Blackberry 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

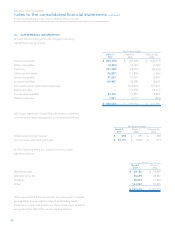

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

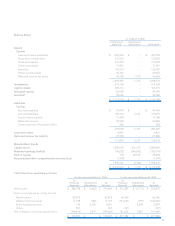

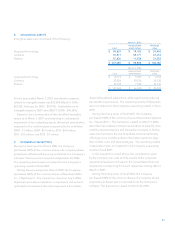

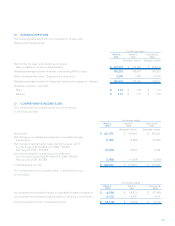

Options Outstanding

Number

(in 000’s)

Weighted

Average

Exercise

Price

Average

Remaining

Contractual

Life in Years

Aggregate

Instrinsic

Value

Balance as at February 28, 2004 16,018 $ 10.82

Granted during the year 315 58.45

Exercised during the year (4,655) 10.19

Forfeited/cancelled/expired during the year (527) 10.49

Balance as at February 26, 2005 11,151 $ 12.44

Granted during the year 911 72.11

Exercised during the year (2,837) 6.81

Forfeited/cancelled/expired during the year (264) 11.11

Balance as at March 4, 2006 8,961 $ 20.33

Granted during the year 584 111.46

Exercised during the year (3,042) 12.89

Forfeited/cancelled/expired during the year (116) 29.90

Balance as at March 3, 2007 6,387 $ 32.54 3.22 $ 660,629

Vested and expected to vest at March 3, 2007 6,133 $ 31.89 3.17 $ 638,340

Exercisable at March 3, 2007 3,344 $ 18.22 2.21 $ 393,733

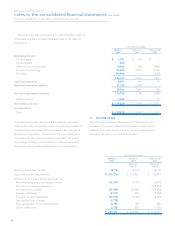

The aggregate intrinsic value in the table above represents

the total pre-tax intrinsic value (the aggregate difference

between the closing stock price of the Company’s common

stock on March 3, 2007 and the exercise price for in-the-

money options) that would have been received by the option

holders if all in-the-money options had been exercised on

In accordance with SFAS 123(R), beginning in fiscal 2007,

the Company has presented excess tax benefits from the

exercise of stock-based compensation awards as a financing

activity in the consolidated statement of cash flows.

Options granted under the plan generally vest over a

period of five years and are generally exercisable over a

period of seven years to a maximum of ten years from the

grant date. The Company issues new shares to satisfy stock

option exercises. There are 3.3 million stock options vested

and not exercised as at March 3, 2007. There are 5.2 million

stock options available for future grants under the stock

option plan.

A summary of option activity since February 28, 2004

is shown below. As a result of the Company’s review of its

historical option granting practice (as more fully discussed

in Note 4), certain outstanding stock options will be repriced

to reflect a higher exercise price as certain employees have

agreed to have their options repriced. As the repricing

of options has not occurred prior to filing these financial

statements, the repricing will be recorded as a subsequent

event, the effects of which will be set out in a subsequent

quarterly financial statement when the options are actually

repriced. The per option information contained in the

disclosure below relates to the historical prices for all stock

options. As the repricing of the options will make the options

less valuable, there will be no accounting expense related to

the repricing event.