Blackberry 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

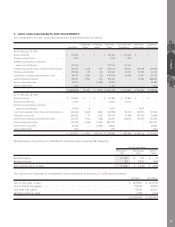

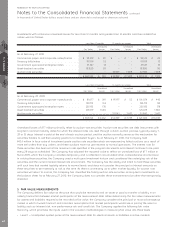

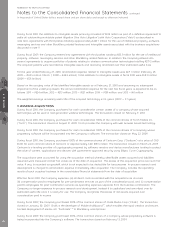

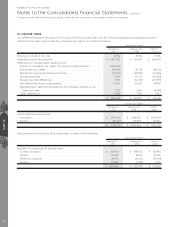

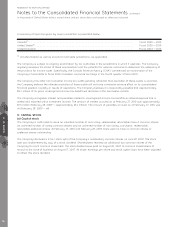

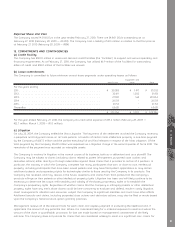

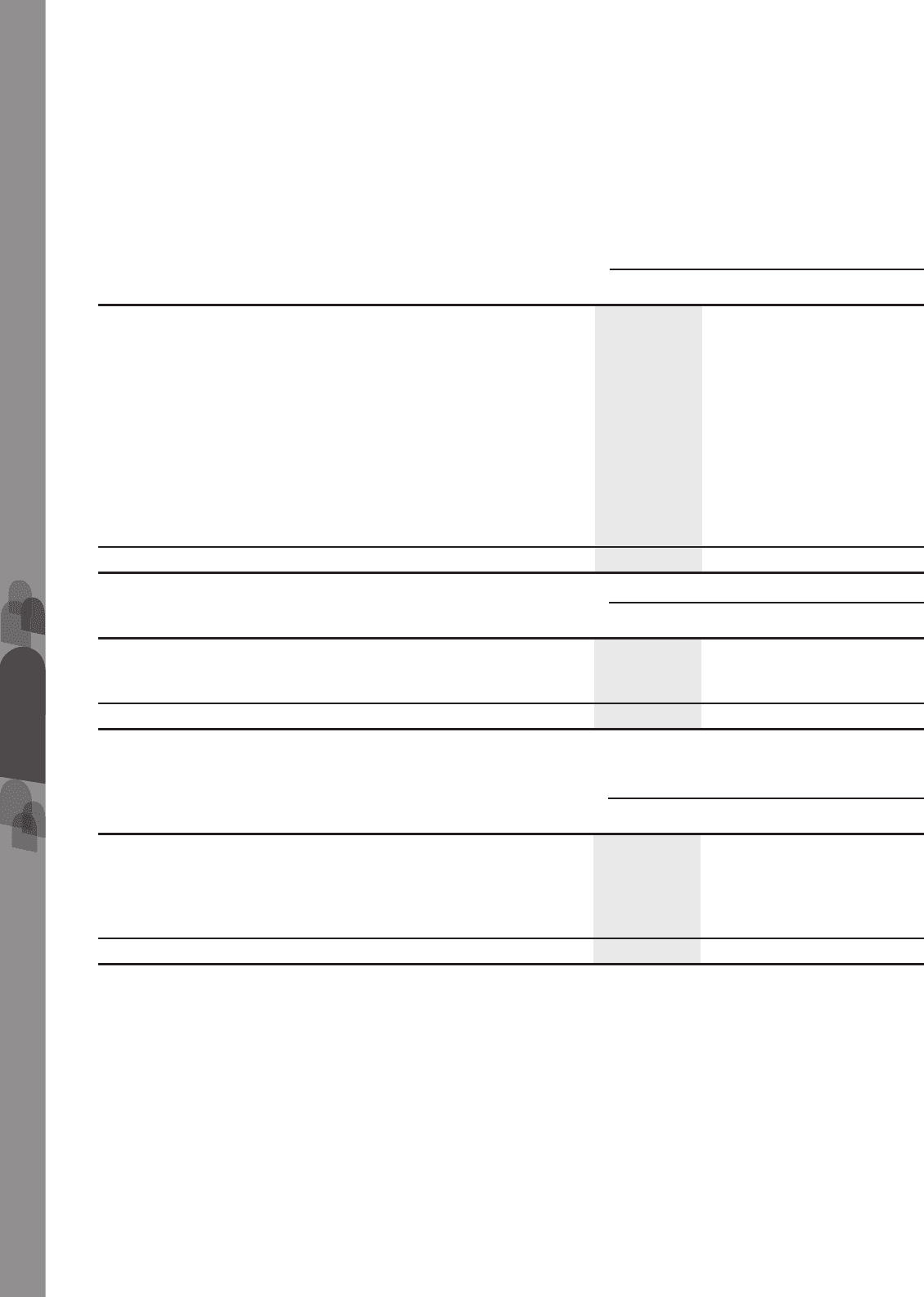

10. INCOME TAXES

The difference between the amount of the provision for income taxes and the amount computed by multiplying income

before income taxes by the statutory Canadian tax rate is reconciled as follows:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Statutory Canadian tax rate ................................................................. 32.8% 33.4% 35.7%

Expected income tax provision .............................................................. $ 1,072,395 $ 935,881 $ 645,994

Differences in income taxes resulting from:

Impact of Canadian U.S. dollar functional currency election .............. (145,000) – –

Investment tax credits ........................................................................ (101,214) (81,173) (58,726)

Manufacturing and processing activities ............................................ (52,053) (49,808) (24,984)

Foreign exchange .............................................................................. 2,837 99,575 (30,826)

Foreign tax rate differences ............................................................... 5,291 (16,273) (29,909)

Non-deductible stock compensation .................................................. 9,600 10,500 10,400

Adjustments to deferred tax balances for enacted changes in tax

laws and rates ............................................................................... 7,927 1,260 (4,648)

Other differences............................................................................... 9,583 7,785 9,352

$ 809,366 $ 907,747 $ 516,653

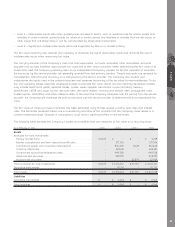

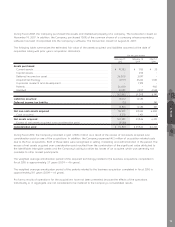

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

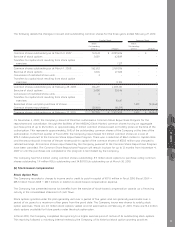

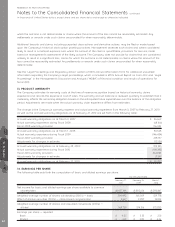

Income before income taxes:

Canadian .......................................................................................... $ 2,999,263 $ 2,583,976 $ 1,635,074

Foreign.............................................................................................. 267,247 216,387 175,446

$ 3,266,510 $ 2,800,363 $ 1,810,520

The provision for (recovery of) income taxes consists of the following:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Provision for (recovery of) income taxes:

Current Canadian.............................................................................. $ 695,790 $ 880,035 $ 555,895

Foreign ............................................................................................. 62,642 68,501 31,950

Deferred Canadian ........................................................................... 20,965 (36,013) (73,294)

Foreign ............................................................................................. 29,969 (4,776) 2,102

$ 809,366 $ 907,747 $ 516,653

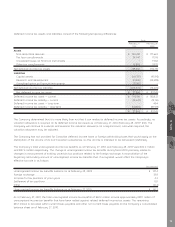

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTE 10

74