Blackberry 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

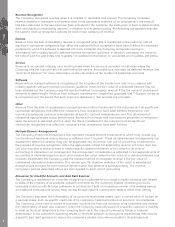

and credit risk. The Company applies the following fair value hierarchy, which prioritizes the inputs used in the

valuation methodologies in measuring fair value into three levels:

• Level 1 — Unadjusted quoted prices at the measurement date for identical assets or liabilities in active

markets.

• Level 2 — Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar

assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets

that are not active; or other inputs that are observable or can be corroborated by observable market data.

• Level 3 — Significant unobservable inputs which are supported by little or no market activity.

The fair value hierarchy also requires the Company to maximize the use of observable inputs and minimize

the use of unobservable inputs when measuring fair value.

When determining the fair value of its investments, the Company primarily relies on an independent third

party valuator. Pricing inputs by the service provider are generally received from two primary vendors. The

pricing inputs are reviewed for completeness, tolerance and accuracy on a daily basis by the service provider.

The Company also reviews and understands the inputs used in the valuation process and assesses the pricing

of the securities for reasonableness. To do this, the Company utilizes internally developed models to estimate

fair value. Inputs into the internally developed models may include benchmark yields, reported trades, quotes,

issuer spreads, benchmark curves (including Treasury benchmarks, LIBOR and swap curves), discount rates,

derivative indices, recovery and default rates, prepayment rates, trustee reports, bids/offers and other

reference data. In the event the Company disagrees with the pricing from the service provider, the Company

will challenge the pricing and work with the service provider to determine the fair value.

Given the current market conditions and economic uncertainties, management exercises significant judgment

in determining the fair value of the Company’s investments and the investment’s classification level within the

three-tier fair value hierarchy. As at February 27, 2010, the Company had approximately 98% of its

available-for-sale investments measured at fair value classified in Level 2.

The Company regularly assesses declines in the value of individual investments for impairment to determine

whether the decline is other-than-temporary. The Company makes this assessment by considering available

evidence, including changes in general market conditions, specific industry and individual company data, the

length of time and the extent to which the market value has been less than cost, the financial condition, the

near-term prospects of the individual investment and the Company’s intent and ability to hold the investments

to maturity. In the event that a decline in the fair value of an investment occurs and the decline in value is

considered to be other-than-temporary, an appropriate write-down would be recorded. The Company’s

assessment on whether an investment is other-than-temporarily impaired or not, could change due to new

developments or changes in assumptions or risks to any particular investment.

For further details on the Company’s investments and fair value conclusions, refer to Note 4 and Note 5 to the

Consolidated Financial Statements.

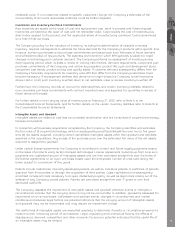

Income Taxes

The Company uses the liability method of tax allocation to account for income taxes. Under this method,

deferred income tax assets and liabilities are recognized based upon differences between the financial

reporting and tax bases of assets and liabilities, and measured using enacted tax rates and laws that will be

in effect when the differences are expected to reverse. The Company’s deferred income tax asset balance

represents temporary differences between the financial reporting and tax basis of assets and liabilities,

including research and development costs and incentives, capital assets, non-deductible reserves and

operating loss carryforwards, net of valuation allowances. The Company records a valuation allowance to

reduce deferred income tax assets to the amount management considers to be more likely than not to be

realized. The Company considers both positive evidence and negative evidence, to determine whether, based

upon the weight of that evidence, a valuation allowance is required. Judgment is required in considering the

relative impact of negative and positive evidence. If the Company determines that it is more likely than not

that it will not be able to realize all or part of its deferred income tax assets in future fiscal periods, the

valuation allowance would be increased, resulting in a decrease to net income in the reporting periods when

such determinations are made.

MD&A

11