Blackberry 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

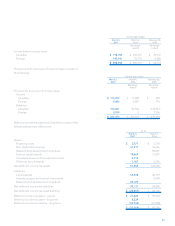

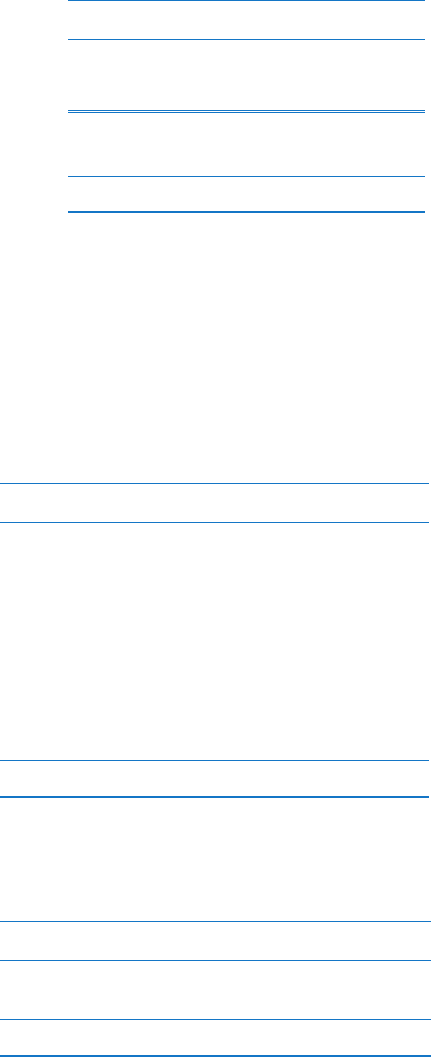

16. EARNINGS PER SHARE

The following table sets forth the computation of basic and

diluted earnings per share.

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

(Restated - note 4) (Restated - note 4)

Net income for basic and diluted earnings per

share available to common shareholders $ 631,572 $ 374,656 $ 205,612

Weighted-average number of shares outstanding (000’s) - basic 185,353 188,914 187,653

Effect of dilutive securities: Employee stock options 5,250 7,242 10,378

Weighted-average number of shares and assumed conversions - diluted 190,603 196,156 198,031

Earnings per share - reported

Basic $ 3.41 $ 1.98 $ 1.10

Diluted $ 3.31 $ 1.91 $ 1.04

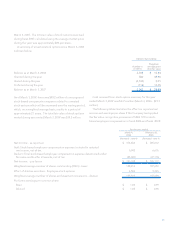

17. COMPREHENSIVE INCOME (LOSS)

The components of comprehensive income are shown

in the following table:

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

(Restated - note 4) (Restated - note 4)

Net income $ 631,572 $ 374,656 $ 205,612

Net change in unrealized gains (losses) on available-for-sale

investments 11,839 (5,888) (18,357)

Net change in derivative fair value during the year, net of

income taxes of $7,124 (March 4, 2006 - $9,539;

February 26, 2005 - $10,429) (13,455) 18,029 8,446

Amounts reclassified to earnings during the year,

net of income taxes of $4,197 (March 4, 2006 - $6,000;

February 26, 2005 - $5,359) (7,926) (11,344) (4,340)

Comprehensive income $ 622,030 $ 375,453 $ 191,361

The components of accumulated other comprehensive loss

are as follows:

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

Accumulated net unrealized losses on available-for-sale investments $ (6,394) $ (18,233) $ (12,345)

Accumulated net unrealized gains (losses) on derivative instruments (5,122) 16,259 9,574

Total accumulated other comprehensive loss $ (11,516) $ (1,974) $ (2,771)