Blackberry 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

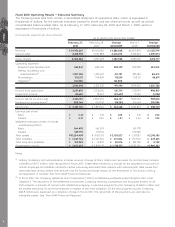

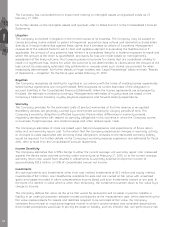

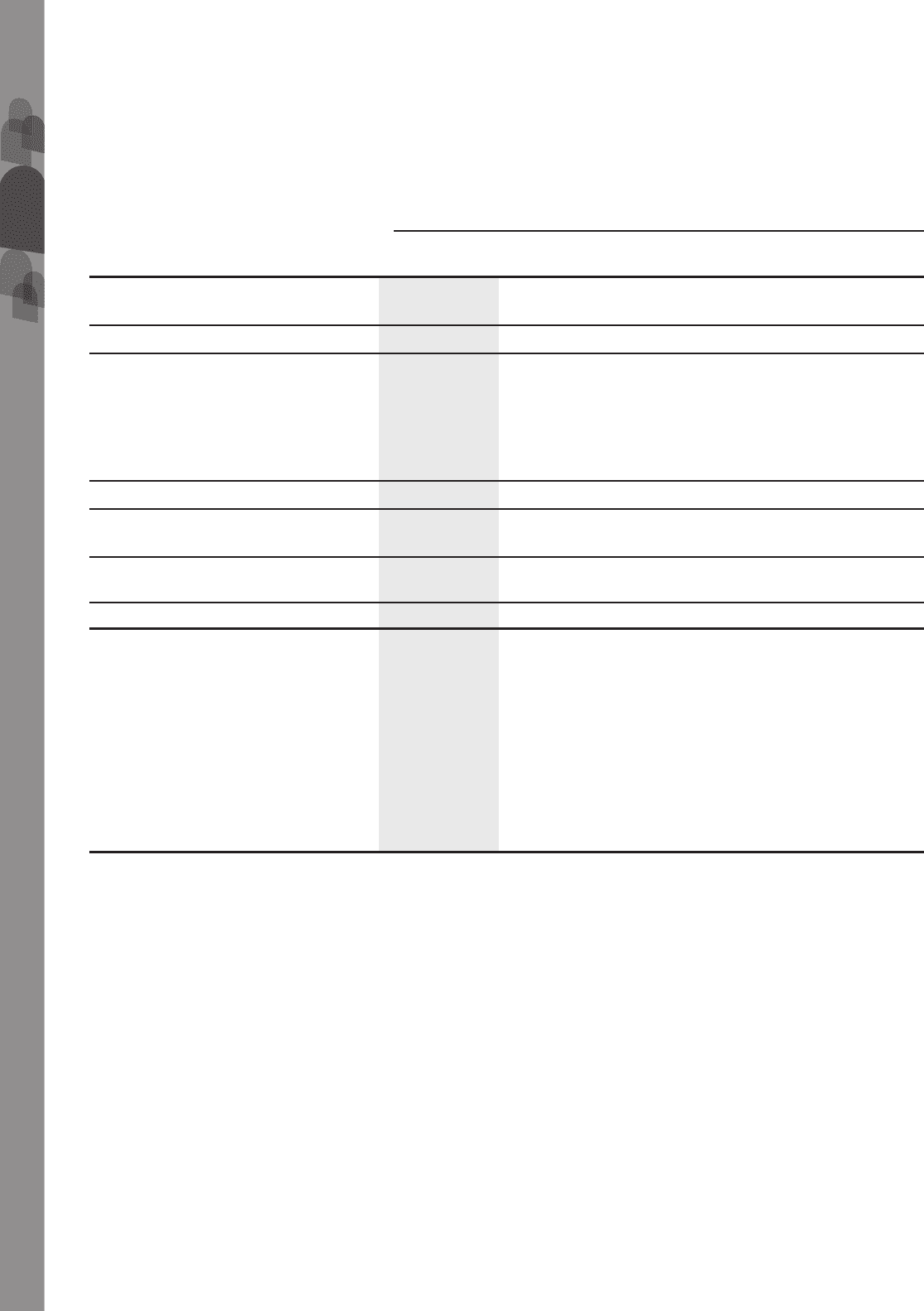

Fiscal 2010 Operating Results — Executive Summary

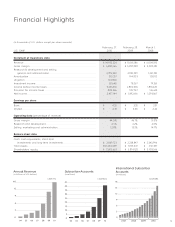

The following table sets forth certain consolidated statement of operations data, which is expressed in

thousands of dollars, for the periods indicated, except for share and per share amounts, as well as certain

consolidated balance sheet data, as at February 27, 2010, February 28, 2009 and March 1, 2008, which is

expressed in thousands of dollars.

(in thousands, except for per share amounts)

February 27,

2010

February 28,

2009

Change

2010/2009

March 1,

2008

Change

2009/2008

As at and for the Fiscal Year Ended

Revenue ............................................... $ 14,953,224 $11,065,186 $ 3,888,038 $6,009,395 $ 5,055,791

Cost of sales ........................................ 8,368,958 5,967,888 2,401,070 2,928,814 3,039,074

Gross margin ....................................... 6,584,266 5,097,298 1,486,968 3,080,581 2,016,717

Operating expenses

Research and development ............... 964,841 684,702 280,139 359,828 324,874

Selling, marketing and

administration

(1)

............................. 1,907,398 1,495,697 411,701 881,482 614,215

Amortization ...................................... 310,357 194,803 115,554 108,112 86,691

Litigation

(2)

........................................ 163,800 –163,800 ––

3,346,396 2,375,202 971,194 1,349,422 1,025,780

Income from operations........................ 3,237,870 2,722,096 515,774 1,731,159 990,937

Investment income................................ 28,640 78,267 (49,627) 79,361 (1,094)

Income before income taxes ................. 3,266,510 2,800,363 466,147 1,810,520 989,843

Provision for income taxes

(1)

.................. 809,366 907,747 (98,381) 516,653 391,094

Net income........................................... $ 2,457,144 $ 1,892,616 $ 564,528 $ 1,293,867 $ 598,749

Earnings per share

Basic................................................. $ 4.35 $ 3.35 $ 1.00 $ 2.31 $ 1.04

Diluted .............................................. $ 4.31 $ 3.30 $ 1.01 $ 2.26 $ 1.04

Weighted-average number of shares

outstanding (000’s)

Basic................................................. 564,492 565,059 559,778

Diluted .............................................. 569,759 574,156 572,830

Total assets.......................................... $10,204,409 $ 8,101,372 $ 2,103,037 $ 5,511,187 $ 2,590,185

Total liabilities ...................................... $ 2,601,746 $ 2,227,244 $ 374,502 $ 1,577,621 $ 649,623

Total long-term liabilities ....................... $ 169,969 $ 111,893 $ 58,076 $ 103,190 $ 8,703

Shareholders’ equity ............................. $ 7,602,663 $ 5,874,128 $ 1,728,535 $ 3,933,566 $1,940,562

Notes:

(1)

Selling, marketing and administration includes unusual charges of $96.4 million and provision for income taxes includes

a benefit of $175.1 million, both recognized in fiscal 2010. These items related to a charge for the payment on account of

certain employee tax liabilities related to certain previously exercised stock options with measurement date issues that

were exercised during certain time periods and the foreign exchange impact of the enactment of functional currency

tax legislation in Canada. See “Non-GAAP Financial Measures”.

(2)

In fiscal 2010, the Company settled all Visto Corporation (“Visto”) outstanding worldwide patent litigation (the “Visto

Litigation”). The key terms of the settlement involved the Company receiving a perpetual and fully-paid license on all

Visto patents, a transfer of certain Visto intellectual property, a one-time payment by the Company of $267.5 million and

the parties executing full and final releases in respect of the Visto Litigation. Of the total payment by the Company,

$163.8 million was expensed as a litigation charge in fiscal 2010. The remainder of the payment was recorded as

intangible assets. See “Non-GAAP Financial Measures”.

MD&A

6