Blackberry 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

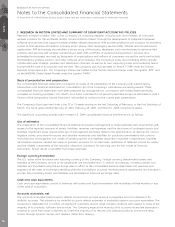

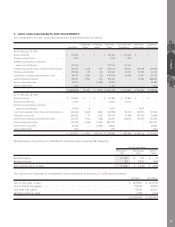

Intangible assets are amortized as follows:

Acquired technology Straight-line over 2 to 5 years

Licenses Straight-line over terms of the license agreements or on a

per unit basis based upon the anticipated number of units

sold during the terms, subject to a maximum of 5 years

Patents Straight-line over 17 years or over estimated useful life

Goodwill

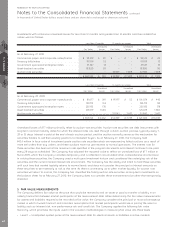

Goodwill represents the excess of the purchase price of business acquisitions over the fair value of identifiable net assets

acquired. Goodwill is allocated as at the date of the business combination. Goodwill is not amortized, but is tested for

impairment annually, or more frequently if events or changes in circumstances indicate the asset may be impaired.

The Company is organized and managed as a single reportable business segment (“reporting unit”). The impairment test

is carried out in two steps. In the first step, the carrying amount of the reporting unit including goodwill is compared with

its fair value. When the fair value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is

considered not to be impaired, and the second step is unnecessary.

In the event that the fair value of the reporting unit, including goodwill, is less than the carrying value, the implied fair value

of the reporting unit’s goodwill is compared with its carrying amount to measure the amount of the impairment loss, if any.

The implied fair value of goodwill is determined in the same manner as the value of goodwill is determined in a business

combination using the fair value of the reporting unit as if it were the purchase price. When the carrying amount of the

reporting unit goodwill exceeds the implied fair value of the goodwill, an impairment loss is recognized in an amount equal

to the excess and is presented as a separate line item in the consolidated statements of operations.

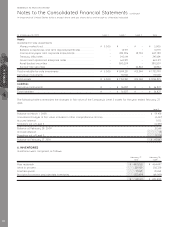

Impairment of long-lived assets

The Company reviews long-lived assets such as property, plant and equipment and intangible assets with finite useful

lives for impairment whenever events or changes in circumstances indicate that the carrying amount may not be

recoverable. If the total of the expected undiscounted future cash flows is less than the carrying amount of the asset, a

loss is recognized for the excess of the carrying amount over the fair value of the asset.

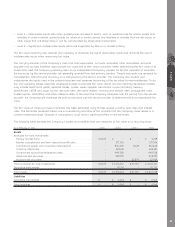

Income taxes

The Company uses the liability method of tax allocation to account for income taxes. Deferred income tax assets and

liabilities are recognized based upon temporary differences between the financial reporting and tax bases of assets and

liabilities, and measured using enacted tax rates and laws that will be in effect when the differences are expected to

reverse. The Company records a valuation allowance to reduce deferred income tax assets to the amount that is more

likely than not to be realized. The Company considers both positive evidence and negative evidence, to determine whether,

based upon the weight of that evidence, a valuation allowance is required. Judgment is required in considering the relative

impact of negative and positive evidence.

Significant judgment is required in evaluating the Company’s uncertain tax positions and provisions for income taxes.

Liabilities for uncertain tax positions are recognized based on a two-step approach. The first step is to evaluate whether a

tax position has met the recognition threshold by determining if the weight of available evidence indicates that it is more

likely than not to be sustained upon examination. The second step is to measure the tax position that has met the

recognition threshold as the largest amount that is more than 50% likely of being realized upon settlement. The Company

continually assesses the likelihood and amount of potential adjustments and adjusts the income tax provisions, income tax

payable and deferred taxes in the period in which the facts that give rise to a revision become known. The Company

recognizes interest and penalties related to uncertain tax positions as interest expense that is netted and reported within

investment income.

The Company uses the flow-through method to account for investment tax credits (“ITCs”) earned on eligible scientific

research and experimental development expenditures. Under this method, the ITCs are recognized as a reduction to

income tax expense.

NOTES 1NOTE 1

61