Blackberry 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company records all derivative instruments at fair value on the consolidated balance sheets. The fair value of these

instruments is calculated based on quoted currency spot rates and interest rates. The accounting for changes in the fair

value of a derivative depends on the intended use of the derivative instrument and the resulting designation.

For derivative instruments designated as cash flow hedges, the effective portion of the derivative’s gain or loss is initially

reported as a component of accumulated other comprehensive income, net of tax, and subsequently reclassified into

income in the same period or periods in which the hedged item affects income. The ineffective portion of the derivative’s

gain or loss is recognized in current income. In order for the Company to receive hedge accounting treatment, the cash

flow hedge must be highly effective in offsetting changes in the fair value of the hedged item and the relationship between

the hedging instrument and the associated hedged item must be formally documented at the inception of the hedge

relationship. Hedge effectiveness is formally assessed, both at hedge inception and on an ongoing basis, to determine

whether the derivatives used in hedging transactions are highly effective in offsetting changes in the value of the hedged

items.

The Company formally documents relationships between hedging instruments and associated hedged items. This

documentation includes: identification of the specific foreign currency asset, liability or forecasted transaction being

hedged; the nature of the risk being hedged; the hedge objective; and the method of assessing hedge effectiveness. If an

anticipated transaction is deemed no longer likely to occur, the corresponding derivative instrument is de-designated as a

hedge and any associated deferred gains and losses in accumulated other comprehensive income are recognized in

income at that time. Any future changes in the fair value of the instrument are recognized in current income. The Company

did not reclassify any significant gains (losses) from accumulated other comprehensive income into income as a result of

the de-designation of any derivative instrument as a hedge during fiscal 2010.

For any derivative instruments that do not meet the requirements for hedge accounting, or for any derivative instrument for

which hedge accounting is not elected, the changes in fair value of the instruments are recognized in income in the current

period and will generally offset the changes in the U.S. dollar value of the associated asset, liability, or forecasted

transaction.

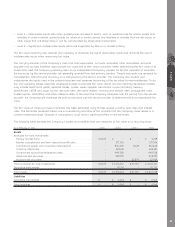

Inventories

Raw materials are stated at the lower of cost and replacement cost. Work in process and finished goods inventories are

stated at the lower of cost and net realizable value. Cost includes the cost of materials plus direct labour applied to the

product and the applicable share of manufacturing overhead. Cost is determined on a first-in-first-out basis.

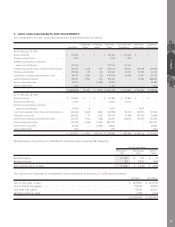

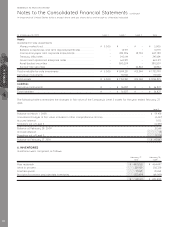

Property, plant and equipment, net

Property, plant and equipment is stated at cost less accumulated amortization. No amortization is provided for

construction in progress until the assets are ready for use. Amortization is provided using the following rates and methods:

Buildings, leaseholds and other Straight-line over terms between 5 and 40 years

BlackBerry operations and other information technology Straight-line over terms between 3 and 5 years

Manufacturing equipment, research and development

equipment and tooling Straight-line over terms between 2 and 8 years

Furniture and fixtures Declining balance at 20% per annum

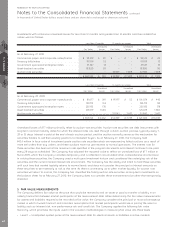

Intangible assets, net

Intangible assets are stated at cost less accumulated amortization and are comprised of acquired technology, licenses,

and patents. Acquired technology consists of purchased developed technology arising from the Company’s business

acquisitions. Licenses include licenses or agreements that the Company has negotiated with third parties upon use of third

parties’ technology. Patents comprise trademarks, internally developed patents, as well as individual patents or portfolios

of patents acquired from third parties. Costs capitalized and subsequently amortized include all costs necessary to

acquire intellectual property, such as patents and trademarks, as well as legal defense costs arising out of the assertion of

any Company-owned patents.

NOTE 1

60

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated