Blackberry 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

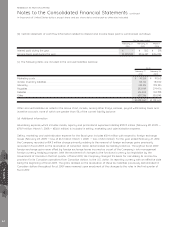

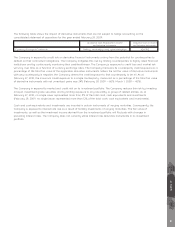

which the outcome is not determinable or claims where the amount of the loss cannot be reasonably estimated. Any

settlements or awards under such claims are provided for when reasonably determinable.

Additional lawsuits and claims, including purported class actions and derivative actions, may be filed or made based

upon the Company’s historical stock option granting practices. Management assesses such claims and where considered

likely to result in a material exposure and, where the amount of the claim is quantifiable, provisions for loss are made

based on management’s assessment of the likely outcome. The Company does not provide for claims that are considered

unlikely to result in a significant loss, claims for which the outcome is not determinable or claims where the amount of the

loss cannot be reasonably estimated. Any settlements or awards under such claims are provided for when reasonably

determinable.

See the “Legal Proceedings and Regulatory Action” section of RIM’s Annual Information Form for additional unaudited

information regarding the Company’s legal proceedings, which is included in RIM’s Annual Report on Form 40-F and “Legal

Proceedings” in the Management’s Discussion and Analysis (“MD&A”) of financial condition and results of operations for

fiscal 2010.

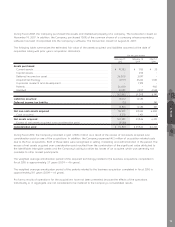

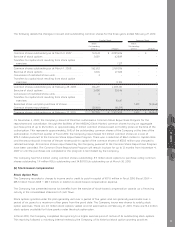

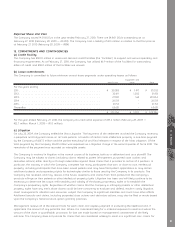

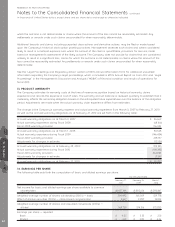

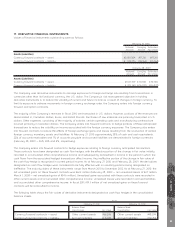

13. PRODUCT WARRANTY

The Company estimates its warranty costs at the time of revenue recognition based on historical warranty claims

experience and records the expense in cost of sales. The warranty accrual balance is reviewed quarterly to establish that it

materially reflects the remaining obligation based on the anticipated future expenditures over the balance of the obligation

period. Adjustments are made when the actual warranty claim experience differs from estimates.

The change in the Company’s warranty expense and actual warranty experience from March 3, 2007 to February 27, 2010

as well as the accrued warranty obligations as at February 27, 2010 are set forth in the following table:

Accrued warranty obligations as at March 3, 2007 ......................................................................................... $ 36,669

Actual warranty experience during fiscal 2008 ............................................................................................... (68,166)

Fiscal 2008 warranty provision ...................................................................................................................... 116,045

Accrued warranty obligations as at March 1, 2008 ......................................................................................... 84,548

Actual warranty experience during fiscal 2009 ............................................................................................... (146,434)

Fiscal 2009 warranty provision ...................................................................................................................... 258,757

Adjustments for changes in estimate .............................................................................................................. (12,536)

Accrued warranty obligations as at February 28, 2009 ................................................................................... 184,335

Actual warranty experience during fiscal 2010 ................................................................................................ (416,393)

Fiscal 2010 warranty provision ....................................................................................................................... 462,834

Adjustments for changes in estimate .............................................................................................................. 21,541

Accrued warranty obligations as at February 27, 2010 .................................................................................... $ 252,317

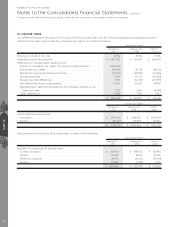

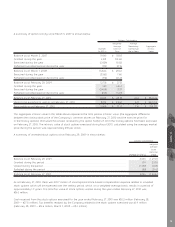

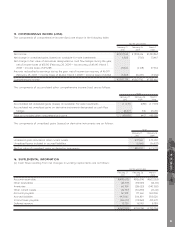

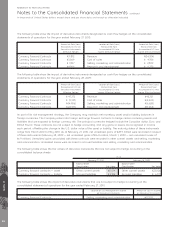

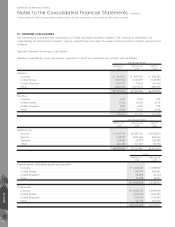

14. EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share:

February 27,

2010

February 28,

2009

March 1,

2008

For the year ended

Net income for basic and diluted earnings per share available to common

shareholders ............................................................................................... $2,457,144 $1,892,616 $1,293,867

Weighted-average number of shares outstanding (000’s) — basic .................... 564,492 565,059 559,778

Effect of dilutive securities (000’s) — stock-based compensation ....................... 5,267 9,097 13,052

Weighted-average number of shares and assumed conversions (000’s) —

diluted ......................................................................................................... 569,759 574,156 572,830

Earnings per share — reported

Basic ............................................................................................................ $ 4.35 $ 3.35 $ 2.31

Diluted .......................................................................................................... $ 4.31 $ 3.30 $ 2.26

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTES 12 14

82