Blackberry 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

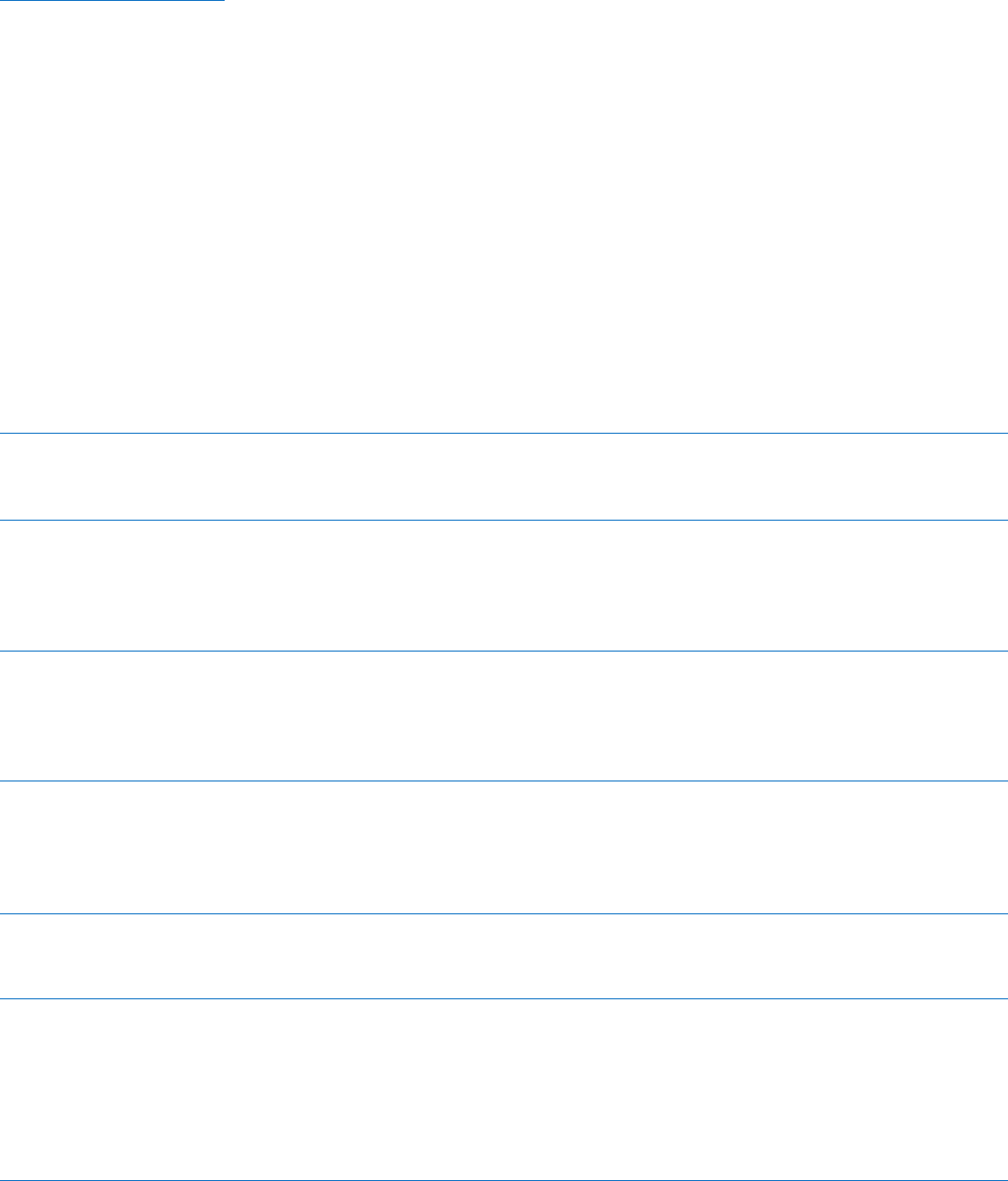

Benefits from Option Grants

All directors and all C-level officers have agreed in respect

of options that were incorrectly priced to return any benefit

on previously exercised options and to re-price unexercised

options that were incorrectly priced. All vice-presidents

of the Company will be asked to agree to similar treatment

for their options that have dating issues, where these

options were granted after the employee’s commencement

of employment and in the employee’s capacity as vice-

president. For exercised options, the gain will be recovered

through a cash payment made by the respective director or

officer, together with interest. No options that are to be re-

priced will be permitted to be exercised prior to re-pricing.

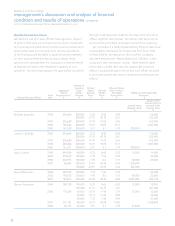

Set out below is a table supplementing the prior executive

compensation disclosure for the periods from fiscal 1998

to fiscal 2006 for the executive officers of the Company

who were listed as the “Named Executive Officers” in the

Company’s last information circular. (Note that the table

below only includes disclosure for a particular executive

officer in a particular year to the extent such officer received

in such year options that require restitution by the particular

officer.)

Named Executive Officer Fiscal

Year

Aggregate

Annual

Compensation1,2

$

Number of

Securities

Under

Option

Granted

#

Original

Option

Exercise

Price2

$

Revised

Option

Price2,3

$

Revised Option

Price in Excess

of Original

Option Price2

$

Reimbursement of Benefits

Received2,4

$

Amount to be

Repaid in Cash

$

Amount to be

Recovered by an

increase in the

Exercise Price

$

Michael Lazaridis 2004 293,600 200,000

200,000

8.33

37.51

8.92

40.18

0.59

2.67

118,000

534,000

2003 256,680 200,000 10.19 13.25 3.06 612,000

2002 124,084 200,000 10.76 18.89 8.13 1,626,000

2000 161,519 200,000 3.91 5.1 1.19 238,000

James L. Balsillie 2004 293,600 200,000

200,000

8.33

37.51

8.92

40.18

0.59

2.67

118,000

534,000

2003 256,680 200,000 10.19 13.25 3.06 612,000

2002 224,084 200,000 10.76 18.89 8.13 1,626,000

2000 161,531 200,000 3.91 5.1 1.19 238,000

Larry Conlee 2004 294,880 100,000 8.33 8.65 0.32 12,800 19,200

2003 374,612 100,000 7.12 7.66 0.54 54,000

2002 282,973 100,000 7.59 8.6 1.01 80,800 20,200

2001 30,995 200,000 23.91 30.45 6.54 1,308,000

100,000 23.91 29.43 5.52 552,000

Donald Morrison 2003 224,595 100,000 7.12 7.66 0.54 54,000

2002 192,072 100,000 7.59 8.6 1.01 80,800 20,200

2001 102,816 500,000 23.84 28.46 4.62 2,055,900 254,100

Dennis Kavelman 2004 198,180 100,000 8.33 8.65 0.32 12,800 19,200

100,000 37.51 40.72 3.21 321,000

2003 173,259 40,000 10.19 11.94 1.75 35,000 35,000

40,000 10.19 11.04 0.85 34,000

40,000 7.12 7.66 0.54 21,600

2001 117,127 80,000 30.12 45.98 15.86 1,268,800

2000 92,135 40,000 3.91 5.1 1.19 47,600