Blackberry 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

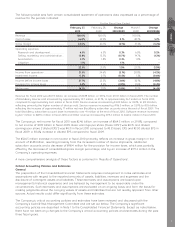

from the consolidation guidance, clarifies the requirements for transferred financial assets that are eligible for

sale accounting and requires enhanced disclosures about a transferor’s continuing involvement with

transferred financial assets. This new authoritative guidance is effective for annual periods beginning after

November 15, 2009. The Company will adopt the guidance in the first quarter of fiscal 2011 and the Company

does not expect the adoption will have a material impact on the Company’s results of operations and

financial condition.

In November 2008, the SEC announced a proposed roadmap for comment regarding the potential use by U.S.

issuers of financial statements prepared in accordance with International Financial Reporting Standards

(“IFRS”). IFRS is a comprehensive series of accounting standards published by the International Accounting

Standards Board. On February 24, 2010, the SEC issued a statement describing its position regarding global

accounting standards. Among other things, the SEC stated that it has directed its staff to execute a work plan,

which will include consideration of IFRS as it exists today and after completion of various “convergence”

projects currently underway between U.S. and international accounting standards setters. By 2011, assuming

completion of certain projects and the SEC staff’s work plan, the SEC will decide whether to incorporate IFRS

into the U.S. financial reporting system. The Company is currently assessing the impact that this proposed

change would have on the consolidated financial statements, accompanying notes and disclosures, and will

continue to monitor the development of the potential implementation of IFRS.

Restatement of Previously Issued Financial Statements

Overview

As discussed in greater detail under “Explanatory Note Regarding the Restatement of Previously Issued

Financial Statements” in the MD&A for the fiscal year ended March 3, 2007 and Note 12(c) to the audited

consolidated financial statements of the Company for the fiscal year ended March 3, 2007, the Company

restated its consolidated balance sheet as of March 4, 2006 and its consolidated statements of operations,

consolidated statements of cash flows and consolidated statements of shareholders’ equity for the fiscal

years ended March 4, 2006 and February 26, 2005, and the related note disclosures (the “Restatement”), to

reflect additional non-cash stock compensation expense relating to certain stock-based awards granted prior

to the adoption of the Company’s stock option plan on December 4, 1996 (as amended from time to time, the

“Stock Option Plan”) and certain stock option grants during the 1997 through 2006 fiscal periods, as well as

certain adjustments related to the tax accounting for deductible stock option expenses. The Restatement was

the result of a voluntary internal review (the “Review”) by the Company of its historical stock option granting

practices. The Restatement did not result in a change in the Company’s previously reported revenues, total

cash and cash equivalents or net cash provided from operating activities.

OSC Settlement

As discussed in greater detail under “Restatement of Previously Issued Financial Statements — OSC Settlement”

in the MD&A for the fiscal year ended February 28, 2009, on February 5, 2009, a panel of Commissioners of

the OSC approved a settlement agreement (the “Settlement Agreement”) with the Company and certain of its

officers and directors, including its Co-Chief Executive Officers (“Co-CEOs”) relating to the previously disclosed

OSC investigation of the Company’s historical stock option granting practices.

As part of the Settlement Agreement, the Company agreed to enter into an agreement with an independent

consultant to conduct a comprehensive examination and review of the Company and report to the Company’s

board of directors and the staff of the OSC the Company’s governance practices and procedures and its

internal control over financial reporting. The Company retained Protiviti Co. (“Protiviti”) to carry out this

engagement. See “Independent Governance Assessment” and Appendix A to this MD&A for a further

description of Protiviti’s engagement, its recommendations and the Company’s responses to such

recommendations. A copy of Protiviti’s recommendations will also appear on the website of the OSC.

Independent Governance Assessment

As described above, the Company’s historical stock option granting practices were the subject of an internal

review by a special committee (the “Special Committee”) of the Board of Directors (“Board”) and investigations

by government authorities in Canada and the United States. In March 2007, the Special Committee made

recommendations to the Board on corporate governance that were adopted by the Board. Later in the same

year, the Company resolved litigation brought by a pension fund, which resulted in the Company

implementing additional corporate governance changes. Since March 2007, five new independent directors

have joined the Board. As a result of these developments, and the importance placed by the Board on

MD&A

14