Blackberry 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

option grants with incorrect measurement dates.

Certain of the Company’s outside directors also received

in-the-money benefits from option grants with incorrect

measurement dates. As the selection of grant dates used on

grants made to outside directors was not apparent to those

directors, they were unaware that they were receiving grants

with dating issues.

Review Costs

Included in the Company’s selling, marketing and

administrative expenses in fiscal 2007 are legal, accounting

and other professional costs incurred by the Company

in fiscal 2007 as well as other costs incurred by the

Company under indemnity agreements in favor of certain

officers and directors of the Company, in each case in

connection with the Review, the Restatement and related

matters.

Mr. Balsillie and Mr. Lazaridis have voluntarily offered to

assist the Company in defraying costs incurred in connection

with the Review and the Restatement by contributing up to

CAD $10 million (up to CAD $5 million each) of those costs.

The Company has agreed to accept this voluntary payment,

which is expected to be recorded in fiscal 2008. The amounts

will be recorded when received as an increase to paid-in

capital.

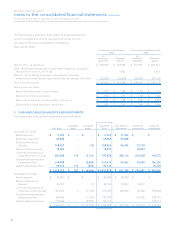

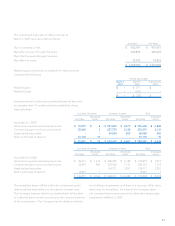

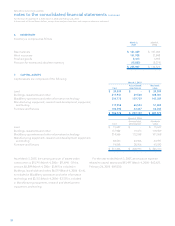

Restatement of Financial Statements

The following tables set forth the effects of the restatement

on the Company’s consolidated statements of operations for

the fiscal year ended March 4, 2006 and February 26, 2005,

the consolidated balance sheet as at March 4, 2006 and the

effect on the Company’s net cash provided by operating

activities within the consolidated statements of cash flows for

the fiscal years ended march 4, 2006 and February 26, 2005.

Cash flows from financing and investing activities were not

affected by the Restatement.

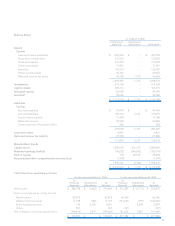

Consolidated Statements of Operations

For the Year Ended March 4, 2006 For the Year Ended February 26, 2005

As Previously

Reported Restatement

Adjustments As Restated As Previously

Reported Restatement

Adjustments As Restated

Revenue $ 2,065,845 $ - $ 2,065,845 $ 1,350,447 $ - $1,350,447

Cost of sales 925,215 383 925,598 635,914 396 636,310

Gross margin 1,140,630 (383) 1,140,247 714,533 (396) 714,137

Expenses

Research and development 157,629 1,258 158,887 101,180 1,485 102,665

Selling, marketing and

administration 311,420 2,897 314,317 190,730 3,108 193,838

Amortization 49,951 - 49,951 35,941 - 35,941

Litigation 201,791 - 201,791 352,628 - 352,628

720,791 4,155 724,946 680,479 4,593 685,072

Income from operations 419,839 (4,538) 415,301 34,054 (4,989) 29,065

Investment income 66,218 - 66,218 37,107 - 37,107

Income before income taxes 486,057 (4,538) 481,519 71,161 (4,989) 66,172

Provision for (recovery of)

income taxes

Current 14,515 - 14,515 1,425 - 1,425

Deferred 89,464 2,884 92,348 (143,651) 2,786 (140,865)

103,979 2,884 106,863 (142,226) 2,786 (139,440)

Net income $ 382,078 $ (7,422) $ 374,656 $ 213,387 $ (7,775) $ 205,612

Earnings per share

Basic $ 2.02 $ (0.04) $ 1.98 $ 1.14 $ (0.04) $ 1.10

Diluted $ 1.96 $ (0.05) $ 1.91 $ 1.09 $ (0.05) $ 1.04