Blackberry 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

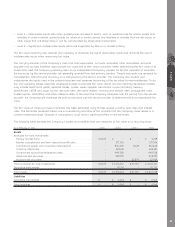

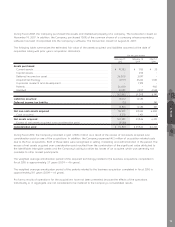

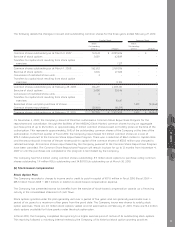

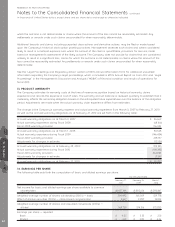

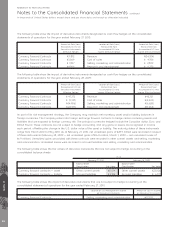

A summary of option activity since March 3, 2007 is shown below:

Number

(in 000’s)

Weighted-

Average

Exercise

Price

Average

Remaining

Contractual

Life in Years

Aggregate

Intrinsic

Value

Options Outstanding

Balance as at March 3, 2007 .......................................................... 19,161 $ 10.85

Granted during the year ................................................................. 2,518 101.60

Exercised during the year ............................................................... (5,039) 10.82

Forfeited/cancelled/expired during the year .................................... (174) 31.76

Balance as at March 1, 2008........................................................... 16,466 $ 28.66

Exercised during the year ............................................................... (3,565) 7.60

Forfeited/cancelled/expired during the year .................................... (170) 60.25

Balance as at February 28, 2009 .................................................... 12,731 $ 27.51

Granted during the year ................................................................. 559 64.14

Exercised during the year ............................................................... (3,408) 8.87

Forfeited/cancelled/expired during the year .................................... (859) 15.03

Balance as at February 27, 2010 ..................................................... 9,023 $ 44.18 2.44 $ 307,626

Vested and expected to vest as at February 27, 2010 ...................... 8,814 $ 43.62 2.41 $ 304,259

Exercisable as at February 27, 2010 ................................................ 5,968 $ 32.15 1.76 $ 258,577

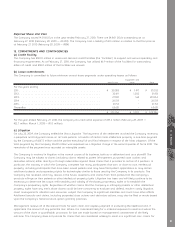

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the aggregate difference

between the closing stock price of the Company’s common shares on February 27, 2010 and the exercise price for

in-the-money options) that would have been received by the option holders if all in-the-money options had been exercised

on February 27, 2010. The intrinsic value of stock options exercised during fiscal 2010, calculated using the average market

price during the period, was approximately $58 per share.

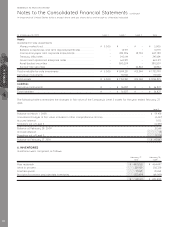

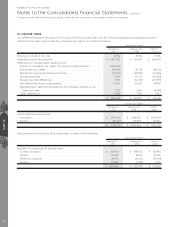

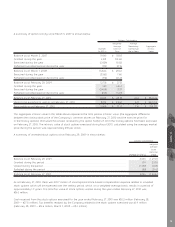

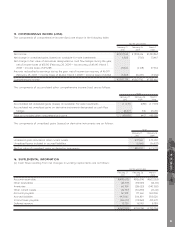

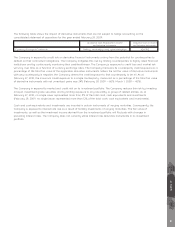

A summary of unvested stock options since February 28, 2009 is shown below:

Number (in 000’s)

Weighted

Average

Grant

Date Fair

Value

Options Outstanding

Balance as at February 28, 2009 ................................................................................................ 4,045 $ 29.69

Granted during the period .......................................................................................................... 559 33.02

Vested during the period ............................................................................................................ (1,468) 24.83

Forfeited during the period ......................................................................................................... (80) 37.45

Balance as at February 27, 2010 ................................................................................................. 3,056 $ 32.44

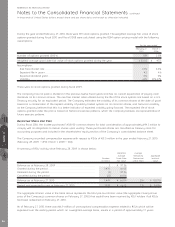

As at February 27, 2010, there was $74.7 million of unrecognized stock-based compensation expense related to unvested

stock options which will be expensed over the vesting period, which, on a weighted-average basis, results in a period of

approximately 1.9 years. The total fair value of stock options vested during the year ended February 27, 2010 was

$36.5 million.

Cash received from the stock options exercised for the year ended February 27, 2010 was $30.2 million (February 28,

2009 — $27.0 million). Tax benefits realized by the Company related to the stock options exercised was $1.9 million

(February 28, 2009 — $12.6 million; March 1, 2008 — $8.2 million).

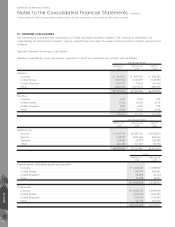

NOTE 11

79