Blackberry 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

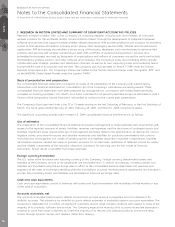

guidance and disclosure requirements in the second quarter of fiscal 2010 and the adoption did not have a material

impact on the Company’s results of operations and financial condition.

In April 2009, the FASB issued authoritative guidance on interim disclosures about fair value of financial instruments.The

guidance expands the fair value disclosure of financial instruments to interim periods. In addition, it requires disclosures of

the methods and significant assumptions used to estimate the fair value of financial instruments. The Company adopted

the authoritative guidance and disclosure requirements in the second quarter of fiscal 2010 and the adoption did not have

a material impact on the Company’s results of operations and financial condition.

In April 2009, the FASB issued authoritative guidance on recognition and presentation of other-than-temporary

impairments. The guidance applies to investments in which other-than-temporary impairments may be recorded and

establishes a new model for measuring other-than-temporary impairments for debt securities. In addition, it requires

additional disclosures related to debt and equity securities. The Company adopted the authoritative guidance in the

second quarter of fiscal 2010 and the adoption did not have a material impact on the Company’s results of operations

and financial condition.

In April 2009, the FASB issued authoritative guidance on determining fair value when the volume and level of activity for the

asset or liability have significantly decreased and identifying transactions that are not orderly. The Company adopted the

authoritative guidance in the second quarter of fiscal 2010 and the adoption did not have a material impact on the

Company’s results of operations and financial condition.

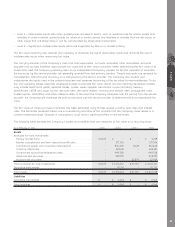

In September 2006, the FASB issued authoritative guidance on fair value measurements which became effective for fiscal

years beginning after November 15, 2007. However, in February 2008, the FASB issued further guidance which delayed the

effective date relating to fair value measurements for non-financial assets and liabilities that are not measured at fair

value on a recurring basis to November 15, 2008. The Company partially adopted the authoritative guidance on fair value

measurements in the first quarter of fiscal 2009. The Company adopted the remaining portion of the authoritative

guidance on fair value measurements relating to non-financial assets and liabilities that are not measured at fair value on

a recurring basis in the first quarter of fiscal 2010. The adoption did not have a material impact on the Company’s results

of operations and financial condition.

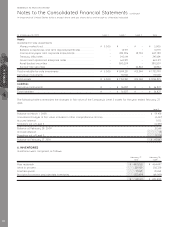

In December 2007, the FASB issued authoritative guidance on business combinations. The guidance is broader in scope

than previous guidance which applied only to business combinations in which control was obtained by transferring

consideration. The issued guidance applies to all transactions and other events in which one entity obtains control over

one or more other businesses. In April 2009, the FASB released further guidance with respect to business combinations

specifically accounting for assets acquired and liabilities assumed in a business combination that arise from

contingencies, which amends and clarifies the initial recognition and measurement, subsequent measurement and

accounting, and related disclosures of assets and liabilities arising from contingencies in a business combination. This

guidance is effective for assets and liabilities arising from contingencies in business combinations for which the acquisition

date is on or after December 15, 2008. As discussed in note 9, the Company adopted the authoritative guidance on

business combinations as amended, in the first quarter of fiscal 2010 and the adoption did not have a material impact on

the Company’s results of operations and financial condition. In December 2007, the FASB issued authoritative guidance on

noncontrolling interests in consolidated financial statements. The guidance requires that the noncontrolling interest in the

equity of a subsidiary be accounted for and reported as equity, provides revised guidance on the treatment of net income

and losses attributable to the noncontrolling interest and changes in ownership interests in a subsidiary and requires

additional disclosures that identify and distinguish between the interests of the controlling and noncontrolling owners. The

Company adopted the guidance in the first quarter of fiscal 2010 and the adoption did not have a material impact on the

Company’s results of operations and financial condition.

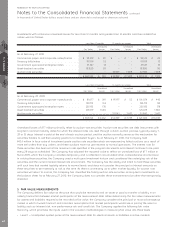

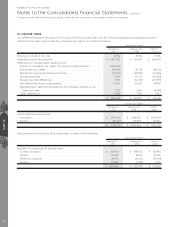

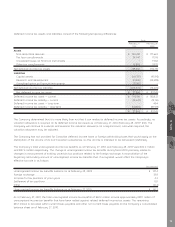

3. RECENTLY ISSUED PRONOUNCEMENTS

In January 2010, the FASB issued authoritative guidance to improve disclosures about fair value measurements. The

guidance amends previous literature to require an entity to provide a number of additional disclosures regarding fair

value measurements including significant transfers between Level 1 and Level 2 on a gross basis and the reasons for such

transfers, transfers in and out of Level 3 on a gross basis and the reasons for such transfers, the entity’s policy for

recognizing transfers between Levels and to disclose information regarding purchases, sales, issuances and settlements on

a gross basis in the Level 3 reconciliation of recurring fair value measurements. The guidance also further clarifies existing

NOTES 2 3

65