Blackberry 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

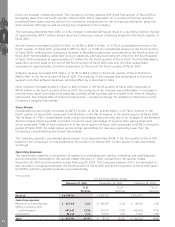

Non-GAAP Financial Measures

The Company’s financial statements are prepared in accordance with U.S. GAAP on a basis consistent for all

periods presented. In this MD&A, the Company has presented the following “non-GAAP financial measures”:

adjusted net income and adjusted diluted earnings per share. The term “non-GAAP financial measure” is used

to refer to a numerical measure of a company’s historical or future financial performance, financial position or

cash flows that: (i) excludes amounts, or is subject to adjustments that have the effect of excluding amounts,

that are included in the most directly comparable measure calculated and presented in accordance with U.S.

GAAP in a company’s statement of income, balance sheet or statement of cash flows; or (ii) includes amounts,

or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly

comparable measure so calculated and presented. Adjusted net income and adjusted diluted earnings per

share are non-GAAP financial measures that exclude the impact of the charge for the payment of the

settlement of the Visto Litigation in the second quarter of fiscal 2010, and the impacts of the benefit relating to

the enactment of functional currency tax reporting legislation by the Government of Canada and the charge

for the payment on account of certain employee tax liabilities related to certain previously exercised stock

options with measurement date issues that were exercised during certain time periods in the first quarter of

fiscal 2010. This section of the MD&A describes the Company’s use of such non-GAAP financial measures.

In the second quarter of fiscal 2010, the Company entered into a definitive agreement to settle the Visto

Litigation with Visto. The key terms of the settlement involved the Company receiving a perpetual and fully-

paid license on all Visto patents, a transfer of certain Visto intellectual property, a one-time payment by the

Company of $267.5 million and the parties executing full and final releases in respect of all outstanding

worldwide litigation. Of the total payment by the Company, $163.8 million ($112.8 million net of tax) was

expensed as a litigation charge in the second quarter of fiscal 2010. The remainder of the payment was

recorded as intangible assets. The settlement was completed on July 23, 2009.

The Company reported an income tax provision for fiscal 2009 that was higher than previously forecasted, the

majority of the incremental portion of which was reversed in the first quarter of fiscal 2010. The fiscal 2009

income tax provision reflects an effective tax rate that is significantly higher than the Company’s historical

effective tax rate due to the significant depreciation of the Canadian dollar relative to the U.S. dollar and its

effect on the Company’s U.S. dollar denominated assets and liabilities held by RIM’s Canadian operating

companies that are subject to tax in Canadian dollars. The majority of this effect was experienced in the third

quarter of fiscal 2009. As described in greater detail under “Results of Operations — Income Taxes” for fiscal

year end February 27, 2010, on March 12, 2009 changes to the Income Tax Act (Canada) that allow RIM to

calculate its fiscal 2009 Canadian income tax expense based on the U.S. dollar (the Company’s functional

currency) were enacted. Although the Company elected for Canadian income tax purposes to adopt these

rules in the third quarter of fiscal 2009, the Company could not recognize the related income tax reduction of

electing to adopt these rules for U.S. GAAP financial reporting purposes until the quarter in which they are

enacted, resulting in a higher provision in fiscal 2009. In the first quarter of fiscal 2010, the Company recorded

an incremental income tax benefit of approximately $145.0 million to net income relating to the enactment of

rules making the election effective to determine its Canadian income tax based on its functional currency. As

result of the enactment of the rules and the Company’s election to determine its Canadian income tax based

on its functional currency, future volatility in the Company’s effective tax rate due to changes in foreign

exchange rates should be reduced.

In the first quarter of fiscal 2010, the Company recorded an expense of $54.3 million ($37.4 million net of tax)

primarily relating to the reversal of foreign exchange gains previously recorded in fiscal 2009 on the

revaluation of Canadian dollar denominated tax liability balances. See “Results of Operations — Selling,

Marketing and Administration Expenses” for fiscal year end February 27, 2010.

Also, in the first quarter of fiscal 2010, there was a charge of approximately $42.1 million ($29.0 million net of

tax) for the payment on account of certain employee tax liabilities related to certain previously-exercised stock

options with measurement date issues that were exercised during certain time periods. The Company’s Board

of Directors approved the payment on account of certain incremental personal tax liabilities of certain

employees, excluding RIM’s Co-CEOs, related to the exercise of certain stock options issued by the Company.

See “Results of Operations — Selling, Marketing and Administration Expenses” for fiscal year end February 27,

2010.

Investors are cautioned that adjusted net income and adjusted diluted earnings per share do not have any

standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similarly titled

measures reported by other issuers. These non-GAAP financial measures should be considered in the context

of the Company’s U.S. GAAP results.

MD&A

29