Blackberry 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

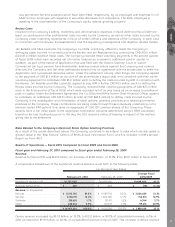

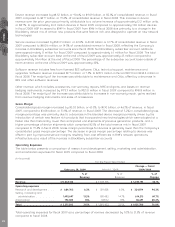

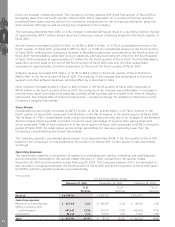

Total operating expenses for the fourth quarter of fiscal 2010 as a percentage of revenue increased by 0.7% to

20.9% of revenues when compared to the third quarter of fiscal 2010.

Research and Development

Research and development expenditures increased by $84.7 million to $267.2 million, or 6.6% of revenue, in the

fourth quarter of fiscal 2010, compared to $182.5 million, or 5.3% of revenue, in the fourth quarter of fiscal 2009.

The majority of the increases during the fourth quarter of fiscal 2010 compared to the fourth quarter of fiscal

2009 were attributable to salaries and benefits due to an increase in the average headcount associated with

research and development activities, new product development costs and office and building infrastructure

costs.

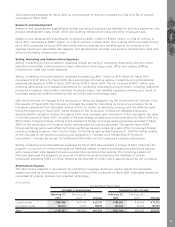

Selling, Marketing and Administration Expenses

Selling, marketing and administration expenses increased by $91.1 million to $497.6 million for the fourth

quarter of fiscal 2010 compared to $406.5 million for the comparable period in fiscal 2009. As a percentage of

revenue, selling, marketing and administration expenses increased to 12.2% in the fourth quarter of fiscal 2010

compared to 11.7% in the fourth quarter of fiscal 2009. The net increase was primarily attributable to increased

expenditures for marketing, advertising and promotion, including additional programs to support new product

launches, increased salary and benefits expenses primarily as a result of increased personnel, external

advisory fees and information technology costs.

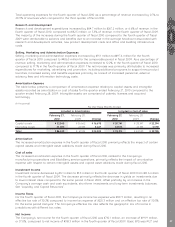

Amortization Expense

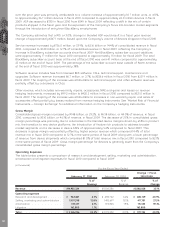

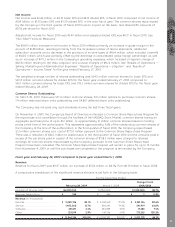

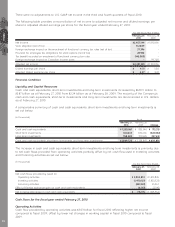

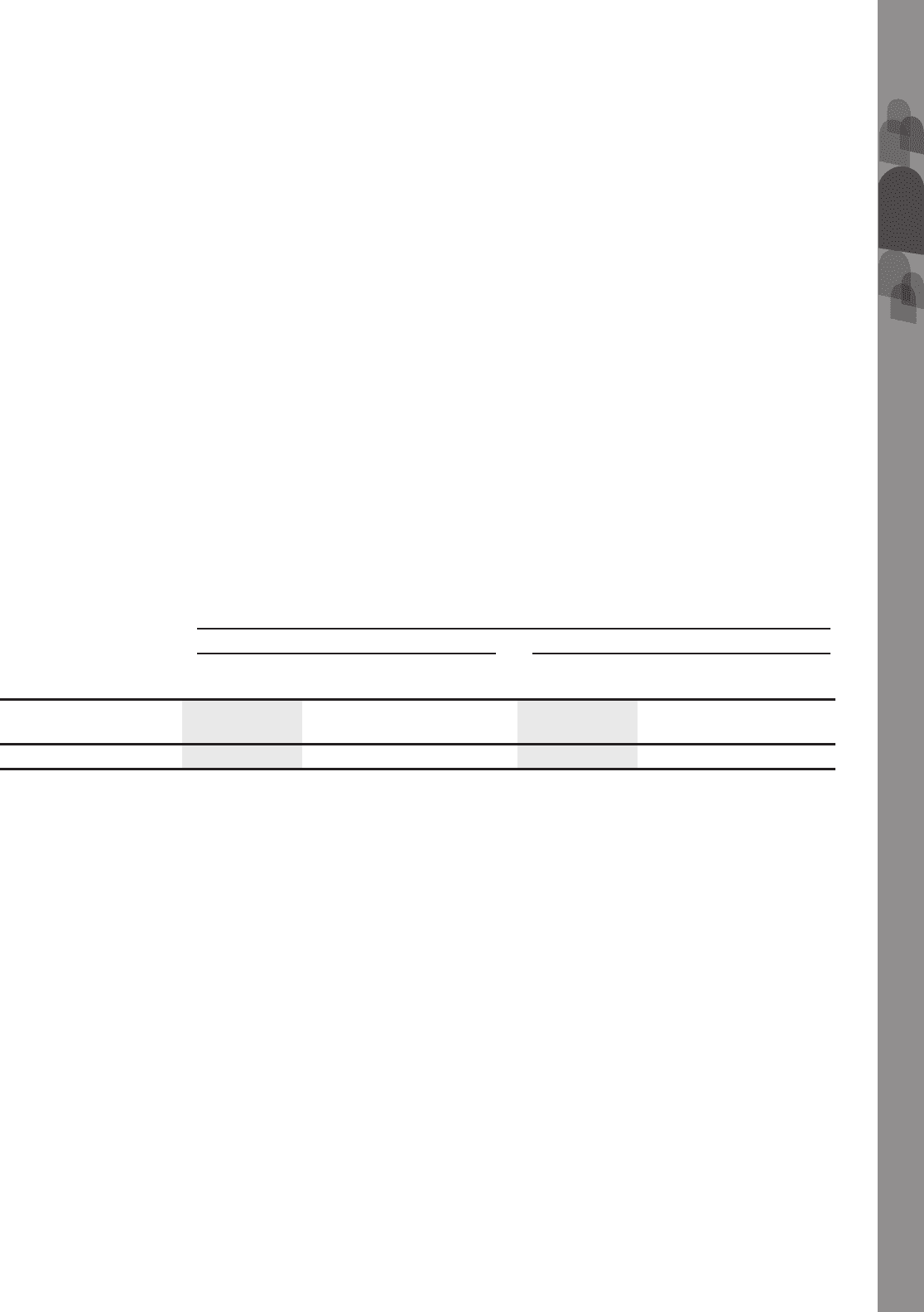

The table below presents a comparison of amortization expense relating to capital assets and intangible

assets recorded as amortization or cost of sales for the quarter ended February 27, 2010 compared to the

quarter ended February 28, 2009. Intangible assets are comprised of patents, licenses and acquired

technology.

(in thousands)

February 27,

2010

February 28,

2009 Change

February 27,

2010

February 28,

2009 Change

Included in Amortization Included in Cost of sales

For the Three Months Ended

Capital assets .............. $ 53,340 $ 36,662 $ 16,678 $ 50,741 $ 28,347 $ 22,394

Intangible assets .......... 33,200 24,933 8,267 43,574 26,183 17,391

Total ............................ $ 86,540 $ 61,595 $ 24,945 $ 94,315 $ 54,530 $ 39,785

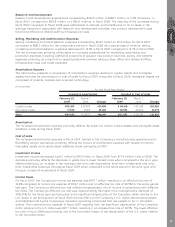

Amortization

The increased amortization expense in the fourth quarter of fiscal 2010 primarily reflects the impact of certain

capital assets and intangible asset additions made during fiscal 2010.

Cost of sales

The increased amortization expense in the fourth quarter of fiscal 2010, related to the Company’s

manufacturing operations and BlackBerry service operations, primarily reflects the impact of amortization

expense with respect to certain intangible assets and capital asset additions made during fiscal 2010.

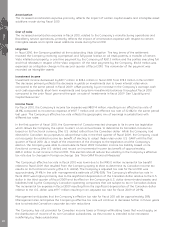

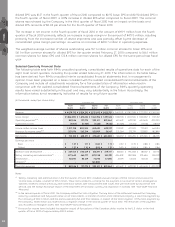

Investment Income

Investment income decreased by $5.1 million to $5.5 million in the fourth quarter of fiscal 2010 from $10.6 million

in the fourth quarter of fiscal 2009. The decrease primarily reflects the decrease in yields on investments due

to lower interest rates compared to the same period in fiscal 2009, offset partially by an increase in the

Company’s average cash and cash equivalents, short-term investments and long-term investments balances.

See “Liquidity and Capital Resources”.

Income Taxes

For the fourth quarter of fiscal 2010, the Company’s income tax expense was $307.1 million, resulting in an

effective tax rate of 30.2% compared to income tax expense of $225.3 million and an effective tax rate of 30.3%

for the same period last year. The Company’s effective tax rate reflects the geographic mix of income in

jurisdictions with different tax rates.

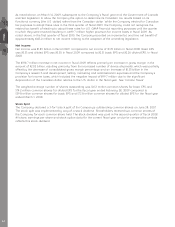

Net Income

The Company’s net income for the fourth quarter of fiscal 2010 was $710.1 million, an increase of $191.9 million,

or 37.0%, compared to net income of $518.3 million in the fourth quarter of fiscal 2009. Basic EPS was $1.27 and

MD&A

27