Blackberry 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During fiscal 2008, the Company purchased the assets and intellectual property of a company. The transaction closed on

November 19, 2007. In addition, the Company purchased 100% of the common shares of a company whose proprietary

software has been incorporated into the Company’s software. The transaction closed on August 22, 2007.

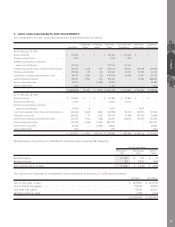

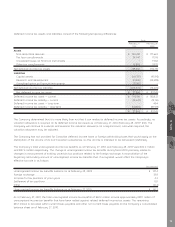

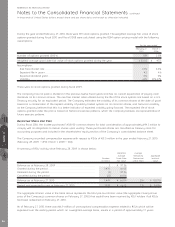

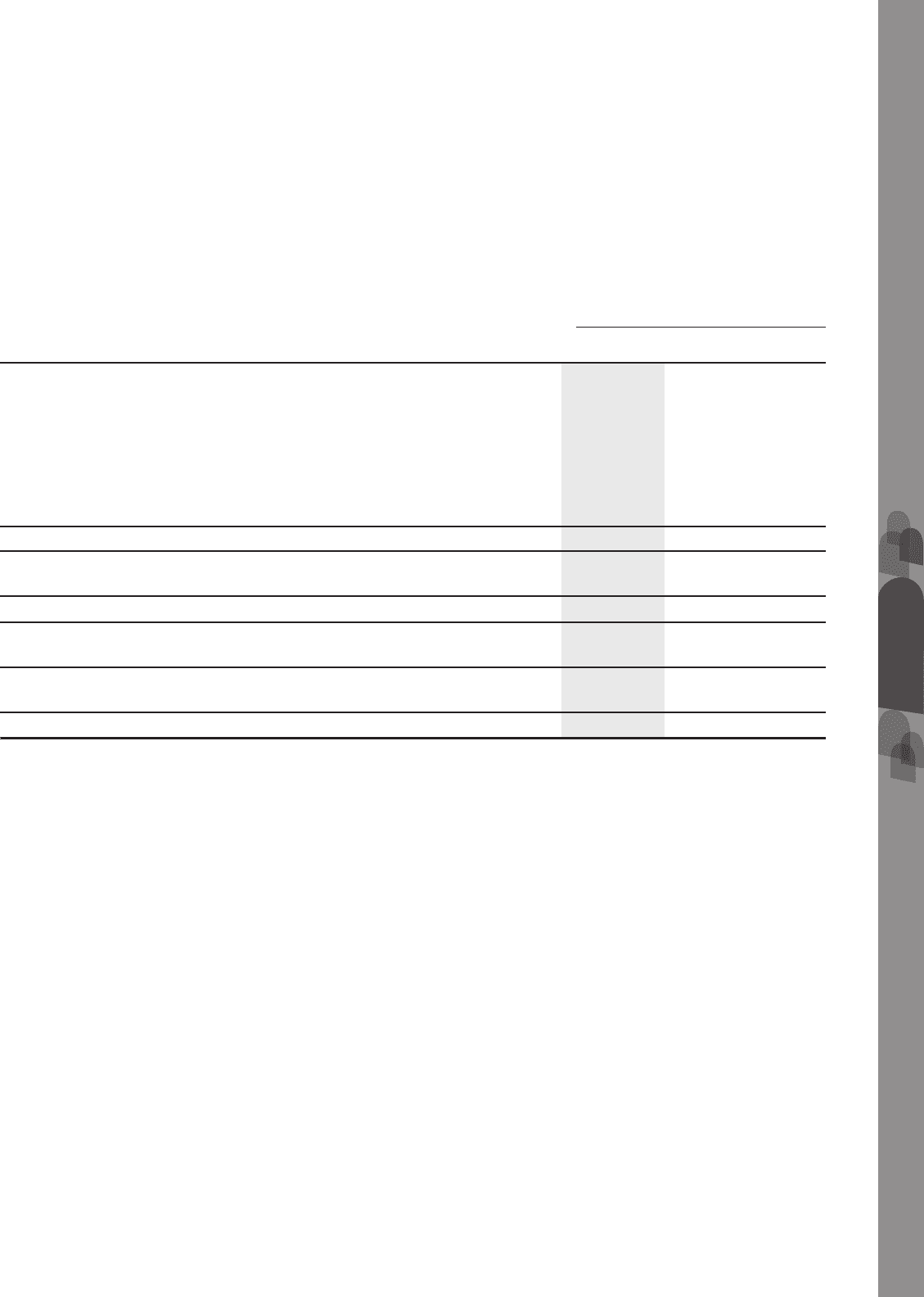

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of

acquisition along with prior year’s acquisition allocations:

February 27,

2010

February 28,

2009

March 1,

2008

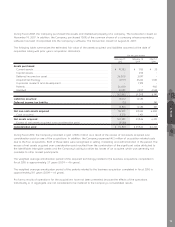

For the year ended

Assets purchased

Current assets.................................................................................................. $ 19,282 $ 1,155 $ 23

Capital assets.................................................................................................. – 494 –

Deferred income tax asset................................................................................ 26,000 3,097 –

Acquired technology ........................................................................................ 72,971 31,226 1,035

In-process research and development .............................................................. – 1,919 –

Patents............................................................................................................. 36,600 – 960

Goodwill .. ......................................................................................................... 12,989 23,117 4,523

167,842 61,008 6,541

Liabilities assumed ............................................................................................. 15,072 12,583 –

Deferred income tax liability .............................................................................. 751 – 341

15,823 12,583 341

Net non-cash assets acquired............................................................................. 152,019 48,425 6,200

Cash acquired ................................................................................................. 8,370 1,421 1

Net assets acquired ............................................................................................ 160,389 49,846 6,201

Excess of net assets acquired over consideration paid ..................................... (8,588) – –

Consideration paid ............................................................................................. $ 151,801 $ 49,846 $ 6,201

During fiscal 2010, the Company recorded a gain of $8.6 million as a result of the excess of net assets acquired over

consideration paid on one of the acquisitions. In addition, the Company expensed $6.5 million of acquisition related costs

due to the four acquisitions. Both of these items were recognized in selling, marketing and administration in the period. The

excess of net assets acquired over consideration paid resulted from the combination of the significant value attributed to

the identifiable intangible assets and the Company’s ability to utilize tax losses of an acquiree, which was generally not

available to other market participants.

The weighted average amortization period of the acquired technology related to the business acquisitions completed in

fiscal 2010 is approximately 3.7 years (2009 — 4.6 years).

The weighted average amortization period of the patents related to the business acquisition completed in fiscal 2010 is

approximately 18.1 years (2009 — nil years).

Pro forma results of operations for the acquisitions have not been presented because the effects of the operations,

individually or in aggregate, are not considered to be material to the Company’s consolidated results.

NOTE 9

73