Blackberry 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

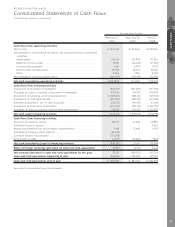

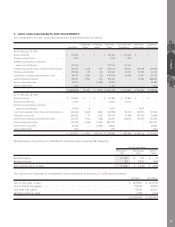

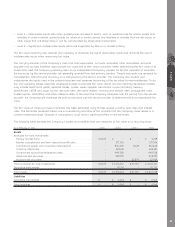

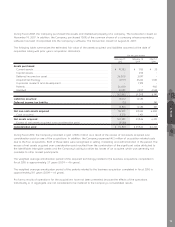

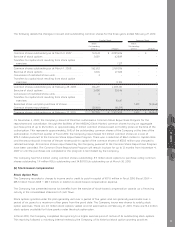

4. CASH, CASH EQUIVALENTS AND INVESTMENTS

The components of cash, cash equivalents and investments were as follows:

Cost Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Cash and Cash

Equivalents

Short-term

Investments

Long-term

Investments

As at February 27, 2010

Bank balances... ................................................ $ 535,445 $ – $ – $ 535,445 $ 535,445 $ – $ –

Money market fund ........................................... 3,278 – – 3,278 3,278 – –

Bankers acceptances and term

deposits/certificates........................................ 377,596 – – 377,596 377,596 – –

Commercial paper and corporate notes/bonds ... 855,145 6,528 (49) 861,624 472,312 187,369 201,943

Treasury bills/notes............................................ 203,514 129 (12) 203,631 92,272 50,786 60,573

Government sponsored enterprise notes.............. 447,131 2,590 (13) 449,708 69,958 111,977 267,773

Asset-backed securities ...................................... 393,751 5,280 (50) 398,981 – 10,482 388,499

Auction-rate securities ........................................ 40,527 – (7,688) 32,839 – – 32,839

Other investments .............................................. 6,621 – – 6,621 – – 6,621

$ 2,863,008 $ 14,527 $ (7,812) $ 2,869,723 $ 1,550,861 $ 360,614 $ 958,248

As at February 28, 2009

Bank balances... ................................................ $ 477,855 $ – $ – $ 477,855 $ 477,855 $ – $ –

Money market fund ........................................... 5,000 – – 5,000 5,000 – –

Bankers acceptances and term

deposits/certificates........................................ 14,963 8 – 14,971 – 14,971 –

Commercial paper and corporate notes/bonds ... 404,623 3,608 (443) 407,788 124,720 145,605 137,463

Treasury bills/notes............................................ 245,050 717 (153) 245,614 19,398 205,633 20,583

Government sponsored enterprise notes.............. 666,627 2,922 (178) 669,371 208,573 316,457 144,341

Asset-backed securities ...................................... 379,091 2,658 (1,540) 380,209 – – 380,209

Auction-rate securities ........................................ 40,529 – (7,687) 32,842 – – 32,842

Other investments .............................................. 5,197 – – 5,197 – – 5,197

$ 2,238,935 $ 9,913 $ (10,001) $ 2,238,847 $ 835,546 $ 682,666 $ 720,635

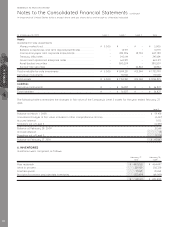

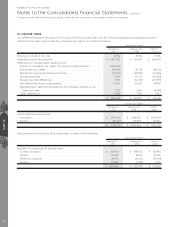

Realized gains and losses on available-for-sale securities comprise the following:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Realized gains ......................................................................................................... $ 439 $ 158 $ 10

Realized losses ........................................................................................................ (17) (1,801) (410)

Net realized gains (losses) ....................................................................................... $ 422 $ (1,643) $ (400)

The contractual maturities of available-for-sale investments at February 27, 2010 were as follows:

Cost Basis Fair Value

Due in one year or less .............................................................................................................. $ 1,371,047 $ 1,372.752

Due in one to five years ............................................................................................................. 773,471 783,451

Due after five years ................................................................................................................... 173,146 168,176

No fixed maturity date ............................................................................................................... 3,278 3,278

$ 2,320,942 $ 2,327,657

NOTE 4

67