Blackberry 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from the Administrators of LBIE relating to the Trust Claim. The Letter noted that, based on the work performed

to date, the Administrators had identified certain assets belonging to the Company within the records of LBIE

and that they are continuing to investigate the records for the remaining assets included in the Trust Claim: an

additional asset was identified as belonging to the Company in the fourth quarter of fiscal 2010. In the fourth

quarter of fiscal 2010, the Company signed the ’Form of Acceptance’ and ’Claim Resolution Agreement’, which

are the necessary steps to have the identified assets returned. The Company continues to work with the

Administrators to identify the remaining assets not specifically identified, along with the interest paid on these

assets since LBIE began its administration proceedings. The Company will continue to take all actions it deems

appropriate to defend its rights to these holdings and as a result, no impairment has been recognized against

these holdings in fiscal 2010.

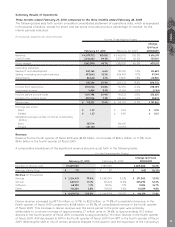

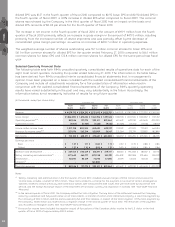

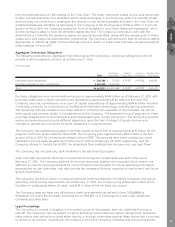

Aggregate Contractual Obligations

The following table sets out aggregate information about the Company’s contractual obligations and the

periods in which payments are due as at February 27, 2010:

(in thousands)

Total

Less than

One Year

One to

Three Years

Four to

Five Years

Greater than

Five Years

Operating lease obligations ................................................................. $ 208,386 $ 37,005 $ 59,817 $ 47,933 $ 63,631

Purchase obligations and commitments .............................................. 4,455,439 4,455,439 – – –

Total...................................................................................................... $4,663,825 $ 4,492,444 $ 59,817 $ 47,933 $ 63,631

Purchase obligations and commitments amounted to approximately $4.46 billion as of February 27, 2010, with

purchase orders with contract manufacturers representing approximately $3.82 billion of the total. The

Company also has commitments on account of capital expenditures of approximately $244.8 million included

in this total, primarily for manufacturing, facilities and information technology, including service operations.

The remaining balance consists of purchase orders or contracts with suppliers of raw materials, as well as

other goods and services utilized in the operations of the Company. The expected timing of payment of these

purchase obligations and commitments is estimated based upon current information. The timing of payments

and actual amounts paid may be different depending upon the time of receipt of goods and services,

changes to agreed-upon amounts for some obligations or payment terms.

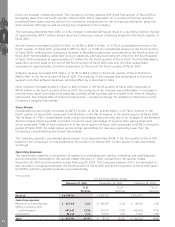

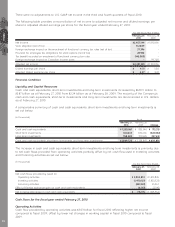

The Company has obligations payable in the first quarter of fiscal 2011 of approximately $135 million for the

payment of income taxes related to fiscal 2010. The Company paid approximately $290 million in the first

quarter of fiscal 2010 for income taxes related to fiscal 2009. The amounts have been included as current

liabilities in income taxes payable as of February 27, 2010 and February 28, 2009 respectively, and the

Company intends to fund its fiscal 2010 tax obligations from existing financial resources and cash flows.

The Company has not paid any cash dividends in the last three fiscal years.

Cash and cash equivalents, short-term investments and long-term investments were $2.87 billion as at

February 27, 2010. The Company believes its financial resources, together with expected future income, are

sufficient to meet funding requirements for current financial commitments, for future operating and capital

expenditures not yet committed, and also provide the necessary financial capacity to meet current and future

growth expectations.

The Company has $150.0 million in unsecured demand credit facilities (the “Facilities”) to support and secure

operating and financing requirements. As at February 27, 2010, the Company has utilized $6.9 million of the

Facilities for outstanding letters of credit, and $143.1 million of the Facilities are unused.

The Company does not have any off-balance sheet arrangements as defined in Item 303(a)(4)(ii) of

Regulation S-K under the Securities Exchange Act of 1934 (the “U.S. Exchange Act”) and under applicable

Canadian securities laws.

Legal Proceedings

The Company is involved in litigation in the normal course of its business, both as a defendant and as a

plaintiff. The Company may be subject to claims (including claims related to patent infringement, purported

class actions and derivative actions) either directly or through indemnities against these claims that it provides

to certain of its partners. In particular, the industry in which the Company competes has many participants

MD&A

33