Blackberry 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

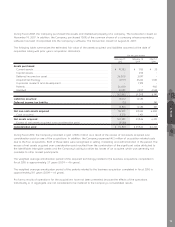

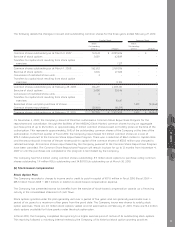

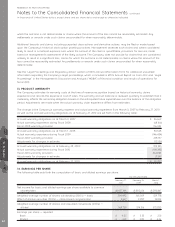

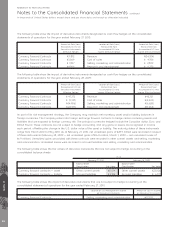

15. COMPREHENSIVE INCOME (LOSS)

The components of comprehensive income (loss) are shown in the following table:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Net income ........................................................................................................................... $2,457,144 $ 1,892,616 $1,293,867

Net change in unrealized gains (losses) on available- for-sale investments ........................ 6,803 (7,161) 13,467

Net change in fair value of derivatives designated as cash flow hedges during the year,

net of income taxes of $13,190 (February 28, 2009 — tax recovery of $8,641; March 1,

2008 — income taxes of $19,238) ....................................................................................... 28,324 (6,168) 37,564

Amounts reclassified to earnings during the year, net of income tax recovery of $6,079

(February 28, 2009 — income taxes of $4,644; March 1, 2008 — income taxes of $5,142) .. 15,508 (16,497) (9,232)

Comprehensive income......................................................................................................... $2,507,779 $1,862,790 $1,335,666

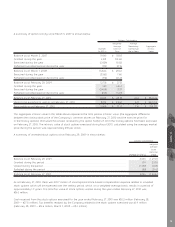

The components of accumulated other comprehensive income (loss) are as follows:

February 27,

2010

February 28,

2009

March 1,

2008

As at

Accumulated net unrealized gains (losses) on available- for-sale investments........................ $ 6,715 $(88) $ 7,073

Accumulated net unrealized gains on derivative instruments designated as cash flow

hedges.................................................................................................................................. 44,377 545 23,210

Total accumulated other comprehensive income..................................................................... $51,092 $457 $30,283

The components of unrealized gains (losses) on derivative instruments are as follows:

February 27,

2010

February 28,

2009

As at

Unrealized gains included in other current assets..................................................................................... $97,261 $ 70,100

Unrealized losses included in accrued liabilities........................................................................................ (6,164) (56,827)

Net fair value of unrealized gains on derivative instruments..................................................................... $91,097 $ 13,273

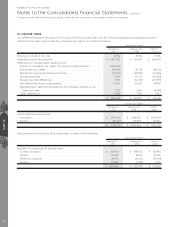

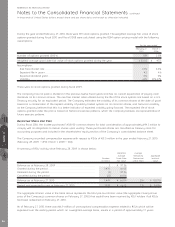

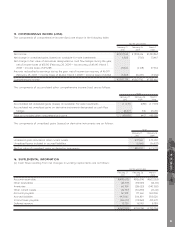

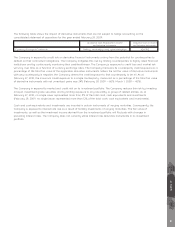

16. SUPPLEMENTAL INFORMATION

(a) Cash flows resulting from net changes in working capital items are as follows:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Accounts receivable............................................................................................................... $(480,610) $(936,514) $(602,055)

Other receivables .................................................................................................................. (44,719) (83,039) (34,515)

Inventories............................................................................................................................. 60,789 (286,133) (140,360)

Other current assets.............................................................................................................. (52,737) (50,280) (26,161)

Accounts payable ................................................................................................................. 167,281 177,263 140,806

Accrued liabilities................................................................................................................... 442,065 506,859 383,020

Income taxes payable .......................................................................................................... (266,517) (113,868) 401,270

Deferred revenue................................................................................................................... 13,739 16,598 8,789

$ (160,709) $ (769,114) $ 130,794

NOTES 15 16

83