Blackberry 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

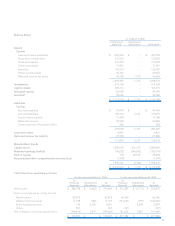

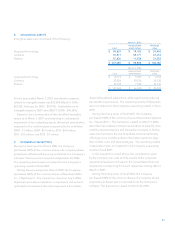

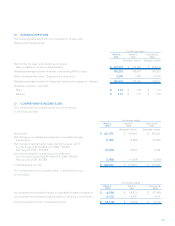

The following details the changes in issued and

outstanding common shares for the three years ended

March 3, 2007:

Number

Outstanding

(000’s)

Common

Shares

Balance as at February 28, 2004 184,830

Exercise of stock options 4,655

Balance as at February 26, 2005 189,485

Exercise of stock options 2,837

Common shares repurchased pursuant to Common

Share Repurchase Program (6,320)

Balance as at March 4, 2006 186,002

Exercise of stock options 3,042

Conversion of restricted share units 7

Common shares repurchased pursuant to Common

Share Repurchase Program (3,180)

Balance as at March 3, 2007 185,871

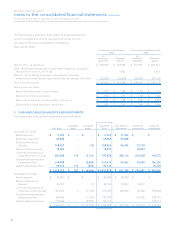

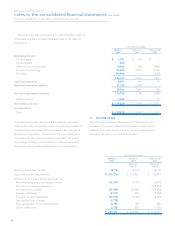

On October 11, 2005, the Company’s Board of Directors

approved the repurchase by the Company, from time to time,

on the NASDAQ National Market, of up to an aggregate of

9.5 million common shares during the subsequent 12 month

period. This represents approximately 5% of the Company’s

outstanding shares.

Pursuant to the Common Share Repurchase Program,

the Company repurchased 6.3 million common shares at a

cost of $391,212 during the third quarter of fiscal 2006 and

repurchased 3.2 million common shares at a cost of $203,933

during the second quarter of fiscal 2007 which brought the

total number of common shares repurchased to the approved

maximum of 9.5 million common shares. The amounts paid in

excess of the per share paid-in capital of the common shares

of $328,231 in the third quarter of fiscal 2006 and $172,171 in

the second quarter of fiscal 2007 were charged to retained

earnings. All common shares repurchased by the Company

pursuant to the Common Share Repurchase Program have

been cancelled.

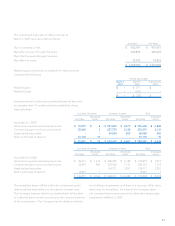

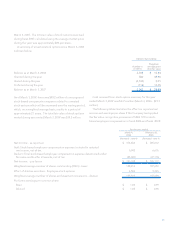

During fiscal 2005, the Company determined that it was

more likely than not it can realize its deferred income tax

assets and therefore recognized a deferred income tax asset

of $8,727 with respect to fiscal 2004 share issue financing

costs.

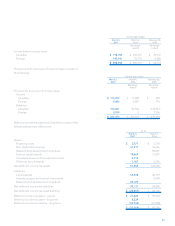

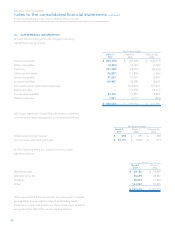

(b) Share-based payment

Stock Option Plan

The Company has an incentive stock option plan for directors,

officers and employees of the Company or its subsidiaries.

Prior to fiscal 2007, the Company accounted for

stock-based compensation using APB 25 and related

interpretations. Under APB 25, compensation expense is

measured as of the date on which the number of shares and

exercise price become fixed. Generally, this occurs on the

grant date and the award is accounted for as a fixed award. If

the number of shares and grant price are not fixed as of the

grant date, the stock option is accounted for as a variable

award until such time as the number of shares and/or exercise

prices become fixed, or the stock option is exercised, is

cancelled, or expires.

Effective March 5, 2006, the Company adopted SFAS

123(R) to record stock compensation expense, using the MPT

method. Under the MPT method, there is no restatement

of prior periods. The adoption of SFAS 123(R) has resulted in

a charge to earnings of $18.8 million in fiscal 2007 (see also

note 2).