Blackberry 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

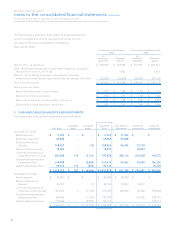

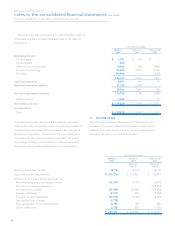

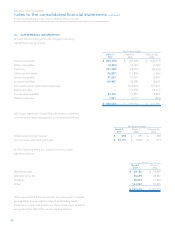

The weighted average fair value of stock options granted

during the quarter was calculated using the BSM option-

pricing model with the following assumptions:

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

(Restated - note 4) (Restated - note 4)

Number of options granted (000’s) 584 911 315

Weighted-average Black-Scholes value of each option $ 49.90 $ 37.17 $ 34.52

Assumptions:

Risk free interest rate 4.8% 4.1% 3.3%

Expected life in years 4.4 4.0 4.0

Expected dividend yield 0% 0% 0%

Volatility 44% - 55% 60% 69%

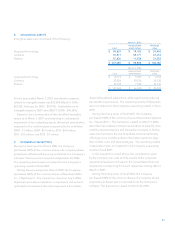

The Company has not paid a dividend in the previous nine

fiscal years and has no current expectation of paying cash

dividends on its common stock. The risk-free interest rates

utilized during the life of the stock option are based on a U.S.

Treasury security for an equivalent period. The Company

estimates the volatility of its common stock at the date of

grant based on a combination of the implied volatility of

publicly traded options on its common stock, and historical

volatility, as the Company believes that this is a better

indicator of expected volatility going forward. The expected

life of stock options granted under the plan is based on

historical exercise patterns, which the Company believes are

representative of future exercise patterns.

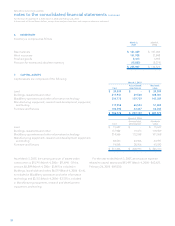

Restricted Share Unit Plan (the “RSU Plan”)

RSUs are redeemed for either common shares issued from

treasury, common shares purchased on the open market

or the cash equivalent on the vesting dates established by

the Company. Compensation expense will be recognized

upon issuance of RSUs over the vesting period. Total

compensation expense recorded in the year with respect to

RSUs was $282.

The Company did not issue any RSUs in the year ended

March 3, 2007 and there were no RSUs outstanding as at

March 3, 2007 (March 4, 2006 – 7,800).

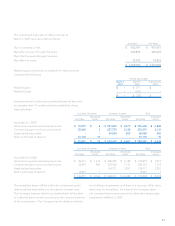

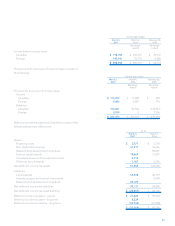

13. COMMITMENTS AND CONTINGENCIES

(a) Lease commitments

The Company is committed to future minimum annual lease

payments under operating leases as follows:

Real Estate Equipment

and other Total

For the years ending

2008 $ 10,721 $ 480 $ 11,201

2009 11,726 226 11,952

2010 9,584 - 9,584

2011 8,847 - 8,847

2012 8,211 - 8,211

Thereafter 38,577 - 38,577

$ 87,666 $ 706 $ 88,372