Blackberry 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

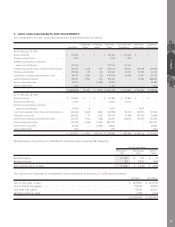

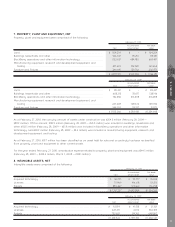

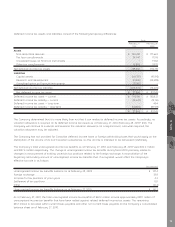

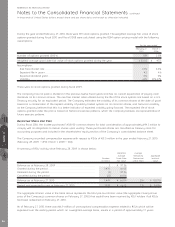

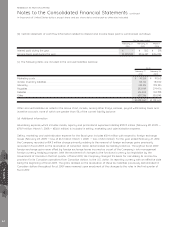

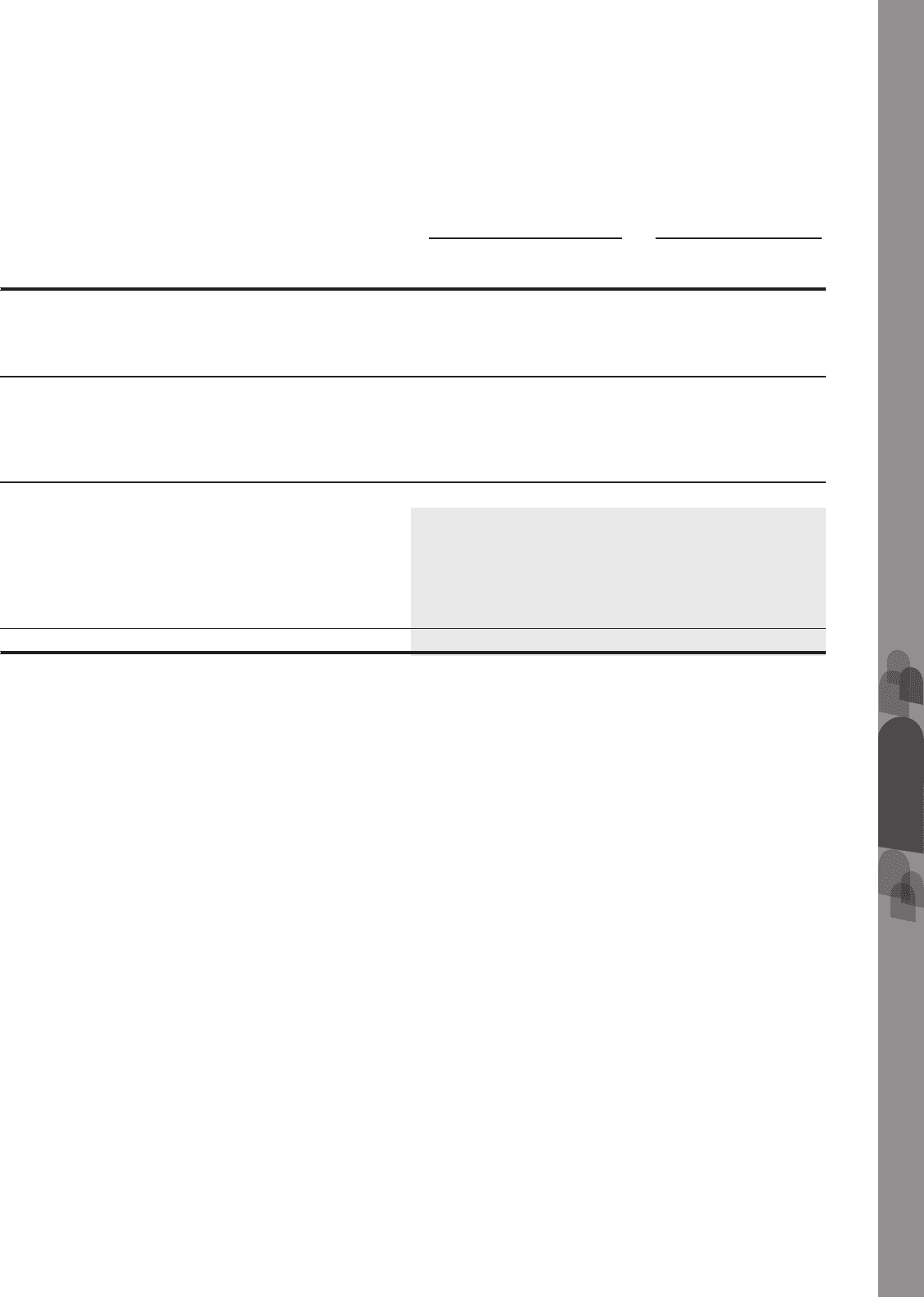

The following details the changes in issued and outstanding common shares for the three years ended February 27, 2010:

Stock

Outstanding

(000’s) Amount

Stock

Outstanding

(000’s) Amount

Capital Stock Treasury Stock

Common shares outstanding as at March 3, 2007 .............. 557,613 $ 2,099,696 – $ –

Exercise of stock options .................................................... 5,039 62,889 – –

Transfers to capital stock resulting from stock option

exercises......................................................................... – 7,271 – –

Common shares outstanding as at March 1, 2008 .............. 562,652 2,169,856 – –

Exercise of stock options .................................................... 3,565 27,024 – –

Conversion of restricted share units .................................... 2 – – –

Transfers to capital stock resulting from stock option

exercises......................................................................... – 11,355 – –

Common shares outstanding as at February 28, 2009 ........ 566,219 2,208,235 – –

Exercise of stock options .................................................... 3,408 30,246 – –

Conversion of restricted share units .................................... 2 – – –

Transfers to capital stock resulting from stock option

exercises......................................................................... – 15,647 – –

Restricted share unit plan purchase of shares .................... – – 1,459 (94,463)

Common shares repurchased............................................. (12,300) (46,519) – –

Common shares outstanding as at February 27, 2010 ......... 557,329 $ 2,207,609 1,459 $ (94,463)

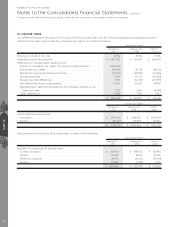

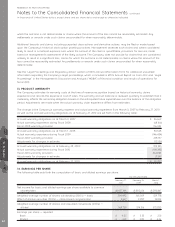

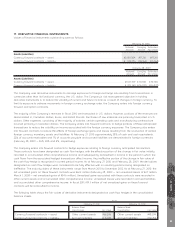

On November 4, 2009, the Company’s Board of Directors authorized a Common Share Repurchase Program for the

repurchase and cancellation, through the facilities of the NASDAQ Stock Market, common shares having an aggregate

purchase price of up to $1.2 billion, or approximately 21 million common shares based on trading prices at the time of the

authorization. This represents approximately 3.6% of the outstanding common shares of the Company at the time of the

authorization. In the third quarter of fiscal 2010, the Company repurchased 12.3 million common shares at a cost of

$775.0 million pursuant to the Common Share Repurchase Program. There was a reduction of $46.5 million to capital stock

and the amounts paid in excess of the per share paid-in capital of the common shares of $728.5 million was charged to

retained earnings. All common shares repurchased by the Company pursuant to the Common Share Repurchase Program

have been cancelled. The Common Share Repurchase Program will remain in place for up to 12 months from November 4,

2009 or until the purchases are completed or the program is terminated by the Company.

The Company had 557.4 million voting common shares outstanding, 8.9 million stock options to purchase voting common

shares outstanding, 1.4 million RSUs outstanding and 34,801 DSUs outstanding as at March 30, 2010.

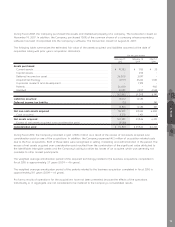

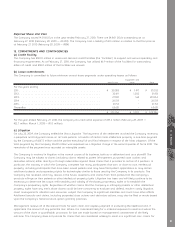

(b) Stock-based compensation

Stock Option Plan

The Company recorded a charge to income and a credit to paid-in-capital of $37.0 million in fiscal 2010 (fiscal 2009 —

$38.1 million; fiscal 2008 — $33.7 million) in relation to stock-based compensation expense.

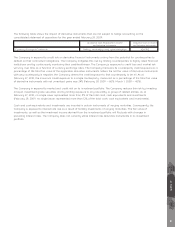

The Company has presented excess tax benefits from the exercise of stock-based compensation awards as a financing

activity in the consolidated statement of cash flows.

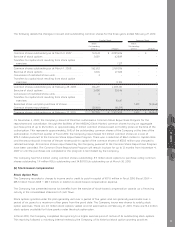

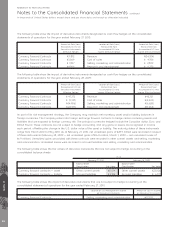

Stock options granted under the plan generally vest over a period of five years and are generally exercisable over a

period of six years to a maximum of ten years from the grant date. The Company issues new shares to satisfy stock

option exercises. There are 6.0 million stock options vested and not exercised as at February 27, 2010. There are 13.6 million

stock options available for future grants under the stock option plan.

In fiscal 2010, the Company completed the repricing to a higher exercise price of certain of its outstanding stock options.

This repricing followed a voluntary internal review by the Company of its historical stock option granting practices.

NOTE 11

77