Blackberry 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

to earnings in the amount of $162.5 million was recorded

in operating results in the three-month period ending

March 4, 2006. During fiscal 2006, the Patent Office issued

various office actions rejecting all claims in all NTP patents.

Accordingly, though the rulings of the Patent Office are

subject to appeal by NTP, given the conclusions and the

strength of the conclusions reached by the Patent Office,

no value has been ascribed to the NTP license. See “Critical

Accounting Policies and Estimates – Litigation”, “Results of

Operations – Litigation” and note 13(b) to the Consolidated

Financial Statements.

Investment Income

Investment income decreased by $4.4 million to $14.8 million

in the fourth quarter of fiscal 2007 from $19.2 million in the

comparable period of fiscal 2006. The decrease reflects the

decrease in cash, cash equivalents, short-term investments

and investments when compared to the prior year’s quarter

resulting primarily from the funding of the NTP litigation

settlement in the amount of $612.5 million in the fourth

quarter of fiscal 2006 as well as the common shares of the

Company repurchased as part of the Company’s Common

Share Repurchase Program at an aggregate cost of $203.9

million offset, in part, by improved interest rate yields.

Income Taxes

For the fourth quarter of fiscal 2007, the Company’s income

tax expense was $68.3 million resulting in an effective tax

rate of 26.7% compared to an income tax recovery of $3.4

million for the same period last year. The fiscal 2006 income

tax recovery on the incremental NTP settlement amount was

in excess of the income tax expense on pre-tax earnings

excluding the litigation accrual.

The Company has not provided for Canadian income

taxes or foreign withholding taxes that would apply on the

distribution of the earnings of its non-Canadian subsidiaries,

as these earnings are intended to be reinvested indefinitely

by these subsidiaries.

Net Income

The Company’s net income increased by $171.8 million to

$187.4 million, or $1.01 basic EPS and $0.98 diluted EPS, in

the fourth quarter of fiscal 2007, compared to $15.6 million,

or $0.08 basic EPS and $0.08 diluted EPS, in the fourth

quarter of fiscal 2006. The $171.8 million increase in net

income in the fourth quarter of fiscal 2007 reflects primarily

an increase in gross margin in the amount of $188.8 million,

which was partially offset by an increase of $96.8 million in the

Company’s research and development expenses, sales and

marketing programs and an increase in legal, accounting and

other professional costs incurred in the fourth quarter of fiscal

2007 in connection with the Review, the Restatement and

related matters. The fiscal 2007 fourth quarter net income

also includes the effect of the Company adopting SFAS

123(R), resulting in stock-based compensation expense in an

after-tax amount of $5.2 million, or $0.03 diluted EPS. The

fourth quarter of fiscal 2006 included a litigation provision of

$162.5 million relating to the NTP litigation matter.

The weighted average number of shares outstanding was

185.7 million common shares for basic EPS and 190.3 million

common shares for diluted EPS for the quarter ended March

3, 2007 compared to 185.6 million common shares for basic

EPS and 191.9 million common shares for diluted EPS for the

comparable period last year.

Liquidity and Capital Resources

Cash and cash equivalents, short-term investments and

investments increased by $163.5 million to $1.41 billion as

at March 3, 2007 from $1.25 billion as at March 4, 2006.

The majority of the Company’s cash and cash equivalents,

short-term investments and investments are denominated in

U.S. dollars as at March 3, 2007.

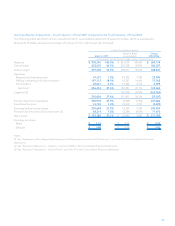

A comparative summary of cash and cash equivalents,

short-term investments and investments is set out below.

As at

March 3, 2007 March 4, 2006 Change - Fiscal

2007/2006

Cash and cash equivalents $ 677,144 $ 459,540 $ 217,604

Short-term investments 310,082 175,553 134,529

Investments 425,652 614,309 (188,657)

Cash, cash equivalents, short-term investments and investments $ 1,412,878 $ 1,249,402 $ 163,476