Blackberry 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

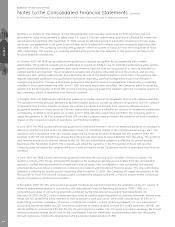

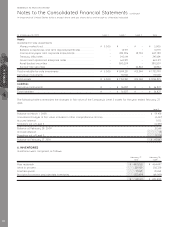

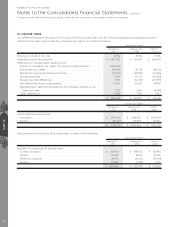

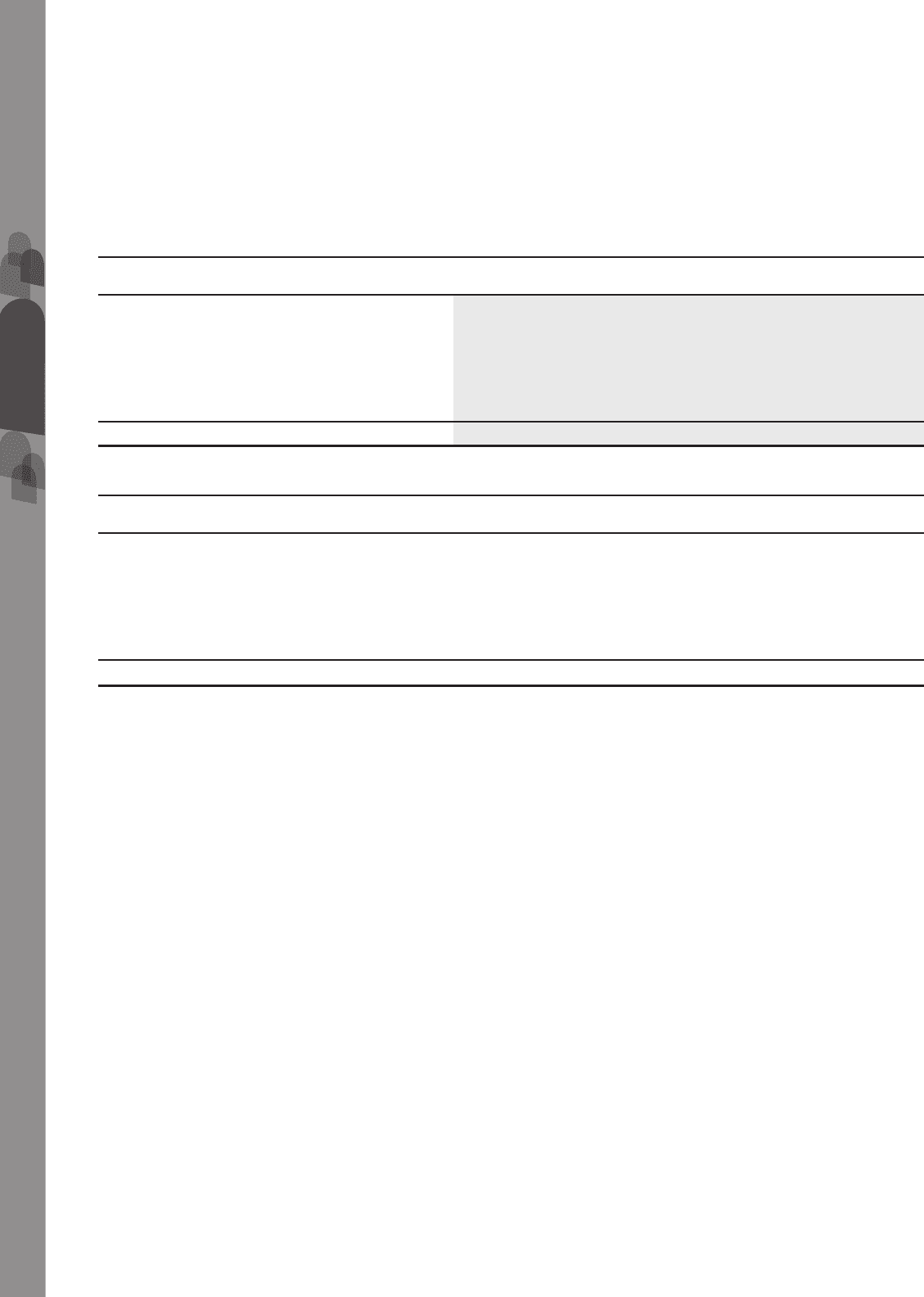

Investments with continuous unrealized losses for less than 12 months and greater than 12 months and their related fair

values were as follows:

Fair Value

Unrealized

losses Fair Value

Unrealized

losses Fair Value

Unrealized

losses

Less than 12 months 12 months or greater Total

As at February 27, 2010

Commercial paper and corporate notes/bonds ......... $ 93,129 $ 49 $ – $ – $ 93,129 $ 49

Treasury bills/notes ................................................... 91,109 12 – – 91,109 12

Government sponsored enterprise notes .. .................. 57,537 13 – – 57,537 13

Asset-backed securities ............................................. 18,820 50 – – 18,820 50

Auction-rate securities................................................ – – 32,839 7,688 32,839 7,688

$ 260,595 $ 124 $ 32,839 $ 7,688 $ 293,434 $ 7,812

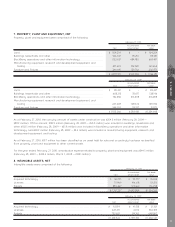

Fair Value

Unrealized

losses Fair Value

Unrealized

losses Fair Value

Unrealized

losses

Less than 12 months 12 months or greater Total

As at February 28, 2009

Commercial paper and corporate notes/bonds ......... $ 81,077 $ 391 $ 19,997 $ 52 $ 101,074 $ 443

Treasury bills/notes ................................................... 130,713 153 – – 130,713 153

Government sponsored enterprise notes .. .................. 231,955 178 – – 231,955 178

Asset-backed securities ............................................. 125,019 1,540 – – 125,019 1,540

Auction-rate securities................................................ – – 32,842 7,687 32,842 7,687

$ 568,764 $ 2,262 $ 52,839 $ 7,739 $ 621,603 $ 10,001

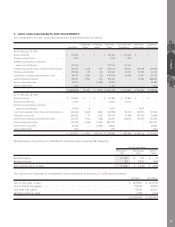

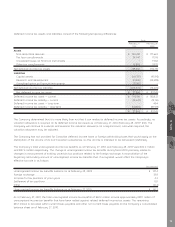

Unrealized losses of $7.7 million primarily relate to auction-rate securities. Auction rate securities are debt instruments with

long-term nominal maturity dates for which the interest rates are reset through a dutch auction process, typically every 7,

28 or 35 days. Interest is paid at the end of each auction period, and the auction normally serves as the mechanism for

securities holders to sell their existing positions to interested buyers. As at February 27, 2010, the Company held

$40.5 million in face value of investment grade auction rate securities which are experiencing failed auctions as a result of

more sell orders than buy orders, and these auctions have not yet returned to normal operations. The interest rate for

these securities has been set at the maximum rate specified in the program documents and interest continues to be paid

every 28 days as scheduled. The Company has adjusted the reported value to reflect an unrealized loss of $7.7 million in

fiscal 2009, which the Company considers temporary and is reflected in accumulated other comprehensive income (loss).

In valuing these securities, the Company used a multi-year investment horizon and considered the underlying risk of the

securities and the current market interest rate environment. The Company has the ability and intent to hold these securities

until such time that market liquidity returns to normal levels, and does not consider the principal or interest amounts on

these securities to be materially at risk at this time. As there is uncertainty as to when market liquidity for auction rate

securities will return to normal, the Company has classified the failing auction rate securities as long-term investments on

the balance sheet. As at February 27, 2010, the Company does not consider these investments to be other-than-temporarily

impaired.

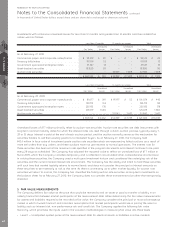

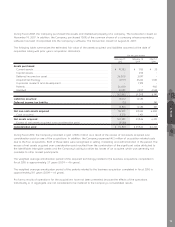

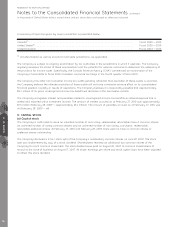

5. FAIR VALUE MEASUREMENTS

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. When determining the fair value measurements

for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous

market in which it would transact and considers assumptions that market participants would use in pricing the asset or

liability such as inherent risk, non-performance risk and credit risk. The Company applies the following fair value

hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value into three levels:

• Level 1 — Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets.

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTES 4 5

68