Blackberry 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

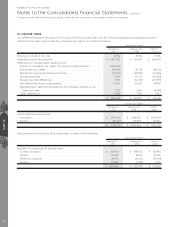

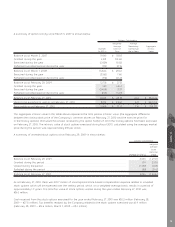

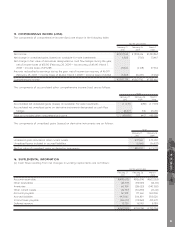

(b) Certain statement of cash flow information related to interest and income taxes paid is summarized as follows:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Interest paid during the year.................................................................................................. $ – $ 502 $ 518

Income taxes paid during the year ........................................................................................ $1,081,720 $946,237 $216,095

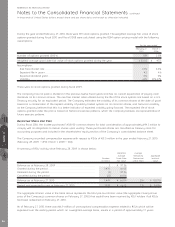

(c) The following items are included in the accrued liabilities balance:

February 27,

2010

February 28,

2009

As at

Marketing costs......................................................................................................................................... $ 91,554 $ 91,160

Vendor inventory liabilities......................................................................................................................... 125,761 18,000

Warranty ................................................................................................................................................... 252,316 184,335

Royalties.................................................................................................................................................... 383,939 279,476

Rebates ..................................................................................................................................................... 146,304 134,788

Other ......................................................................................................................................................... 638,386 530,843

$1,638,260 $1,238,602

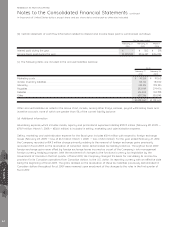

Other accrued liabilities as noted in the above chart, include, among other things, salaries, payroll withholding taxes and

incentive accruals, none of which are greater than 5% of the current liability balance.

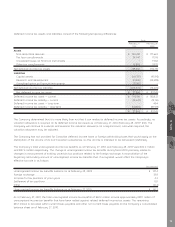

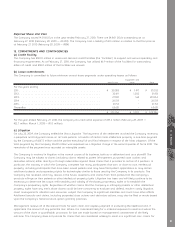

(d) Additional information

Advertising expense, which includes media, agency and promotional expenses totalling $790.8 million (February 28, 2009 —

$718.9 million; March 1, 2008 — $336.0 million) is included in selling, marketing and administration expense.

Selling, marketing and administration expense for the fiscal year includes $58.4 million with respect to foreign exchange

losses (February 28, 2009 — loss of $6.1 million; March 1, 2008 — loss of $5.3 million). For the year ended February 27, 2010,

the Company recorded a $54.3 million charge primarily relating to the reversal of foreign exchange gains previously

recorded in fiscal 2009 on the revaluation of Canadian dollar denominated tax liability balances. Throughout fiscal 2009,

foreign exchange gains were offset by foreign exchange losses incurred as a part of the Company’s risk management

foreign currency hedging program. With the enactment of changes to the functional currency tax legislation by the

Government of Canada in the first quarter of fiscal 2010, the Company changed the basis for calculating its income tax

provision for its Canadian operations from Canadian dollars, to the U.S. dollar, its reporting currency with an effective date

being the beginning of fiscal 2009. The gains realized on the revaluation of these tax liabilities previously denominated in

Canadian dollars throughout fiscal 2009 were reversed upon enactment of the changes to the rules in the first quarter of

fiscal 2010.

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTE 16

84