Blackberry 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

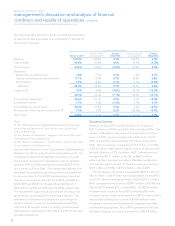

37

relating to the NTP matter (see “Results of Operations-

Litigation” and note 13(b) to the Consolidated Financial

Statements). Fiscal 2007 net income also includes the effect

of the Company adopting SFAS 123(R), resulting in an after-

tax stock-based compensation expense in the amount of

$18.8 million, or $0.10 diluted EPS.

A more comprehensive analysis of these factors is

contained in “Results of Operations”.

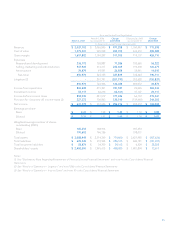

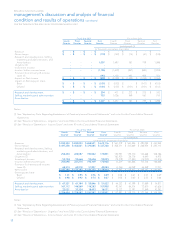

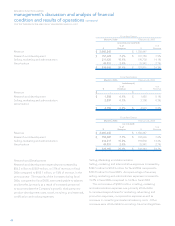

Selected Quarterly Financial Data

The following tables set forth RIM’s restated unaudited

quarterly consolidated results of operations data for each of

the eight most recent quarters, including the quarter ended

March 3, 2007. The first table presents the information as

previously reported for the four quarters in fiscal 2006 and

the first quarter of fiscal 2007. The second table presents the

adjustments relating to the Restatement as it applies to these

quarters. The third table presents the information reflecting

the Restatement on those quarters. The information has

been derived from RIM’s unaudited interim consolidated

financial statements that, in management’s opinion, have

been prepared on a basis consistent with the Consolidated

Financial Statements and include all adjustments necessary

for a fair presentation of information when read in

conjunction with the Consolidated Financial Statements.

RIM’s quarterly operating results have varied substantially in

the past and may vary substantially in the future. Accordingly,

the information below is not necessarily indicative of results

for any future quarter.

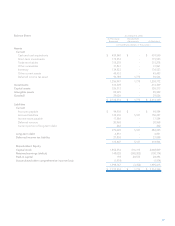

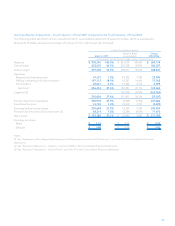

Fiscal Year 2007 Fiscal Year 2006

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

(as previously reported) (1)

(in thousands, except per share data)

Revenue $ 930,393 $ 835,053 $ 658,541 $ 613,116 $ 561,219 $ 560,596 $ 490,082 $ 453,948

Gross margin $ 497,358 $ 452,631 $ 370,085 $ 337,847 $ 308,653 $ 312,745 $ 269,015 $ 250,217

Research and development, Selling,

marketing and administration, and

Amortization 256,454 228,087 190,582 174,844 151,494 138,329 121,489 107,688

Litigation (2) - - - - 162,500 26,176 6,640 6,475

Investment income (14,794) (12,666) (12,606) (12,051) (19,219) (17,483) (15,700) (13,816)

Income before income taxes 255,698 237,210 192,109 175,054 13,878 165,723 156,586 149,870

Provision for (recovery of) income

taxes (3) 68,314 62,018 51,957 45,281 (4,476) 45,574 45,531 17,350

Net income $ 187,384 $ 175,192 $ 140,152 $ 129,773 $ 18,354 $ 120,149 $ 111,055 $ 132,520

Earnings per share

Basic $ 1.01 $ 0.95 $ 0.76 $ 0.70 $ 0.10 $ 0.63 $ 0.58 $ 0.70

Diluted $ 0.98 $ 0.92 $ 0.74 $ 0.68 $ 0.10 $ 0.61 $ 0.56 $ 0.67

Research and development $ 67,321 $ 61,184 $ 55,846 $ 51,518 $ 43,851 $ 41,567 $ 37,677 $ 34,534

Selling, marketing and administration 167,112 146,569 116,283 107,255 92,321 83,965 72,263 62,871

Amortization 22,021 20,334 18,453 16,071 15,322 12,797 11,549 10,283

$ 256,454 $ 228,087 $ 190,582 $ 174,844 $ 151,494 $ 138,329 $ 121,489 $ 107,688

Notes:

(1) See “Explanatory Note Regarding Restatement of Previously Issued Financial Statements” and note 4 to the Consolidated Financial

Statements.

(2) See “Results of Operations – Litigation” and note 13(b) to the Consolidated Financial Statements.

(3) See “Results of Operations – Income Taxes” and note 10 to the Consolidated Financial Statements.