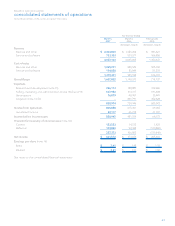

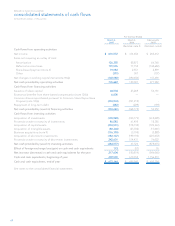

Blackberry 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

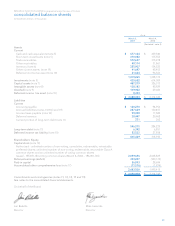

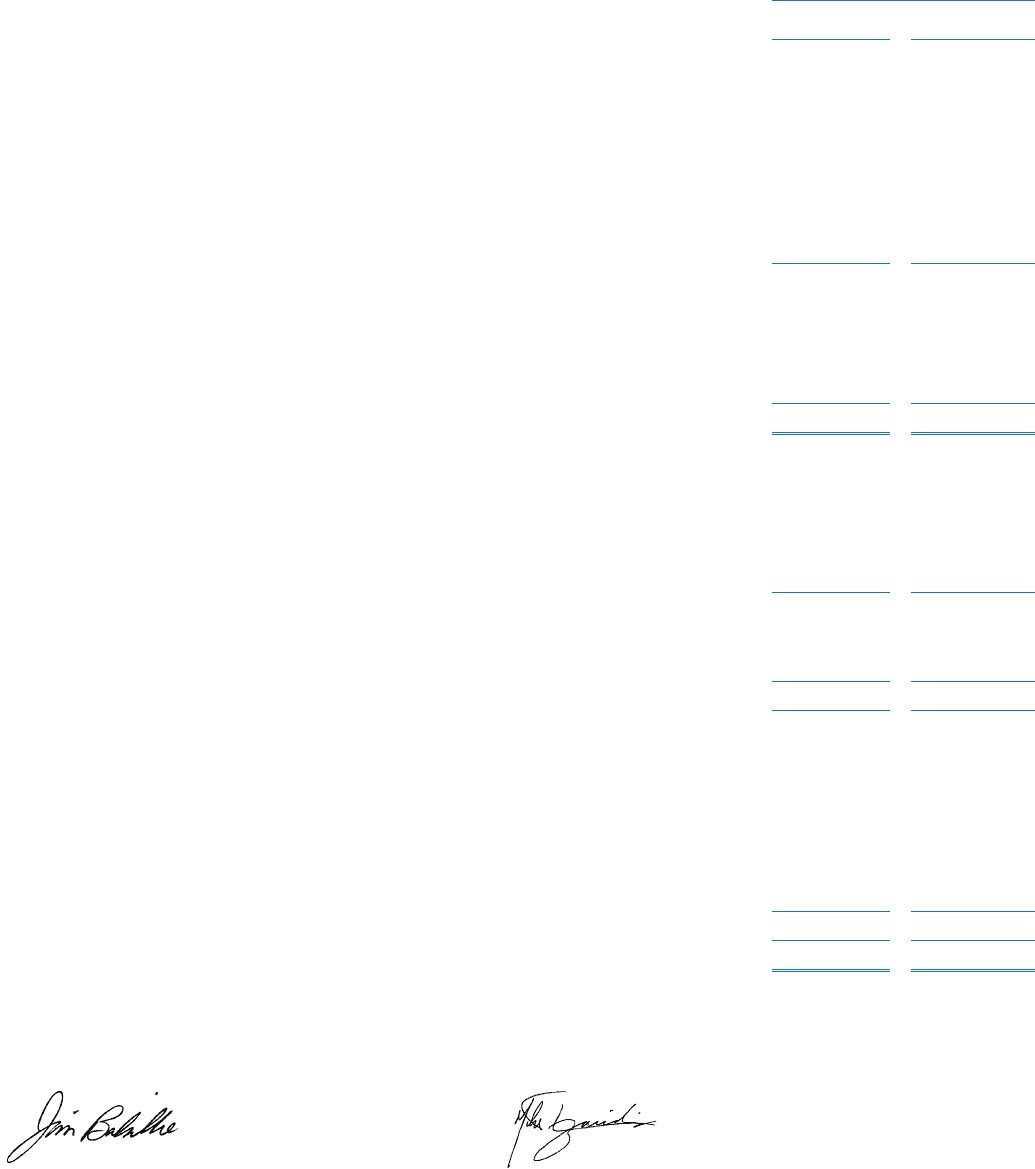

61

As at

March 3,

2007 March 4,

2006

(Restated - note 4)

Assets

Current

Cash and cash equivalents (note 5) $ 677,144 $ 459,540

Short-term investments (note 5) 310,082 175,553

Trade receivables 572,637 315,278

Other receivables 40,174 31,861

Inventory (note 6) 255,907 134,523

Other current assets (note 19) 41,697 45,453

Deferred income tax asset (note 10) 21,624 96,564

1,919,265 1,258,772

Investments (note 5) 425,652 614,309

Capital assets (note 7) 487,579 326,313

Intangible assets (note 8) 138,182 85,929

Goodwill (note 9) 109,932 29,026

Deferred income tax asset (note 10) 8,339 -

$ 3,088,949 $ 2,314,349

Liabilities

Current

Accounts payable $ 130,270 $ 94,954

Accrued liabilities (notes 14,18(c) and 19) 287,629 150,457

Income taxes payable (note 10) 99,958 17,584

Deferred revenue 28,447 20,968

Current portion of long-term debt (note 11) 271 262

546,575 284,225

Long-term debt (note 11) 6,342 6,851

Deferred income tax liability (note 10) 52,532 27,858

605,449 318,934

Shareholders’ Equity

Capital stock (note 12)

Authorized - unlimited number of non-voting, cumulative, redeemable, retractable

preferred shares; unlimited number of non-voting, redeemable, retractable Class A

common shares and an unlimited number of voting common shares

Issued - 185,871,144 voting common shares (March 4, 2006 - 186,001,765) 2,099,696 2,068,869

Retained earnings (deficit) 359,227 (100,174)

Paid-in capital 36,093 28,694

Accumulated other comprehensive loss (note 17) (11,516) (1,974)

2,483,500 1,995,415

$ 3,088,949 $ 2,314,349

Commitments and contingencies (notes 11, 13, 14, 15 and 19)

See notes to the consolidated financial statements.

On behalf of the Board:

Jim Balsillie Mike Lazaridis

Director Director

RESEARCH IN MOTION LIMITED Incorporated under the Laws of Ontario

consolidated balance sheets

(United States Dollars, in thousands)