fiscal 2009. All sale-leaseback

transactions are structured at competitive rates. Gains or losses on sale-leaseback transactions are recorded as

deferred rent and amortized over the lease term. Other than occupancy, we do not have continuing involvement

under the sale-leaseback transactions. In conjunction with certain sale-leaseback transactions, we must meet

financial covenants relating to minimum tangible net worth and minimum coverage of rent expense. We were in

compliance with all such covenants as of February 28, 2010.

15. SUPPLEMENTAL FINANCIAL STATEMENT INFORMATION

(A) Goodwill and Other Intangibles

Other assets included goodwill and other intangibles with a carrying value of $10.1 million as of February 28, 2010,

and February 28, 2009. No impairment of goodwill or intangible assets resulted from our annual impairment tests in

fiscal 2010, fiscal 2009 or fiscal 2008.

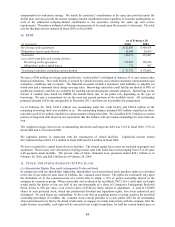

(B) Restricted Investments

Restricted investments, included in other assets, consisted of $30.7 million in money market securities as of

February 28, 2010, and $28.5 million in money market securities and $2.2 million in other debt securities as of

February 28, 2009. For fiscal 2010, proceeds from the sales of other debt securities totaled $2.2 million. For fiscal

2009, there were no proceeds from the sales of other debt securities. Due to the short-term nature and/or variable

rates associated with these financial instruments, the carrying value approximates fair value.

(C) Other Accrued Expenses

As of February 28, 2010 and 2009, accrued expenses and other current liabilities included accrued compensation

and benefits of $62.1 million and $24.3 million, respectively, and loss reserves for general liability and workers’

compensation insurance of $23.9 million and $22.2 million, respectively.

(D) Advertising Expense

SG&A expenses included advertising expense of $75.1 million in fiscal 2010, $101.5 million in fiscal 2009 and

$108.8 million in fiscal 2008. Advertising expenses were 1.0% of net sales and operating revenues for fiscal 2010,

1.5% for fiscal 2009 and 1.3% for fiscal year 2008.

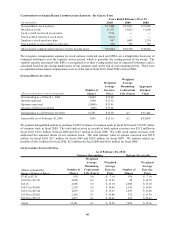

16. CONTINGENT LIABILITIES

(A) Litigation

On April 2, 2008, Mr. John Fowler filed a putative class action lawsuit against CarMax Auto Superstores California,

LLC and CarMax Auto Superstores West Coast, Inc. in the Superior Court of California, County of Los Angeles.

Subsequently, two other lawsuits, Leena Areso et al. v. CarMax Auto Superstores California, LLC and Justin

Weaver v. CarMax Auto Superstores California, LLC, were consolidated as part of the Fowler case. The allegations