Blackberry 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

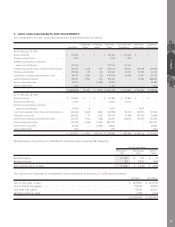

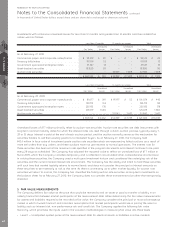

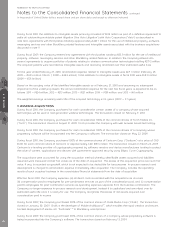

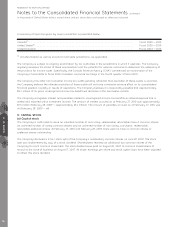

As at February 28, 2009 Level 1 Level 2 Level 3 Total

Assets

Available-for-sale investments

Money market fund ................................................................... $ 5,000 $ – $ – $ 5,000

Bankers acceptances and term deposits/certificates.................. – 14,971 – 14,971

Commerical paper and corporate notes/bonds ......................... – 389,086 18,702 407,788

Treasury bills/notes ................................................................... – 245,614 – 245,614

Government sponsored enterprise notes .................................... – 669,371 – 669,371

Asset-backed securities ............................................................. – 380,209 – 380,209

Auction-rate securities................................................................ – – 32,842 32,842

Total available-for-sale investments .............................................. $ 5,000 $ 1,699,251 $ 51,544 $ 1,755,795

Derivative instruments................................................................... – 70,100 – 70,100

Total assets .................................................................................. $ 5,000 $ 1,769,351 $ 51,544 $ 1,825,895

Liabilities

Derivative instruments................................................................... $ – $ 56,827 $ – $ 56,827

Total liabilities............................................................................... $ – $ 56,827 $ – $ 56,827

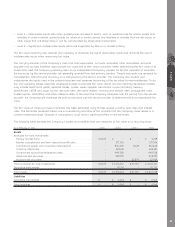

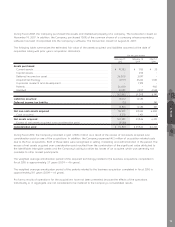

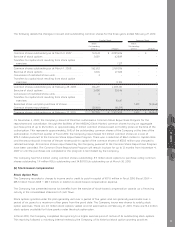

The following table summarizes the changes in fair value of the Company’s Level 3 assets for the year ended February 27,

2010:

Level 3

Balance at March 1, 2008 ................................................................................................................................ $ 59,418

Unrealized changes in fair value included in other comprehensive income ...................................................... (4,457)

Accrued interest .............................................................................................................................................. 1,072

Transfers out of Level 3 ................................................................................................................................... (4,489)

Balance at February 28, 2009 ......................................................................................................................... 51,544

Accrued interest .............................................................................................................................................. (3)

Transfers out of Level 3 ................................................................................................................................... (3,574)

Balance at February 27, 2010 .......................................................................................................................... $ 47,967

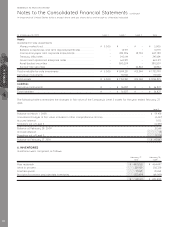

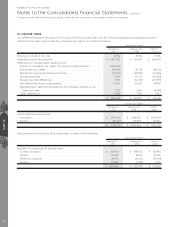

6. INVENTORIES

Inventories were comprised as follows:

February 27,

2010

February 28,

2009

Raw materials ..................................................................................................................... $ 490,063 $ 464,497

Work in process .................................................................................................................. 231,939 250,728

Finished goods.................................................................................................................... 17,068 35,264

Provision for excess and obsolete inventories ...................................................................... (117,459) (68,089)

$ 621,611 $ 682,400

RESEARCH IN MOTION LIMITED

Notes to the Consolidated Financial Statements continued

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

NOTES 5 6

70