Blackberry 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.74

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

options are validly exercised by option holders.

The Review revealed that prior to the commencement

of the Review in August 2006, all stock option grants,

except grants to the Company’s co-CEOs, were made

by or under the authority of co-CEO Jim Balsillie or his

delegate in accordance with an apparent delegation of

such authority by the Company’s Board. For a number of

years after the IPO, Mr. Balsillie was directly involved in

approving grants, including grants that have been found to

have been accounted for incorrectly. Mr. Balsillie’s direct

involvement in approving grants diminished over time,

as more responsibility for approving certain grants was

delegated, without explicit conditions or documentation,

to Mr. Kavelman and to other employees. Mr. Kavelman

and other, less senior, personnel were also involved in the

granting of options that have been found to have been

accounted for incorrectly.

Grants to the co-CEOs were approved by the Company’s

Compensation Committee or the Board. After March 2003,

the Compensation Committee also reviewed compensation

payable to the COOs and the CFO, including option grants.

The 3,231 stock option grants made between December

1996 and August 2006 can be broadly classified as grants

to new employees or to former co-op students who

rejoined the Company after completing university (“New

Hire Grants”), and periodic awards to existing employees

and directors, including grants awarded to employees

following a promotion to a more senior position (“Grants to

Existing Employees”). The Special Committee determined

that some New Hire Grants and the majority of Grants to

Existing Employees used an incorrect measurement date

for accounting purposes, with the result that the exercise

price of the options was less than the fair market value of the

shares as of the date on which the terms and recipients of

those options were ascertained with finality, as determined

through objective evidence. In many instances, including in

connection with some option grants to the co-CEOs, COOs

and the CFO (the “C-level officers”), hindsight was used to

select grant dates with favorable pricing on grants and in

limited instances grant dates were selected based on low

prices over a future period, resulting in grantees receiving an

in-the-money option that was not recorded in the financial

statements as stock-based compensation.

The Special Committee determined that the Company

failed to maintain adequate internal and accounting controls

with respect to the issuance of options in compliance with

the Stock Option Plan, both in terms of how options were

granted and documented, and the measurement date used

to account for certain option grants. The grant process

was characterized by informality and a lack of definitive

documentation as to when the accounting measurement date

for a stock option occurred, and lacked safeguards to ensure

compliance with applicable accounting, regulatory and

disclosure rules.

Nature of the Errors

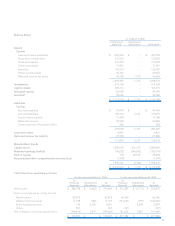

The period covered by the Review spans the inception

of the Stock Option Plan in December 1996 to August

2006. The Special Committee also examined certain

stock-based awards granted prior to the adoption of the

Stock Option Plan. As was permitted prior to fiscal 2007, the

Company elected to use APB 25 to measure and recognize

compensation cost for all awards granted to employees for

their service as employees, as discussed in Note 1. APB 25 is

based upon an intrinsic value method of accounting for stock-

based compensation. Under this method, compensation cost

is measured as the excess, if any, of the quoted market price

of the stock at the measurement date over the amount to be

paid by the employee.

Under APB 25, the measurement date for determining

compensation cost of stock options is the first date on which

are known both (1) the number of shares that an individual

employee is entitled to receive and (2) the option exercise

price. If either the number of shares or the exercise price

(or both) of a particular award are not known on the grant

date, the Company must remeasure compensation cost at

each reporting date until both are known. The application

of this principle is referred to as variable plan accounting,

and requires the Company to remeasure compensation

cost at the award’s intrinsic value until a measurement date

is triggered. When both terms are known, the award is

referred to as a fixed award, and compensation cost is not

remeasured for any changes in intrinsic value subsequent to

the measurement date.

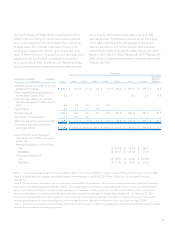

The Review identified three significant types of accounting

errors being: (1) the misapplication of U.S. GAAP as it relates

to a “net settlement” feature contained in the Stock Option