Blackberry 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

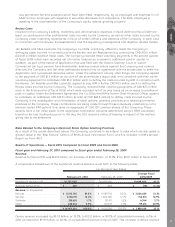

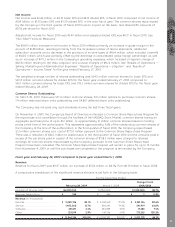

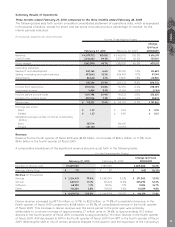

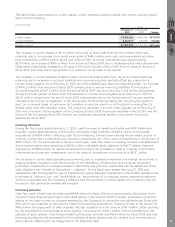

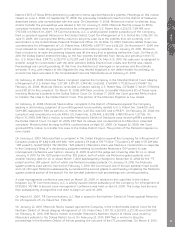

Summary Results of Operations

Three months ended February 27, 2010 compared to the three months ended February 28, 2009

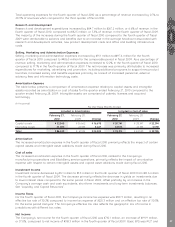

The following table sets forth certain unaudited consolidated statement of operations data, which is expressed

in thousands of dollars, except for share and per share amounts and as a percentage of revenue, for the

interim periods indicated.

(in thousands, except for per share amounts)

February 27, 2010 February 28, 2009

Change

Q4 Fiscal

2010/2009

For the Three Months Ended

Revenue.................................................................... $ 4,079,712 100.0% $ 3,463,193 100.0% $ 616,519

Cost of sales............................................................. 2,216,622 54.3% 2,079,615 60.0% 137,007

Gross margin............................................................ 1,863,090 45.7% 1,383,578 40.0% 479,512

Operating expenses

Research and development....................................... 267,164 6.6% 182,535 5.3% 84,629

Selling, marketing and administration ....................... 497,642 12.2% 406,493 11.7% 91,149

Amortization ............................................................. 86,540 2.1% 61,595 1.8% 24,945

851,346 20.9% 650,623 18.8% 200,723

Income from operations ............................................ 1,011,744 24.8% 732,955 21.2% 278,789

Investment income .................................................... 5,454 0.1% 10,568 0.3% (5,114)

Income before income taxes ..................................... 1,017,198 24.9% 743,523 21.5% 273,675

Provision for income taxes ........................................ 307,076 7.5% 225,264 6.5% 81,812

Net income ............................................................... $ 710,122 17.4% $ 518,259 15.0% $ 191,863

Earnings per share

Basic..................................................................... $ 1.27 $ 0.92 $ 0.35

Diluted .................................................................. $ 1.27 $ 0.90 $ 0.37

Weighted-average number of shares outstanding

(000’s)

Basic..................................................................... 557,114 566,105

Diluted .................................................................. 561,130 572,753

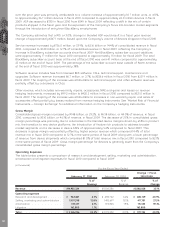

Revenue

Revenue for the fourth quarter of fiscal 2010 was $4.08 billion, an increase of $616.5 million, or 17.8%, from

$3.46 billion in the fourth quarter of fiscal 2009.

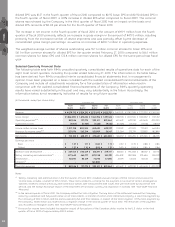

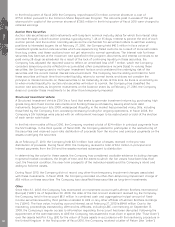

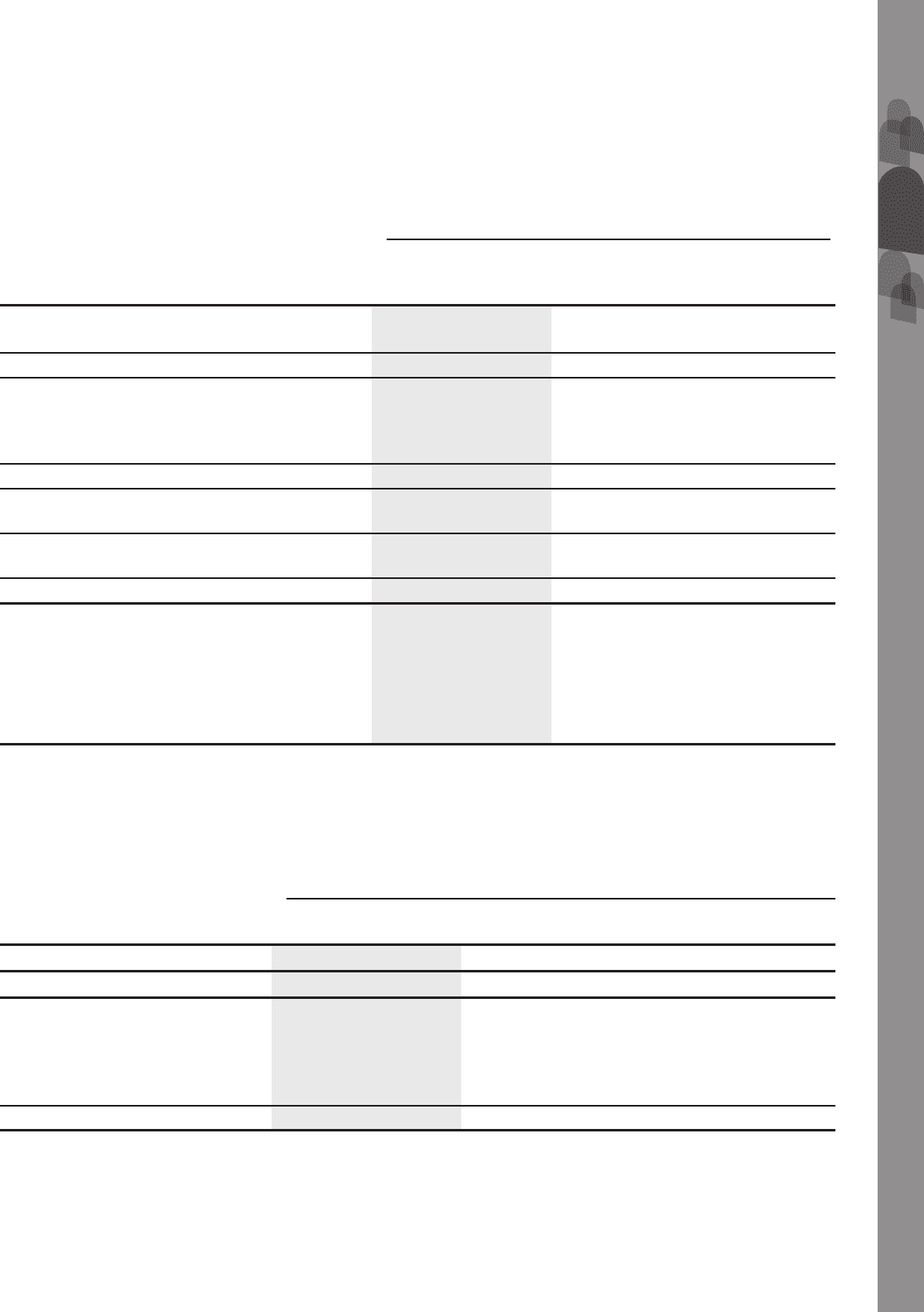

A comparative breakdown of the significant revenue streams is set forth in the following table:

February 27, 2010 February 28, 2009

Change Q4 Fiscal

2010/2009

For the Three Months Ended

Number of devices sold .................... 10,469,000 7,780,000 2,689,000 34.6%

Average Selling Price ........................ $ 311 $ 371 $ (60) (16.2%)

Revenue (in thousands)

Devices............................................. $ 3,254,401 79.8% $ 2,883,399 83.3% $ 371,002 12.9%

Service ............................................. 640,517 15.7% 415,223 12.0% 225,294 54.3%

Software........................................... 68,590 1.7% 58,756 1.7% 9,834 16.7%

Other................................................ 116,204 2.8% 105,815 3.0% 10,389 9.8%

$ 4,079,712 100.0% $ 3,463,193 100.0% $ 616,519 17.8%

Device revenue increased by $371.0 million, or 12.9%, to $3.25 billion, or 79.8% of consolidated revenue, in the

fourth quarter of fiscal 2010 compared to $2.88 billion, or 83.3%, of consolidated revenue in the fourth quarter

of fiscal 2009. This increase in device revenue over the same period in the prior year was primarily

attributable to a volume increase of approximately 2.7 million units, or 34.6%, to approximately 10.5 million

devices in the fourth quarter of fiscal 2010 compared to approximately 7.8 million devices in the fourth quarter

of fiscal 2009. ASP decreased to $311 in the fourth quarter of fiscal 2010 from $371 in the fourth quarter of fiscal

2009 reflecting the shift in mix of certain products shipped in the quarter and the expansion of the Company’s

MD&A

25