Blackberry 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

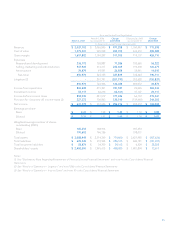

Amortization

Amortization expense relating to certain capital and all

intangible assets other than licenses increased by $14.1

million to $50.0 million for fiscal 2006 compared to $35.9

million for fiscal 2005. The increased amortization expense

in fiscal 2006 reflects the impact of a full year’s amortization

expense with respect to capital and certain intangible asset

expenditures incurred during fiscal 2005 and also incremental

amortization with respect to capital and certain intangible

asset expenditures incurred during fiscal 2006.

Cost of sales

Amortization expense with respect to capital assets

employed in the Company’s manufacturing operations and

BlackBerry service operations increased to $18.5 million in

fiscal 2006 compared to $14.3 million in fiscal 2005 and is

charged to Cost of sales in the consolidated statements

of operations. The increased amortization expense in

fiscal 2006 reflects the impact of a full year’s amortization

expense with respect to these capital asset expenditures

incurred during fiscal 2005 and also incremental amortization

with respect to capital asset expenditures incurred during

fiscal 2006. See also note 7 to the Consolidated Financial

Statements.

Amortization expense with respect to licenses (a component

of Intangible assets) is charged to Cost of sales and was $17.5

million in fiscal 2006 compared to $16.5 million in fiscal 2005.

Total amortization expense with respect to Intangible

assets was $23.2 million in fiscal 2006 compared to $19.7

million in fiscal 2005. See also notes 1(l) and 8 to the

Consolidated Financial Statements and “Critical Accounting

Policies and Estimates - Valuation of long-lived assets,

intangible assets and goodwill”.

Changes in Capital Assets Amortization

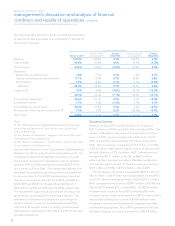

During fiscal 2005, the Company re-evaluated the estimated

useful lives of certain of its information technology assets

and determined that the estimated useful lives should be

reduced from five years to periods of three to four years. The

impact of this change was applied on a prospective basis

commencing in the first quarter of fiscal 2005. The impact of

this change of accounting estimate resulted in incremental

amortization expense of $4.3 million for the year. Of this

amount, $1.8 million was included in Cost of sales, and $2.5

million was included in Amortization. See also note 1(k) to

the Consolidated Financial Statements.

During fiscal 2005, the Company also re-evaluated the

estimated useful lives of capital assets used in manufacturing,

and research and development operations that resulted from

the application of the 20% declining balance amortization

methodology. As a result of the plant capacity and capital

asset utilizations currently approaching 100% compared to

much lower levels in prior fiscal years, the Company now

believes that the 20% declining balance method will not

produce quarterly and annual depreciation expense and

resulting residual net book values that are consistent with

the increased current and future capital asset usage. The

Company, therefore, revised its amortization method to a

straight-line method and determined estimated useful lives to

be between five and eight years for such capital assets, on a

prospective basis, effective the second quarter of fiscal 2005.

The impact of this change of method of accounting was

insignificant for fiscal years 2006 and 2005. See also notes 2

and 7 to the Consolidated Financial Statements.

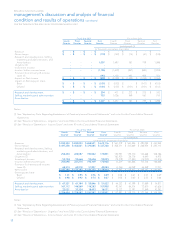

Litigation

As more fully disclosed in the Consolidated Financial

Statements, the Company was the defendant in a patent

litigation matter brought by NTP alleging that the Company

infringed on eight of NTP’s patents.

On March 16, 2005, the parties jointly announced the

signing of a binding Term Sheet to resolve all current

litigation between them. The parties announced that RIM

would pay NTP $450 million in final and full resolution of all

claims to date against RIM, as well as a fully-paid up license

going forward. During fiscal 2005, the Company recorded

an incremental expense of $352.6 million to adjust the total

NTP provision to the resolution amount plus current and

estimated legal, professional and other fees, less the previous

cumulative quarterly provisions for enhanced compensatory

damages, prejudgment interest, plaintiff’s attorney fees,

estimated postjudgment interest, and current and estimated

future costs with respect to legal and other professional

fees, and the acquisition of a $20 million intangible asset.

The $76.2 million attributable to enhanced compensatory

damages and postjudgment interest with respect to fiscal

2005 was classified as Restricted cash on its consolidated

balance sheets as at February 26, 2005.

On March 3, 2006, the Company and NTP signed

definitive licensing and settlement agreements. All terms

of the agreement were finalized and the litigation against

the Company was dismissed by a court order on March 3,