Blackberry 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

The Company uses the flow-through method to account

for investment tax credits (“ITCs”) earned on eligible

scientific research and experimental development (“SR&ED”)

expenditures. Under this method, the ITCs are recognized as

a reduction to income tax expense.

Share-Based Payment

The Company has an incentive stock option plan for directors,

officers and employees of the Company or its subsidiaries.

Effective March 5, 2006, the Company adopted the

provisions of SFAS 123(R). Under the provisions of SFAS

123(R), stock-based compensation expense is estimated at

the grant date based on the award’s fair value as calculated

by the Black-Scholes-Merton (“BSM”) option-pricing model

and is recognized rateably over the requisite service period.

The BSM model requires various judgmental assumptions

including volatility, forfeiture rates and expected option life.

If any of the assumptions used in the BSM model change

significantly, stock-based compensation expense may differ

materially in the future from that recorded in the current

period.

The BSM option-pricing model used in SFAS 123(R) is

consistent with that used in pro forma disclosures under SFAS

No. 123. The Company is using the modified prospective

transition (“MPT”) method as permitted by SFAS 123(R) to

record stock-based compensation expense and accordingly

prior periods have not been restated to reflect the impact of

SFAS 123(R). Stock-based compensation expense calculated

using the MPT approach is recognized on a prospective basis

in the financial statements for all new and unvested stock

options that are ultimately expected to vest as the requisite

service is rendered beginning in the Company’s fiscal 2007

year. Stock-based compensation expense for awards granted

prior to fiscal 2007 is based on the grant-date fair value as

determined under the pro forma provisions of SFAS 123. As

a result of the Company adopting SFAS 123(R) in the first

quarter of fiscal 2007, the Company’s net income for the year

ended March 3, 2007 included stock-based compensation of

$18.8 million, or $0.10 per share basic and diluted. (See also

note 12(b) to the Consolidated Financial Statements).

Prior to fiscal 2007, the Company accounted for

stock-based compensation using APB 25 and related

interpretations. Under APB 25, compensation expense is

measured as of the date on which the number of shares and

exercise price become fixed. Generally, this occurs on the

grant date and the award is accounted for as a fixed award. If

the number of shares and grant price are not fixed as of the

grant date, the stock option is accounted for as a variable

award until such time as the number of shares and/or exercise

prices become fixed, or the stock option is exercised, is

cancelled, or expires.

In accordance with SFAS 123(R), beginning in fiscal 2007,

the Company has presented excess tax benefits from the

exercise of stock-based compensation awards as a financing

activity in the consolidated statement of cash flows.

In connection with the Review and the Restatement, the

Company has applied judgment in choosing whether to

revise measurement dates for prior option grants. Information

regarding the Restatement is set forth above under

“Explanatory Note Regarding the Restatement of Previously

Issued Financial Statements” and note 4 to the Consolidated

Financial Statements.

At the Company’s Annual General Meeting on July 18,

2005, shareholders approved the establishment of the

Restricted Share Unit (“RSU”) Plan. The eligible participants

under the RSU Plan include any officer or employee of the

Company or its subsidiaries. RSUs are redeemed for either

common shares issued by the Company, common shares

purchased on the open market or the cash equivalent on the

vesting dates established by the Company. Compensation

expense, based on the fair value of the Company’s shares at

the date of the grant, will be recognized upon issuance of

RSUs over the RSU vesting period.

Common Shares Outstanding

On May 10, 2007, there were 185.9 million voting common

shares, 6.4 million options to purchase voting common shares

and no Restricted Share Units outstanding.

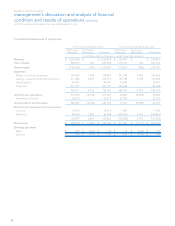

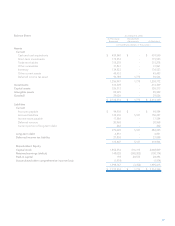

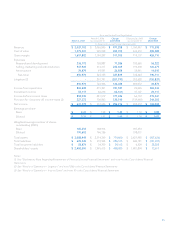

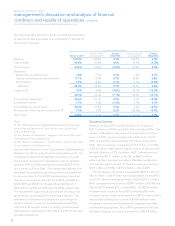

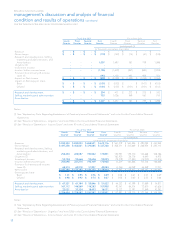

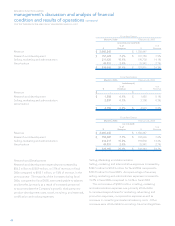

Summary Results of Operations – Fiscal 2007 Compared to

Fiscal 2006, and Fiscal 2005

The following table sets forth certain consolidated statement

of operations data, which is expressed in thousands of dollars

and as a percentage of revenue for the interim periods

indicated, as well as consolidated balance sheet data, which

is expressed in thousands of dollars, as at March 3, 2007,

March 4, 2006 and February 26, 2005: