Blackberry 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

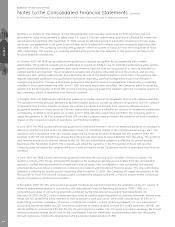

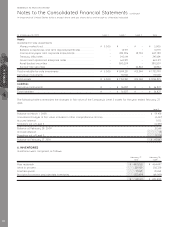

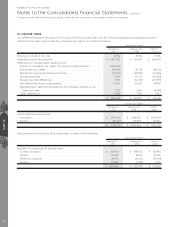

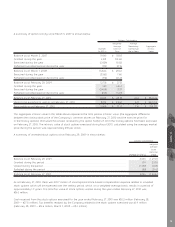

During fiscal 2010, the additions to intangible assets primarily consisted of $104 million as part of a definitive agreement to

settle all outstanding worldwide patent litigation (“the Visto Litigation”) with Visto Corporation (“Visto”) as described in

note 12(c), agreements with third parties totalling approximately $245.7 million for the use of intellectual property, software,

messaging services and other BlackBerry related features and intangible assets associated with the business acquisitions

discussed in note 9.

During fiscal 2009, the Company entered into agreements with third parties totalling $353.5 million for the use of intellectual

property, software, messaging services and other BlackBerry related features. In addition, the Company entered into

several agreements to acquire portfolios of patents relating to wireless communication technologies totalling $279.5 million.

The acquired patents were recorded as intangible assets and are being amortized over their estimated useful lives.

For the year ended February 27, 2010, amortization expense related to intangible assets was $271.1 million (February 28,

2009 — $124.5 million; March 1, 2008 — $44.3 million). Total additions to intangible assets in fiscal 2010 were $531.0 million

(2009 — $721.1million).

Based on the carrying value of the identified intangible assets as at February 27, 2010 and assuming no subsequent

impairment of the underlying assets, the annual amortization expense for the next five fiscal years is expected to be as

follows: 2011 — $324 million; 2012 — $275 million; 2013 — $227 million; 2014 — $139 million; and 2015 — $61 million.

The weighted-average remaining useful life of the acquired technology is 3.4 years (2009 — 3.7 years).

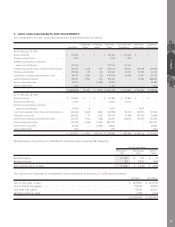

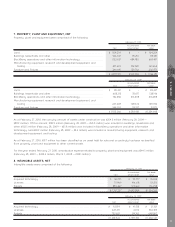

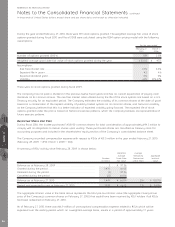

9. BUSINESS ACQUISITIONS

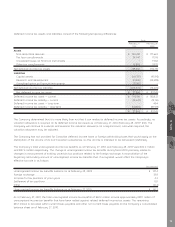

During fiscal 2010, the Company purchased for cash consideration certain assets of a company whose acquired

technologies will be used in next generation wireless technologies. The transaction closed on February 9, 2010.

During fiscal 2010, the Company purchased for cash consideration 100% of the common shares of Torch Mobile Inc.

(“Torch”). The transaction closed on August 21, 2009. Torch provides the Company with web browser based technology.

During fiscal 2010, the Company purchased for cash consideration 100% of the common shares of a company whose

proprietary software will be incorporated into the Company’s software. The transaction closed on May 22, 2009.

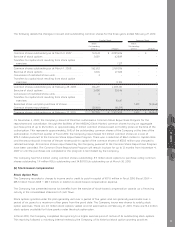

During fiscal 2010, the Company purchased 100% of the common shares of Certicom Corp. (“Certicom”) at a price of CAD

$3.00 for each common share of Certicom or approximately CAD $131.3 million. The transaction closed on March 23, 2009.

Certicom is a leading provider of cryptography required by software vendors and device manufacturers looking to protect

the value of content, applications and devices with government approved security using Elliptic Curve Cryptography.

The acquisitions were accounted for using the acquisition method whereby identifiable assets acquired and liabilities

assumed were measured at their fair values as of the date of acquisition. The excess of the acquisition price over such fair

value, if any, is recorded as goodwill, which is not expected to be deductible for tax purposes. In-process research and

development is charged to amortization expense immediately after acquisition. The Company includes the operating

results of each acquired business in the consolidated financial statements from the date of acquisition.

Effective fiscal 2010, the Company expenses: (a) all direct costs associated with the acquisitions as incurred;

(b) compensation paid to employees for pre-combination services as part of the consideration paid; and (c) compensation

paid to employees for post-combination services as operating expenses separate from the business combination. The

Company no longer expenses in-process research and development; instead it is capitalized and amortized over its

estimated useful life once it is ready for use. The Company recognizes the excess of net assets acquired over

consideration paid in income.

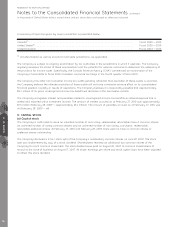

During fiscal 2009, the Company purchased 100% of the common shares of Chalk Media Corp (“Chalk”). The transaction

closed on January 30, 2009. Chalk is the developer of Mobile chalkboard

TM

, which enables the rapid creation and secure,

tracked deployment of media-rich “Pushcasts”

TM

to BlackBerry smartphones.

During fiscal 2009, the Company purchased 100% of the common shares of a company whose proprietary software is

being incorporated into the Company’s software. The transaction closed on February 13, 2009.

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTES 8 9

72