Blackberry 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has a Deferred Share Unit Plan (the “DSU Plan”) adopted by the Board of Directors on December 20, 2007,

under which each independent director will be credited with Deferred Share Units (“DSUs”) in satisfaction of all or a portion

of the cash fees otherwise payable to them for serving as a director of the Company. Grants under the DSU plan replace

the stock option awards that were historically granted to independent members of the Board of Directors. At a minimum,

50% of each independent director’s annual retainer will be satisfied in the form of DSUs. The director can elect to receive

the remaining 50% in any combination of cash and DSUs. Within a specified period after such a director ceases to be a

director, DSUs will be redeemed for cash with the redemption value of each DSU equal to the weighted average trading

price of the Company’s shares over the five trading days preceding the redemption date. Alternatively, subject to receipt

of shareholder approval, the Company may elect to redeem DSUs by way of shares purchased on the open market or

issued by the Company. DSUs are accounted for as liability-classified awards and are awarded on a quarterly basis.

These awards are measured at their fair value on the date of issuance, and remeasured at each reporting period, until

settlement.

Warranty

The Company provides for the estimated costs of product warranties at the time revenue is recognized. BlackBerry devices

are generally covered by a time-limited warranty for varying periods of time. The Company’s warranty obligation is

affected by product failure rates, differences in warranty periods, regulatory developments with respect to warranty

obligations in the countries in which the Company carries on business, freight expense, and material usage and other

related repair costs.

The Company’s estimates of costs are based upon historical experience and expectations of future return rates and unit

warranty repair cost. If the Company experiences increased or decreased warranty activity, or increased or decreased

costs associated with servicing those obligations, revisions to the estimated warranty liability would be recognized in the

reporting period when such revisions are made.

Advertising costs

The Company expenses all advertising costs as incurred. These costs are included in selling, marketing and

administration.

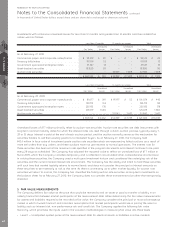

2. ADOPTION OF ACCOUNTING POLICIES

In February 2010, the Financial Accounting Standards Board (“FASB”) issued authoritative guidance updating previously

issued guidance on accounting for subsequent events. The guidance amends previous literature to remove the requirement

for a Securities and Exchange Commission (“SEC”) filer to disclose the date through which subsequent events have been

evaluated and reaffirms that an SEC filer is required to evaluate subsequent events through the date the financial

statements are issued. The Company adopted this authoritative guidance in the fourth quarter of fiscal 2010 and the

adoption did not have a material impact on the results of operations and financial condition.

In August 2009, the FASB issued authoritative guidance on measuring the fair value of liabilities. The guidance amends

previous literature and clarifies that in circumstances in which a quoted market price in an active market for an identical

liability is not available, an entity is required to use a valuation technique that uses quoted market price of the identical

liability when traded as an asset, the quoted market price of a similar liability or the quoted market price of a similar

liability when traded as an asset to measure fair value. If these quoted prices are not available, an entity is required to use

a valuation technique that is in accordance with existing fair value principles, such as the income or market approach. The

Company adopted this authoritative guidance in the third quarter of fiscal 2010 and the adoption did not have a material

impact on the Company’s results of operations and financial condition.

In June 2009, the FASB issued the FASB Accounting Standards Codification (“the Codification”). The Codification became the

source of authoritative U.S. GAAP recognized by the FASB to be applied to nongovernmental entities. The Codification did

not change U.S. GAAP but reorganizes literature into a single source. The Codification is effective for interim periods ending

after September 15, 2009. The Company adopted the Codification and has updated its disclosure and references to U.S.

GAAP as required by the standard in the third quarter of fiscal 2010.

In May 2009, the FASB issued authoritative guidance on accounting for subsequent events that was previously only

addressed in auditing literature. The guidance is largely similar to current guidance in the auditing literature with some

minor exceptions that are not intended to result in significant changes in practice. The Company adopted the authoritative

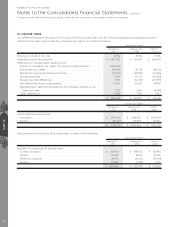

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTES 1 2

64