Blackberry 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

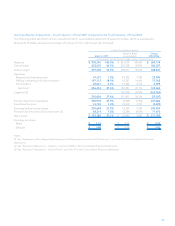

Summary Results of Operations – Fourth Quarter of Fiscal 2007 Compared to the Fourth Quarter of Fiscal 2006

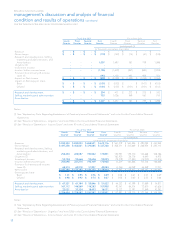

The following table sets forth certain unaudited interim consolidated statement of operations data, which is expressed in

thousands of dollars and as a percentage of revenue for the interim periods indicated:

For the Three Months Ended

March 3, 2007 March 4, 2006

(as restated) (1) Change

2007/2006

(in thousands, except for percentages and per share amounts)

Revenue $ 930,393 100.0% $ 561,219 100.0% $ 369,174

Cost of sales 433,035 46.5% 252,708 45.0% 180,327

Gross margin 497,358 53.5% 308,511 55.0% 188,847

Expenses

Research and development 67,321 7.2% 44,322 7.9% 22,999

Selling, marketing and administration 167,112 18.0% 93,347 16.6% 73,765

Amortization 22,021 2.4% 15,322 2.7% 6,699

Sub-total 256,454 27.6% 152,991 27.3% 103,463

Litigation (2) - - 162,500 29.0% (162,500)

256,454 27.6% 315,491 56.2% (59,037)

Income (loss) from operations 240,904 25.9% (6,980) (1.2%) 247,884

Investment income 14,794 1.6% 19,219 3.4% (4,425)

Earnings before income taxes 255,698 27.5% 12,239 2.2% 243,459

Provision for (recovery of) income taxes (3) 68,314 7.3% (3,356) (0.6%) 71,670

Net income $ 187,384 20.1% $ 15,595 2.8% $ 171,789

Earnings per share

Basic $ 1.01 $ 0.08 $ 0.93

Diluted $ 0.98 $ 0.08 $ 0.90

Notes:

(1) See “Explanatory Note Regarding Restatement of Previously Issued Financial Statements” and note 4 to the Consolidated Financial

Statements.

(2) See “Results of Operations – Litigation” and note 13(b) to the Consolidated Financial Statements.

(3) See “Results of Operations – Income Taxes” and note 10 to the Consolidated Financial Statements.