Blackberry 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.56

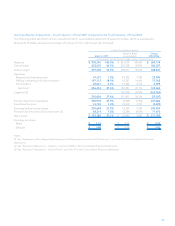

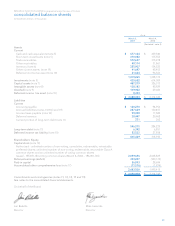

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

• the conclusion of the Special Committee upon completion

of the Review, as disclosed by the Company in a press

release on March 5, 2007, that the Company failed to

maintain adequate internal and accounting controls prior

to August 8, 2006 with respect to the issuance of options

in compliance with the Stock Option Plan, both in terms

of how options were granted and documented, and the

measurement date used to account for certain option

grants;

• the steps taken by the Company to enhance its controls

following the commencement of the Review on August

8, 2006, including the measures adopted by the Board

of Directors that are summarized above, based on

the recommendations of the Special Committee, in

response to the findings of the Special Committee, that

are designed to enhance the oversight and corporate

governance of the Company and to strengthen the

Company’s control over its stock option granting process;

• the fact that the Special Committee did not find

intentional misconduct on the part of any director, officer

or employee responsible for the administration of the

Company’s stock option grant program; and

• the increased participation of, and reliance by the

Company on, outside accounting advisors and legal

counsel following the commencement of the Review, which

will continue until the Company has established its internal

audit department and has enhanced its capabilities in U.S.

GAAP.

In light of these and other measures undertaken as described

above, management has concluded that the control

deficiencies that resulted in the Restatement were addressed

following the commencement of the Review on August 8,

2006 and has determined that as of March 3, 2007, the design

and operating effectiveness of controls over the recording of

stock-based compensation expense were effective. These

measures included increased documentation and testing

of the design and operation of internal controls, the

establishment of guidelines and the enhanced focus by

all levels of management on the improvement of controls

following the commencement of the Review, and increased

participation in the Company’s processes by external

advisors.

Disclosure Controls and Procedures

As of March 3, 2007, the end of the period covered by this

Annual Report on Form 40-F, the Company carried out an

evaluation, under the supervision and with the participation

of the Company’s management, including the Company’s

Co-Chief Executive Officers and its Chief Accounting Officer,

of the effectiveness of the design and operation of the

Company’s disclosure controls and procedures, as defined in

Rules 13a-15(e) and 15d-15(e) of the United States Securities

and Exchange Act of 1934 (the “Exchange Act”). Based on

that evaluation, the Co-Chief Executive Officers and the

Chief Accounting Officer have concluded that, as of such

date, the Company’s disclosure controls and procedures were

effective to give reasonable assurance that the information

required to be disclosed by the Company in reports that

it files or submits under the Exchange Act is (i) recorded,

processed, summarized and reported, within the time periods

specified in the Securities and Exchange Commission’s

rules and forms, and (ii) accumulated and communicated to

management, including its principal executive and principal

financial officers, or persons performing similar functions,

as appropriate to allow timely decisions regarding required

disclosure.

Management’s Report on Internal Control Over Financial

Reporting

Management of the Company is responsible for establishing

and maintaining adequate internal control over financial

reporting. Internal control over financial reporting is

defined in Rule 13a-15(f) and 15d-15(f) under the Exchange

Act as a process designed by, or under the supervision of,

the Company’s principal executive and principal financial

officers and effected by the Company’s Board of Directors,

management and other personnel to provide reasonable

assurance regarding the reliability of financial reporting and

the preparation of financial statements for external purposes

in accordance with GAAP and includes those policies and

procedures that:

• pertain to the maintenance of records that in reasonable

detail accurately and fairly reflect the transactions and

dispositions of the assets of the Company;