Blackberry 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

beginning after September 15, 2006 and the Company will

be required to adopt the standard in the first quarter of fiscal

2008. The Company is currently evaluating what impact, if

any, SFAS 155 will have on its financial statements.

Fair Value Measurements

In September 2006, the FASB issued SFAS 157 Fair Value

Measurements. SFAS 157 clarifies the definition of fair value,

establishes a framework for measurement of fair value, and

expands disclosure about fair value measurements. SFAS

157 is effective for fiscal years beginning after December 15,

2007 and the Company will be required to adopt the standard

in the first quarter of fiscal 2009. The Company is currently

evaluating what impact, if any, SFAS 157 will have on its

financial statements.

Accounting for Uncertainty in Income Taxes

In July 2006, the FASB issued FASB Interpretation No. 48

(“FIN 48”) Accounting for Uncertainty in Income Taxes. FIN 48

clarifies the accounting for uncertainty in tax positions subject

to SFAS 109 Accounting for Income Taxes. FIN 48 provides

a recognition threshold and a mechanism to measure and

record tax positions taken, or expected to be taken during

the filing of tax returns. The mechanism is a two-step

process in which the tax position is evaluated for recognition

on “a more likely than not” basis that it will be sustained

upon examination. If step one is satisfied the position is

then evaluated to determine the amount to be recognized

in the financial statements. It also provides guidance on

derecognition, classification, interest and penalties, interim

period accounting, disclosure and transition. FIN 48 is

effective for the Company as of the beginning of its fiscal

2008 year. The Company is currently evaluating the impact

FIN 48 will have on its financial statements.

The Fair Value Option for Financial Assets and Financial

Liabilities - Including an Amendment of SFAS 115.

In February 2007, the FASB issued SFAS 159 The Fair Value

Option for Financial Assets and Financial Liabilities - Including

an Ammendment of SFAS 115. SFAS 159 permits entities to

measure many financial instruments and certain other items

at fair value that currently are not required to be measured

at fair value. If elected, unrealized gains or losses on certain

items will be reported in earnings at each subsequent

reporting period. SFAS 159 is effective for the Company as

of the beginning of its 2009 fiscal year. The Company has

not determined whether it will elect to adopt the fair value

measurement provisions of this statement, or what impact it

will have on its consolidated financial statements.

Disclosure Controls and Procedures and Internal Controls

Background of the Internal Review of Stock Option

Granting Practices

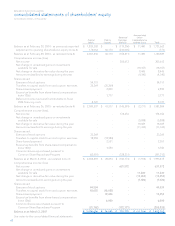

As discussed in greater detail under “Explanatory Note

Regarding the Restatement of Previously Issued Financial

Statements”, the Company has restated its consolidated

balance sheet as of March 4, 2006 and its consolidated

statements of operations, consolidated statements of cash

flows and consolidated statements of shareholders’ equity for

the fiscal years ended March 4, 2006 and February 26, 2005,

and the related note disclosures, to reflect additional non-

cash stock compensation expense relating to certain stock

based awards granted prior to the adoption of the Stock

Option Plan and certain stock option grants during the 1997

through 2006 fiscal periods, as well as certain adjustments

related to the tax accounting for deductible stock option

expenses.

The Restatement is the result of the Review by the

Company of its stock option granting practices, which was

commenced under the direction of the Audit Committee

of the Company’s Board of Directors, at the initiative of Mr.

Kavelman, with the support of Mr. Balsillie and the executive

management team. Following the recusal of two Audit

Committee members who also served on the Compensation

Committee, the Review was completed by the remaining two

members of the Audit Committee as a Special Committee of

independent directors of the Board of Directors. The Special

Committee was assisted in the Review by outside legal

counsel and outside accounting advisors in both Canada

and the United States. The Special Committee reviewed the

facts and circumstances surrounding the 3,231 grants of stock

options to acquire common shares that were made between

December 1996 and August 2006 to 2,034 employees and

directors of the Company. The Special Committee also

reviewed stock-based awards granted prior to the adoption

of the Stock Option Plan.

The Review identified three significant types of accounting

errors being: (1) the misapplication of U.S. GAAP as it relates

to a “net settlement” feature contained in the Stock Option

Plan until February 27, 2002, which resulted in variable