Blackberry 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

in percentage of device shipments was offset in part by

improved service margins resulting from cost efficiencies

in RIM’s network operations infrastructure as a result of the

increase in the BlackBerry subscriber account base and a

decline in certain fixed costs as a percentage of consolidated

revenue as the Company continues to realize economies of

scale in its manufacturing operations.

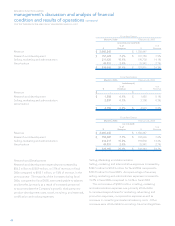

Research and Development, Selling, Marketing and

Administration, and Amortization Expense

The table below presents a comparison of research and

development, selling, marketing and administration, and

amortization expenses for the quarter ended March 3, 2007

compared to the quarter ended December 2, 2006 and the

quarter ended March 4, 2006. The Company believes it is

meaningful to provide a comparison between the fourth

quarter and the third quarter of fiscal 2007 given the quarterly

increases in revenue realized by the Company during fiscal

2007.

Three Month Fiscal Periods Ended

March 3, 2007 December 2, 2006

March 4, 2006

(as restated)

$% of

Revenue $

% of

Revenue $

% of

Revenue

Revenue $ 930,393 $ 835,053 $ 561,219

Research and development $ 67,321 7.2% $ 61,184 7.3% $ 44,322 7.9%

Selling, marketing and administration 167,112 18.0% 146,569 17.6% 93,347 16.6%

Amortization 22,021 2.4% 20,334 2.4% 15,322 2.7%

$ 256,454 27.6% $ 228,087 27.3% $ 152,991 27.3%

Research and Development

Research and development expenditures increased by $23.0

million to $67.3 million, or 7.2% of revenue, in the fourth

quarter of fiscal 2007 compared to $44.3 million, or 7.9% of

revenue, in the fourth quarter of fiscal 2006. The majority

of the increase in expenditures during the fourth quarter of

fiscal 2007 compared to the fourth quarter of fiscal 2006 were

attributable to salaries and benefits, third party new product

development costs, travel and office expenses, as well as

related staffing infrastructure costs.

Selling, Marketing and Administration Expenses

Selling, marketing and administrative expenses increased

by $73.8 million to $167.1 million, or 18.0% of revenue, for the

fourth quarter of fiscal 2007 compared to $93.3 million, or

16.6% of revenue for the comparable period in fiscal 2006.

The net increase of $73.8 million was primarily attributable

to increased expenditures for marketing, advertising and

promotion expenses including additional programs to

support new product launches, salary and benefit expense

primarily as a result of increased personnel, external

advisory fees, travel and office expenses as well as related

staffing infrastructure costs. The increase also includes

legal, accounting and other professional costs incurred by

the Company in fiscal 2007 as well as other costs incurred

by the Company under indemnity agreements in favor of

certain officers and directors of the Company, in each case in

connection with the Review, the Restatement and related

matters.

Amortization

Amortization expense relating to certain capital and all

intangible assets other than licenses increased by $6.7 million

to $22.0 million for the fourth quarter of fiscal 2007 compared

to $15.3 million for the comparable period in fiscal 2006. The

increased amortization expense primarily reflects the impact

of amortization expense with respect to capital and certain

intangible asset expenditures incurred primarily during the

first three quarters of fiscal 2007.

Litigation

As at November 26, 2005, the Company had an accrued

liability of $450.0 million in respect of the NTP litigation

which represented, at that time, management’s best current

estimate as to the litigation expense relating to this matter

based on then current knowledge and consultation with

legal counsel. As the full and final settlement amount paid

on March 3, 2006 was $612.5 million, an additional charge