Blackberry 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

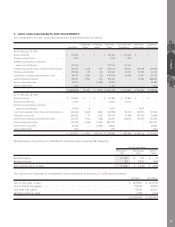

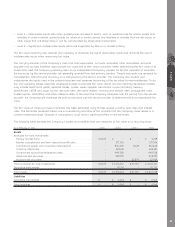

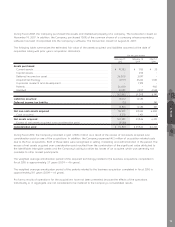

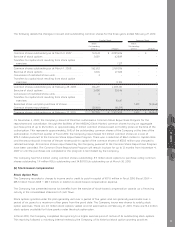

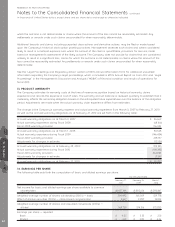

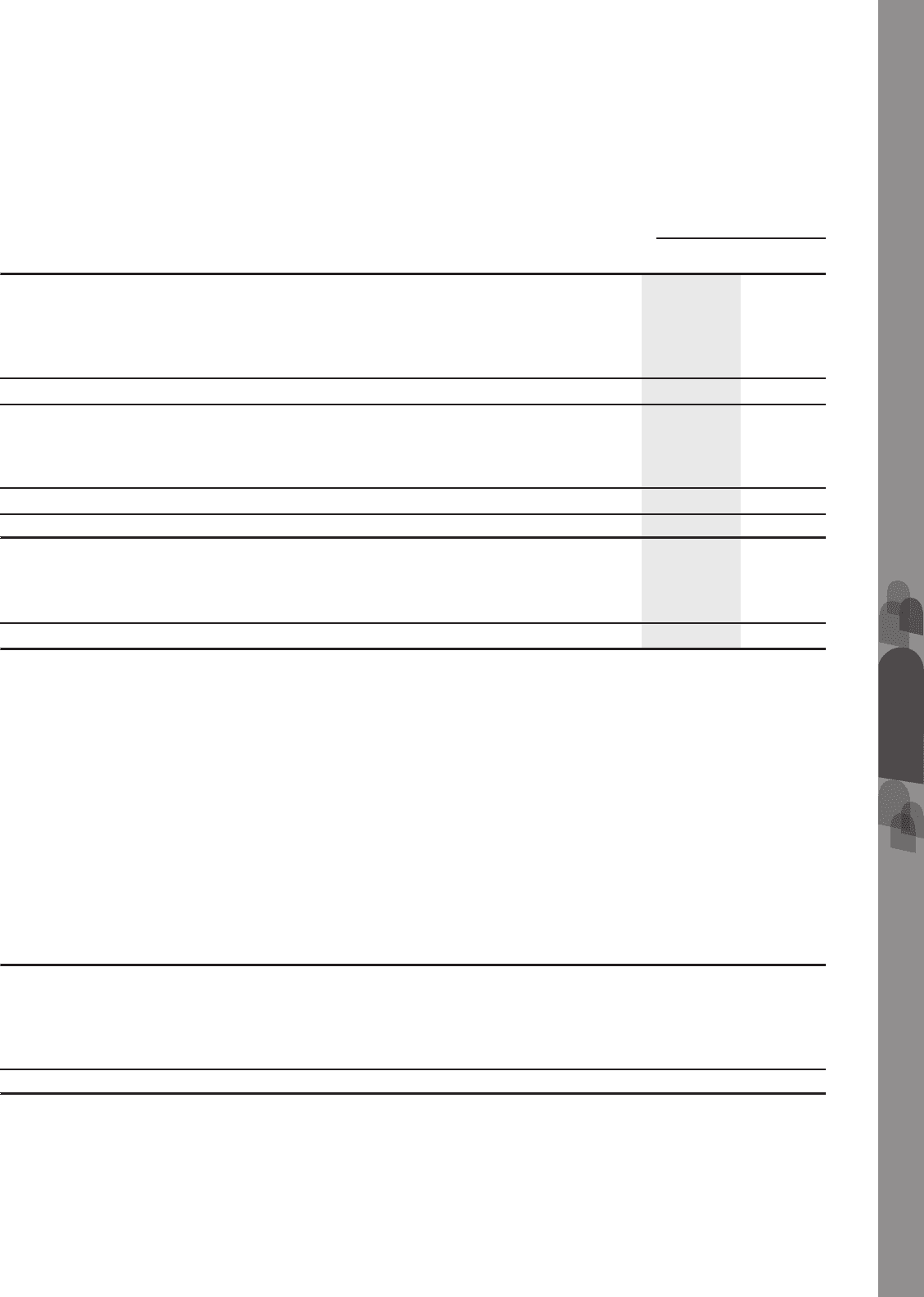

Deferred income tax assets and liabilities consist of the following temporary differences:

February 27,

2010

February 28,

2009

As at

Assets

Non-deductible reserves ..................................................................................................... $ 190,491 $ 177,669

Tax loss carryforwards ....................................................................................................... 34,947 11,176

Unrealized losses on financial instruments .......................................................................... – 1,902

Other tax carryforwards ..................................................................................................... 12,892 3,972

Net deferred income tax assets.............................................................................................. 238,330 194,719

Liabilities

Capital assets .................................................................................................................... (161,707) (91,193)

Research and development ................................................................................................ (21,396) (20,283)

Unrealized gains on financial instruments ........................................................................... (17,367) –

Net deferred income tax liabilities .......................................................................................... (200,470) (111,476)

Net deferred income tax asset............................................................................................ $ 37,860 $ 83,243

Deferred income tax asset — current ...................................................................................... $ 193,916 $ 183,872

Deferred income tax liability — current ................................................................................... (14,674) (13,116)

Deferred income tax asset — long-term .................................................................................. – 404

Deferred income tax liability — long-term ............................................................................... (141,382) (87,917)

$ 37,860 $ 83,243

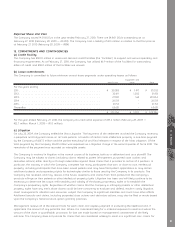

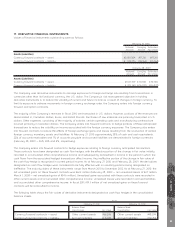

The Company determined that it is more likely than not that it can realize its deferred income tax assets. Accordingly, no

valuation allowance is required on its deferred income tax assets as at February 27, 2010 (February 28, 2009- $nil). The

Company will continue to evaluate and examine the valuation allowance on a regular basis, and when required, the

valuation allowance may be adjusted.

The Company has not provided for Canadian deferred income taxes or foreign withholding taxes that would apply on the

distribution of the income of its non-Canadian subsidiaries, as this income is intended to be reinvested indefinitely.

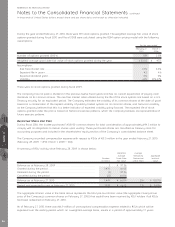

The Company’s total unrecognized income tax benefits as at February 27, 2010 and February 28, 2009 were $161.2 million

and $137.4 million respectively. The change in unrecognized income tax benefits during fiscal 2010 primarily relates to

changes in measurement of existing uncertain tax positions related to the foreign exchange. A reconciliation of the

beginning and ending amount of unrecognized income tax benefits that, if recognized, would affect the Company’s

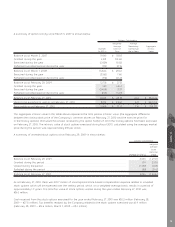

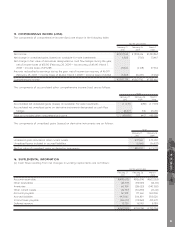

effective tax rate is as follows:

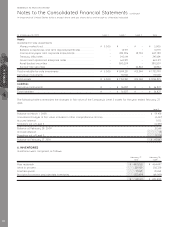

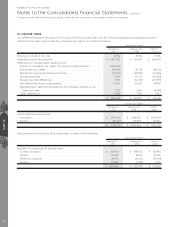

(in millions)

Unrecognized income tax benefits balance as at February 28, 2009 .............................................................. $ 137.4

Foreign exchange .......................................................................................................................................... 35.8

Increase for tax positions of prior years ........................................................................................................ 4.2

Settlement of tax positions ............................................................................................................................ 0.0

Other ............................................................................................................................................................ (16.2)

Unrecognized income tax benefits balance as at February 27, 2010 ............................................................... $ 161.2

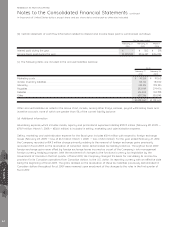

As at February 27, 2010, the total unrecognized income tax benefits of $161.2 million include approximately $118.1 million of

unrecognized income tax benefits that have been netted against related deferred income tax assets. The remaining

$43.1 million is recorded within current taxes payable and other non-current taxes payable on the Company’s consolidated

balance sheet as of February 27, 2010.

NOTE 10

75