Blackberry 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

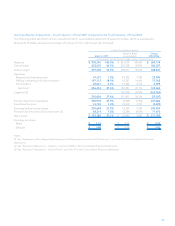

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

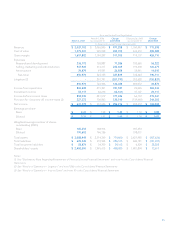

Fiscal Year 2007 Fiscal Year 2006

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

(restatement) (1)

(in thousands, except per share data)

Revenue $ - $ - $ - $ - $ - $ - $ - $ -

Gross margin $ - $ - $ - $ (119) $ (142) $ (76) $ (61) $ (104)

Research and development, Selling,

marketing and administration, and

Amortization - - - 1,007 1,497 781 779 1,098

Litigation (2) - - - - ----

Investment income - - - - - - - -

Income before income taxes - - - (1,126) (1,639) (857) (840) (1,202)

Provision for (recovery of) income

taxes (3) - - - (197) 1,120 485 928 351

Impact on Net income $ - $ - $ - $ (929) $ (2,759) $ (1,342) $ (1,768) $ (1,553)

Impact on Earnings per share

Basic $ - $ - $ - $ (0.01) $ (0.02) $ - $ (0.01) $ (0.01)

Diluted $ - $ - $ - $ (0.01) $ (0.02) $ (0.01) $ (0.01) $ (0.01)

Research and development $ - $ - $ - $ 304 $ 471 $ 232 $ 212 $ 343

Selling, marketing and administration - - - 703 1,026 549 567 755

Amortization - - - - ----

$ - $ - $ - $ 1,007 $ 1,497 $ 781 $ 779 $ 1,098

Notes:

(1) See “Explanatory Note Regarding Restatement of Previously Issued Financial Statements” and note 4 to the Consolidated Financial

Statements.

(2) See “Results of Operations – Litigation” and note 13(b) to the Consolidated Financial Statements.

(3) See “Results of Operations – Income Taxes” and note 10 to the Consolidated Financial Statements.

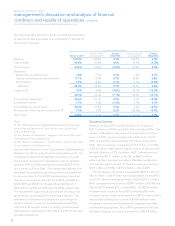

Fiscal Year 2007 Fiscal Year 2006

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

(as restated) (1)

(in thousands, except per share data)

Revenue $ 930,393 $ 835,053 $ 658,541 $ 613,116 $ 561,219 $ 560,596 $ 490,082 $ 453,948

Gross margin $ 497,358 $ 452,631 $ 370,085 $ 337,728 $ 308,511 $ 312,669 $ 268,954 $ 250,113

Research and development, Selling,

marketing and administration, and

Amortization 256,454 228,087 190,582 175,851 152,991 139,110 122,268 108,786

Litigation (2) - - - - 162,500 26,176 6,640 6,475

Investment income (14,794) (12,666) (12,606) (12,051) (19,219) (17,483) (15,700) (13,816)

Income before income taxes 255,698 237,210 192,109 173,928 12,239 164,866 155,746 148,668

Provision for (recovery of) income

taxes (3) 68,314 62,018 51,957 45,084 (3,356) 46,059 46,459 17,701

Net income $ 187,384 $ 175,192 $ 140,152 $ 128,844 $ 15,595 $ 118,807 $ 109,287 $ 130,967

Earnings per share

Basic $ 1.01 $ 0.95 $ 0.76 $ 0.69 $ 0.08 $ 0.63 $ 0.57 $ 0.69

Diluted $ 0.98 $ 0.92 $ 0.74 $ 0.67 $ 0.08 $ 0.60 $ 0.55 $ 0.66

Research and development $ 67,321 $ 61,184 $ 55,846 $ 51,822 $ 44,322 $ 41,799 $ 37,889 $ 34,877

Selling, marketing and administration 167,112 146,569 116,283 107,958 93,347 84,514 72,830 63,626

Amortization 22,021 20,334 18,453 16,071 15,322 12,797 11,549 10,283

$ 256,454 $ 228,087 $ 190,582 $ 175,851 $ 152,991 $ 139,110 $ 122,268 $ 108,786

Notes:

(1) See “Explanatory Note Regarding Restatement of Previously Issued Financial Statements” and note 4 to the Consolidated Financial

Statements.

(2) See “Results of Operations – Litigation” and note 13(b) to the Consolidated Financial Statements.

(3) See “Results of Operations – Income Taxes” and note 10 to the Consolidated Financial Statements.