Blackberry 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

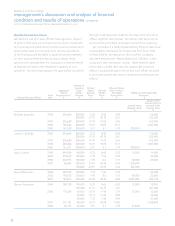

1 The Aggregate Annual Compensations reflects the aggregate of

the compensation received by the individual for the year as set out in

the Compensation Table in the Company’s proxy circular.

2 Dollar amounts set out in this table are in U.S. dollars. The

Aggregate Annual Compensation and all stock option exercise prices

included in the table above are denominated in Canadian dollars

and have been converted from Canadian dollars to U.S. dollars at the

average annual historical exchange rates.

3 The Revised Option Price presented in the table above has been

determined by the Special Committee of the Board of Directors and

represents the fair market value of the shares on the TSX on the day

immediately prior to the date on which the number of options the

recipient was to receive was known and approved. With respect

to the Fiscal 2001 option grants to Don Morrison and Larry Conlee,

which were made in connection with Messrs. Morrison and Conlee

agreeing to join the Company, the Special Committee of the Board of

Directors determined the Revised Option Price based on the value of

the shares on the TSX on the day immediately prior to the date that

the terms of the grant were agreed to between the Company and,

respectively, Messrs. Morrison and Conlee. Because these dates are

not always the same as the accounting measurement dates, these

values do not always equal the values used for accounting purposes

under U.S. GAAP.

4 The Aggregate Reimbursement of Benefits Received by the

external directors is approximately $0.2 million.

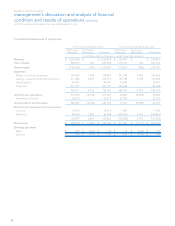

Changes to the Company’s Stock Option Granting Practices

In December 2006, the Board of Directors adopted an interim

option granting process, whereby all stock options (including

stock options for new hires during a fiscal quarter) would be

issued and priced quarterly and approved in advance by the

Compensation Committee or the Board of Directors. The

Compensation Committee and the newly formed Oversight

Committee of the Board are reviewing the interim option

granting process in light of evolving best practices and will

recommend to the Board any changes required as a result of

this review.

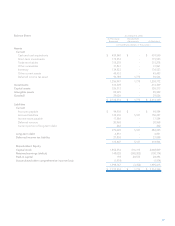

Changes to the Company’s Board of Directors, Board

Committees and Organizational Structure

The Company grew dramatically during the period covered

by the Review, and the Special Committee provided

recommendations to expand and enhance the Company’s

governance practices to address issues identified during

the Review and to better reflect the magnified size and

complexity of the Company’s business.

In accordance with the Special Committee’s

recommendations and other considerations, the Board has

established a new Oversight Committee and implemented

changes to the Company’s Board, Audit Committee,

Compensation Committee, and Nominating Committee, and

has changed various management roles:

• A new Oversight Committee of the Board has been

established whose mandate includes providing

oversight into areas typically under the responsibility

of management. Among other things, the Oversight

Committee will examine executive compensation, the use

of stock options as a compensation mechanism, trading by

insiders, hiring practices and a general review of activities

within the accounting and finance groups. The Oversight

Committee will work cooperatively as appropriate with the

other board committees. In 2009, the Board and Oversight

Committee will determine whether the committee has

completed its mandate or whether it should continue

and, if so, for what period. The Oversight Committee is

comprised of Jim Estill, John Richardson, Barbara Stymiest

and John Wetmore, each an independent director of the

Company.

• Consistent with current best practices in corporate

governance, the roles of Chairman and CEO have been

separated. Mr. Balsillie has voluntarily stepped down from

the role of Chairman to allow future consideration of a

non-executive Chairman by the Nominating Committee.

Mr. Balsillie has retained his leadership roles as Co-CEO

and Director.

• Mr. Richardson has been appointed as Lead Director of

the Board of Directors. Mr. Richardson’s responsibilities in

that position include: (a) approving information submitted

by management to the Board, (b) approving the agenda

for Board meetings, (c) leading meetings of the external

directors, (d) serving as a liaison between the external

directors and the chief executive officers, and (e) being

able to call, with due notice, a meeting of the Board and/or

an executive session of the Board consisting exclusively of

external directors.