Blackberry 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

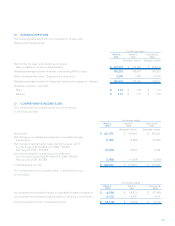

(d) Additional information

Advertising expense, which includes media, agency and

promotional expenses totalling $67,738 (March 4,

2006 - $32,606; February 26, 2005 - $29,208) is included in

Selling, marketing and administration expense.

Selling, marketing and administration expense for the

fiscal year includes a foreign currency exchange loss of

$2,045 (March 4, 2006 – loss of $2,519; February 26, 2005 –

gain of $418).

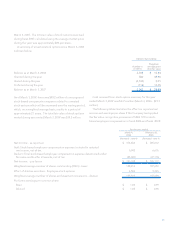

19. FINANCIAL INSTRUMENTS

Values of financial instruments outstanding were as follows:

March 3, 2007

Assets (Liabilities) Notional

Amount Carrying

Amount Estimated

Fair Value

Cash and cash equivalents $ - $ 677,144 $ 677,144

Available-for-sale investments $ - $ 735,734 $ 735,734

Long-term debt $ - $ (6,613) $ (6,767)

Currency forward contracts - asset $ 246,325 $ 5,115 $ 5,115

Currency forward contracts - liability $ 575,406 $ (12,406) $ (12,406)

March 4, 2006

Assets (Liabilities) Notional

Amount Carrying

Amount Estimated

Fair Value

Cash and cash equivalents $ - $ 459,540 $ 459,540

Available-for-sale investments $ - $ 789,862 $ 789,862

Long-term debt $ - $ (7,113) $ (7,322)

Currency forward contracts - asset $ 300,362 $ 24,900 $ 24,900

Currency forward contracts - liability $ 74,891 $ (418) $ (418)

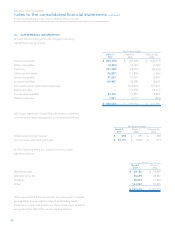

For the Company’s trade receivables, other receivables,

accounts payable and accrued liabilities, the fair values

approximate their respective carrying amounts due to

their short maturities. The fair value of investments has

been estimated by using market quoted prices and interest

rates. The fair value of currency forward contracts has been

estimated using market quoted currency spot rates and

interest rates. The fair value of long-term debt has been

estimated using market quoted interest rates. The estimates

presented herein are not necessarily indicative of the

amounts that RIM could realize in a current market exchange.

Changes in assumptions could have a significant effect on the

estimates.

The Company is exposed to foreign exchange risk as a

result of transactions in currencies other than its functional

currency, the U.S. dollar. The majority of the Company’s

revenues in fiscal 2007 are transacted in U.S. dollars. Portions

of the revenues are denominated in British Pounds, Canadian

dollars, and Euros. Purchases of raw materials are primarily

transacted in U.S. dollars. Other expenses, consisting

of the majority of salaries, certain operating costs and

manufacturing overhead are incurred primarily in Canadian

dollars. At March 3, 2007 approximately 3% of cash and cash

equivalents, 30% of trade receivables and 14% of accounts

payable and accrued liabilities are denominated in foreign

currencies (March 4, 2006 – 5%, 28% and 19%, respectively).

These foreign currencies primarily include the British Pound,

Canadian dollar, and Euro.

As part of its risk management strategy, the Company

maintains net monetary asset and/or liability balances in

foreign currencies and engages in foreign currency hedging

activities using derivative financial instruments, including

currency forward contracts and currency options. The

Company does not use derivative instruments for speculative

purposes. The principal currencies hedged include the British

Pound, Canadian dollar, and Euro.